Market Data

September 22, 2016

SMU Steel Sentiment Index Takes Hard Dive

Written by John Packard

The Steel Market Update (SMU) Steel Buyers Sentiment Index dropped 14 points since we last measured Sentiment at the beginning of the month. The 14 point drop took the Current Index to +49, the lowest point for our index since the +44 reported during the first week of January 2016. The 14 point drop is also the largest single decline in our index since early September 2012 when it dropped from +34 to +19.

Even with the sharp drop our index is still well within the “optimistic” range (we provide a complete explanation of our numbering system at the end of this article) although the bloom is coming off the rose as the trend has been for a less optimistic flat rolled steel industry beginning in late June/early July of this year.

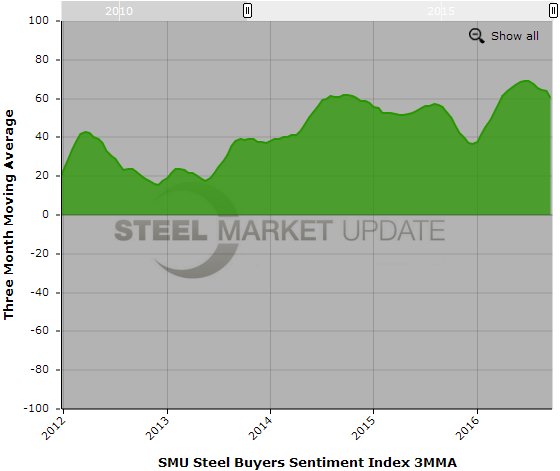

SMU prefers to look at our data based on a three month moving average (3MMA) which helps take the bumps out and smooth the data. The trend line has definitely been broken as our 3MMA for Current Sentiment is down more than 3 points to +60.33. Our index, from a three month moving average perspective, has been dropping since the first week of July when our index hit a record high of +71.

It is our opinion that the sharp drop coincides with the sharp decline we have seen in flat rolled steel prices over the past two to three weeks combined with weakening demand and seasonal slowdowns on the horizon.

SMU Future Steel Buyers Sentiment Index

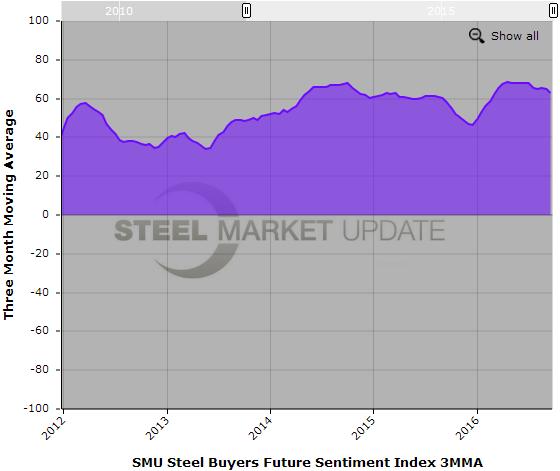

Our Future Index, which measures how buyers and sellers feel about their ability to be successful three to six months into the future, dropped 5 points to +59. When looking at the data using a three month moving average (3MMA) the index is now at +62.83 down 2.0 points from the beginning of September. The negative trend now goes back to the first week of June 2016. At that point in time the our Futures Sentiment 3MMA was +68.17.

What our Respondents are Saying

“Releases are starting to slow down in most areas.” Service center

“Business starting to pick up for the fall. Finally.” Manufacturing company

“Volumes are softening substantially, getting concerned about direction of economy.” Service center

“CRU deals will be a little upside down going into Q4.” Service center

“Let’s get past Nov 6 as fast as possible!” Service center

“Texas two step all over again……one step forward, two steps back…..two steps forward, one step back….” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.