Prices

September 16, 2016

Tenaris Cautiously Restarting Algoma Tubes

Written by Sandy Williams

Tenaris is recalling workers to its Tenaris Algoma Tubes factory in Sault Ste. Marie. The facility which make seamless pipe for the oil and gas industry has been idle since February 8 due to continued adverse market conditions in the energy sector.

Tenaris Algoma Tubes said it will recall 120-150 employees and restart production in November.

“We are cautiously proceeding to restart Algoma, understanding the environment of today remains difficult,” said Tenaris Canada vice-president Guillermo Moreno in a statement.

“While market volatility persists, a modest improvement in Tenaris’ forecast, as well as progress in ongoing policy discussions with members of the federal and provincial government that support Canadian manufacturing drove the decision to commence operations,” the statement continued.

Tenaris laid off half of its 520 union employees in December of 2015 and completely shut down operations in February 2016. Tube sales for Tenaris in North America were down 58 percent in the first half of 2016 compared to the same period in 2015.

Is the timing right?

Alberta approved last week three oilsands projects with an estimated joint production capacity of about 95,000 barrels per day. Whether the projects will go forward depends on oil price and development of new markets for Canada.

Said Tim McMillan, President and CEO of the Canadian Association of Petroleum Products (CAPP), in a recent article in the Winnipeg Free Press:

“Canada currently exports oil and natural gas to its only customer, the United States. However, the U.S. is quickly becoming one of the largest producers in the world, meaning the No. 1 customer is now the No. 1 competitor.”

Global demand for energy is expected to increase by 32 percent through 2040 with a one fourth of that coming from oil, said McMillan. Most of that demand will come from China and India which are expected to have a combined consumption of 10.8 million barrels per day by 2040. During the same period, natural gas demand is expected to increase by 50 percent with one fifth being supplied by liquefied natural gas or natural gas transported via pipelines.

There are at least four major pipeline projects currently in the approval process in Canada, each a potential customer for the steel pipe and tube industry. Continued low oil prices, however, are part of the persistent volatility that Tenaris is cautiously watching as it reopens its mill.

CAPP is predicting oilsands production to reach 4.8 million barrels per day by 2030, 250 percent higher than the 1.9 billion barrels per day output in 2015. According to data from the Carbon Tracker Initiative, oil prices need to be at a minimum of $95 per barrel for most large oil projects to be economically feasible and some will need prices in the range of $110-$150 per barrel. As of September 16, Brent crude oil was trading at $45.71 per barrel.

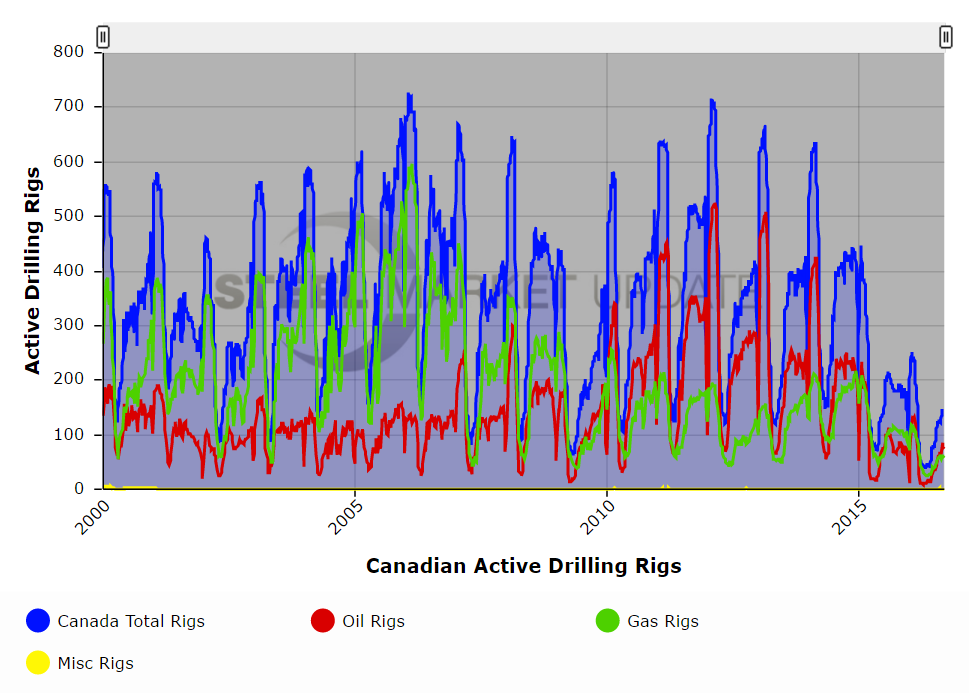

The number of active rig count in Canada on Sept. 9 was 134—74 for oil and 59 for gas. The number has been slowly growing from its latest drop in the cycle, but is nowhere near its most recent peak of 710 rigs on Feb. 3, 2012

The U.S. Energy Information Administration, in its Annual Energy Outlook 2016, expects 2017 to be another poor year for the oil industry with U.S. oil production falling to 8.6 billion barrels per day at an annual average price of less than $50 per barrel. In 2018 prices are expected to begin increasing, reaching $130 per barrel by 2040.

According to the EIA, global oil and gas investment fell 25 percent in 2015 and is expected to fall another 24 percent to $450 billion in 2016. In comparison, investment in 2014 exceeded $750 million. U.S. Spending on energy investment declined by almost $75 billion in the U.S. between 2014 and 2015. The cutbacks in spending may result in tighter supply in the future leading to higher prices, said the EIA.

So although the much stronger market in 2040 is a long time away, 2018 is not, and perhaps the first signs of relief for the oil and gas industry may finally be within sight.