Prices

September 15, 2016

Hot Rolled Futures: No Man's Land

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

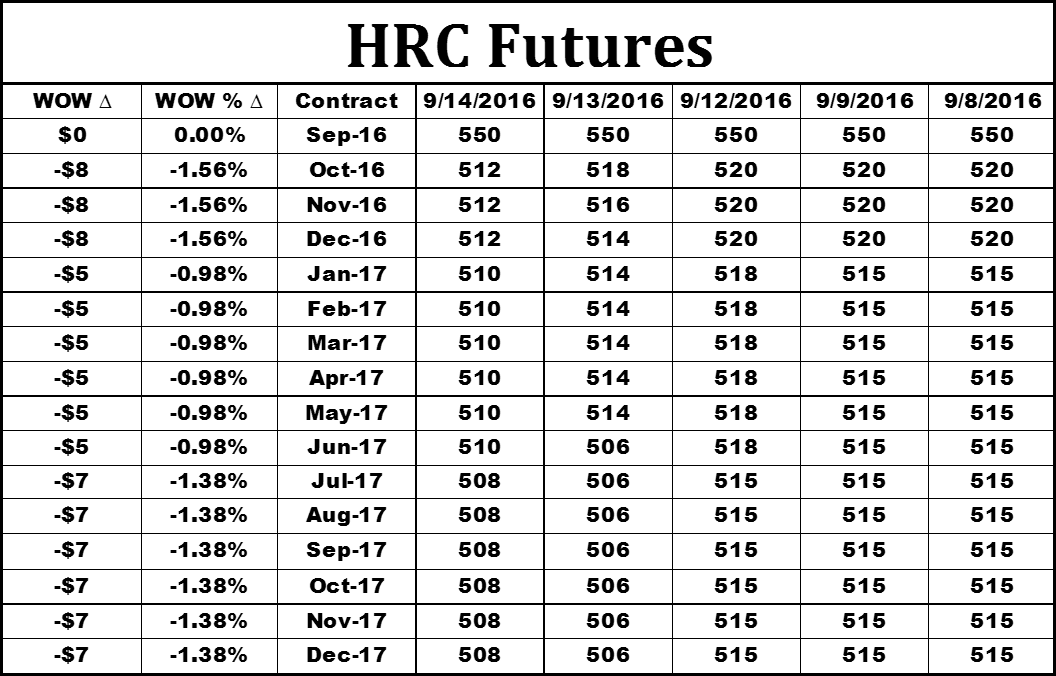

The HRC futures curve moved lower again in the past week. Excluding September, the curve has flattened out.

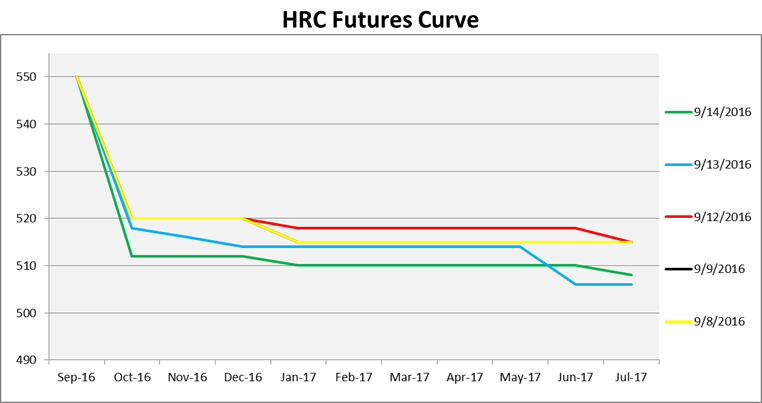

Looking back over the past year, the TSI Daily HRC price has been as low as $364/st and as high as $630/st with an average of $485/st. The flat HRC futures curve is sitting in no man’s land just above the $485 average level.

TSI Daily Midwest HRC Index

Supply side fundamentals have shifted quickly in past weeks with falling domestic lead times, increasing import license data and the addition of Big River and the former Wheeling, Pitt mill expected to come online in the not too distant future. Demand side fundamentals have moved from modest to concerning with recent disappointing economic data including an ISM Manufacturing PMI abruptly falling into contraction territory, slowing auto sales and the weakest ISM Services PMI since February, 2010.

Sitting in no man’s land about 10% below steel index levels are the HRC futures. To hedge downside risk, one could sell futures at the $510 level. The purpose of hedging is to transfer risk, but maybe the $510 level is just not juicy enough for you.

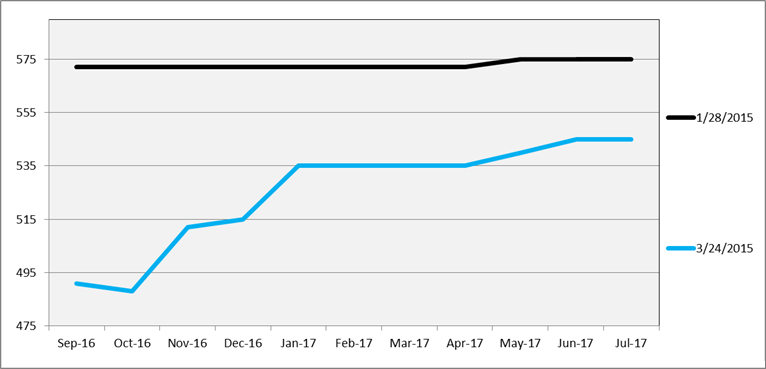

Perhaps you are concerned that prices are about to fall abruptly, perhaps down to the $400 level in the next couple months. If this occurs, import purchases will probably collapse as they usually do in a sharply falling market and this could lead to a tight domestic market in 4-6 months down the road. Moving forward with this line of reasoning, if steel prices fall fast in the short term, maybe they rocket back higher to the $500 or even $600 level down the road similar to what happened this past spring. If this fits your forecast, perhaps one solution to hedge downside risk without taking a strictly directional bet (i.e. just shorting the futures) is to short Q4 and/or Q1 2017 futures and buy Q2 17 and/or Q3 17 futures.

If prices fall hard and fast from here, the flat curve will move lower to a point and then the front of the curve will continue to fall while the back half of the curve shifts into contango (i.e. upward sloping) as market participants price in a rebound months later. This type of “spread” trade takes some of the directional risk out of the hedge and fits well with the expected scenario described above.

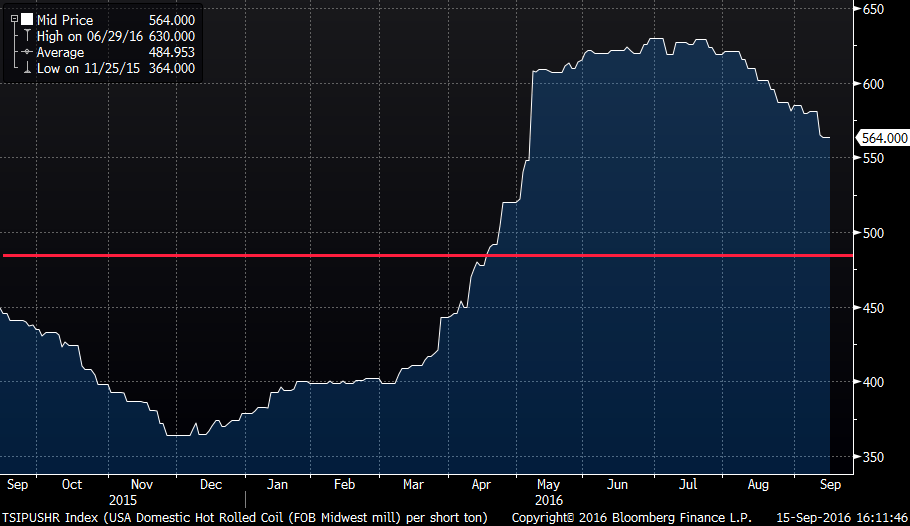

For example, see the HRC futures curve as of January 28th, 2015 and March 24th, 2015:

As you can see, the drop in the front months was much greater than the drop the farther out you go. You would profit much more with the short position in the front months than you would lose with the long position in the back months.

In this example, if you put on 2000 t/m of the Q2 vs. Q3 spread, you would be short 2000 t/m of Q2 2015 at $575 and buy 2000t/m of Q3 2015 at $575. The result of the trade as of 3/24/15 would be:

-2000 Q2 x (495 – 575) = +$480,000

+2000 x (535 – 575) = -$240,000

Adding the two together, one would have profited $240,000 while assuming less directional risk.

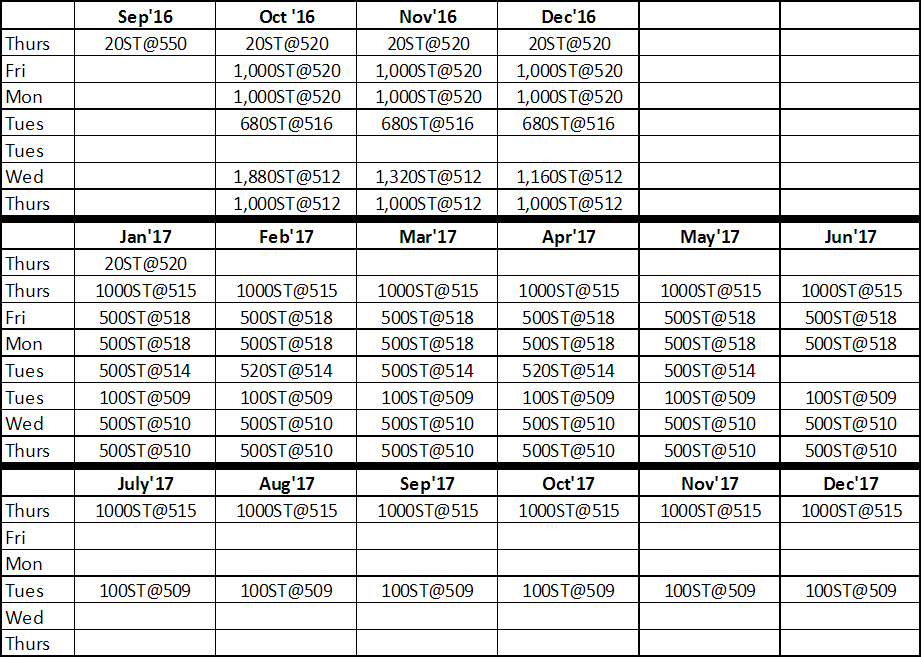

43,240 short tons of CME Midwest HRC futures traded since last Thursday. Open interest currently stands at 379,040 short tons. Below are the trades executed since last Thursday: