Canada

September 20, 2016

Canadian Service Centers Shipments 2nd Lowest Month This Year

Written by John Packard

Canadian steel service centers shipped a total of 364,800 tons of steel products during the month of August. Compared to the previous year shipments were 6.1 percent lower and the 364,800 ton level was the second lowest shipping month this calendar year (July was the lowest at 318,700 tons).

Year to date the Canadian distributors have shipped a total of 2,997,600 tons which is 8.1 percent lower than year ago levels.

Inventories (all products) stood at 1,148,900 tons at the end of August which is 48,100 tons higher than at the end of July. Even so, inventories are 18.0 percent lower than year ago levels.

The number of months supply on hand as of the end of August is 3.1 months, down from the 3.5 months reported at the end of July.

Carbon Flat Rolled

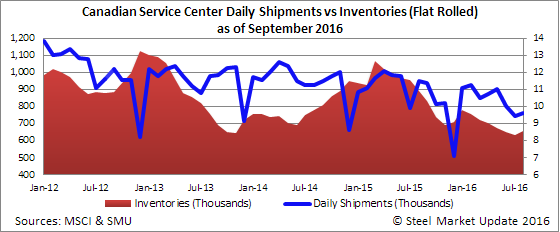

Canadian service centers shipped 212,100 tons of flat rolled steel during the month of August. Shipments were 7.9 percent lower than year ago levels. The 9,600 tons per day was the second lowest shipping rate this year (9,400 tons per day in July was the lowest).

Year to date the Canadian distributors have shipped 1,768,100 tons of flat rolled which is 7.2 percent below year ago levels.

Inventories stood at 653,300 tons at the end of August which is 26.9 percent lower than year ago levels. The number of months on hand shrunk from 3.4 at the end of July to 3.1 as of the end of August based on current shipping levels.

Carbon Plate

Distributors shipped 54,200 tons of plate products during the month of August. Just like the United States there has been a collapse to the plate markets and the shipments were 18 percent lower than year ago levels. The daily shipping rate was 2,500 tons per day.

Year to date the Canadian plate service centers have shipped 524,600 tons of product which is 13.5 percent below year ago levels.

Inventories stood at 212,900 tons according to the MSCI, which is 5.8 percent below year ago levels. The number of months supply which was at 4.2 months at the end of July dropped to 3.9 months by the end of August.

Carbon Pipe & Tube

Canadian distributors shipped 45,700 tons of pipe and tube products during the month of August. This represents a 5.4 percent reduction in shipments when compared to August 2015 levels. The daily shipment rate was 2,100 tons per day.

Year to date the Canadian service centers dealing in pipe & tube products shipped 340,600 tons, which is 12.3 percent below year ago levels.

Pipe and tube inventories totaled 128,000 tons according to the MSCI. This is 4.7 percent below year ago levels. The number of months supply dropped from 3.2 months at the end of July to 2.8 months by the end of August.