Market Data

September 12, 2016

US Gross Domestic Product by Region and by State Q1 2016

Written by Peter Wright

The Bureau of Economic Analysis (BEA) introduced a new data set for GDP by state and region last year and back dated it to Q1 2005. On Tuesday this week the data was updated through Q1 2016. Even though we might consider this to be historically ‘old’ we think it’s worth reporting because it is a foundation for where we are now. The data is published quarterly and is reported in chained 2009 dollars seasonally adjusted.

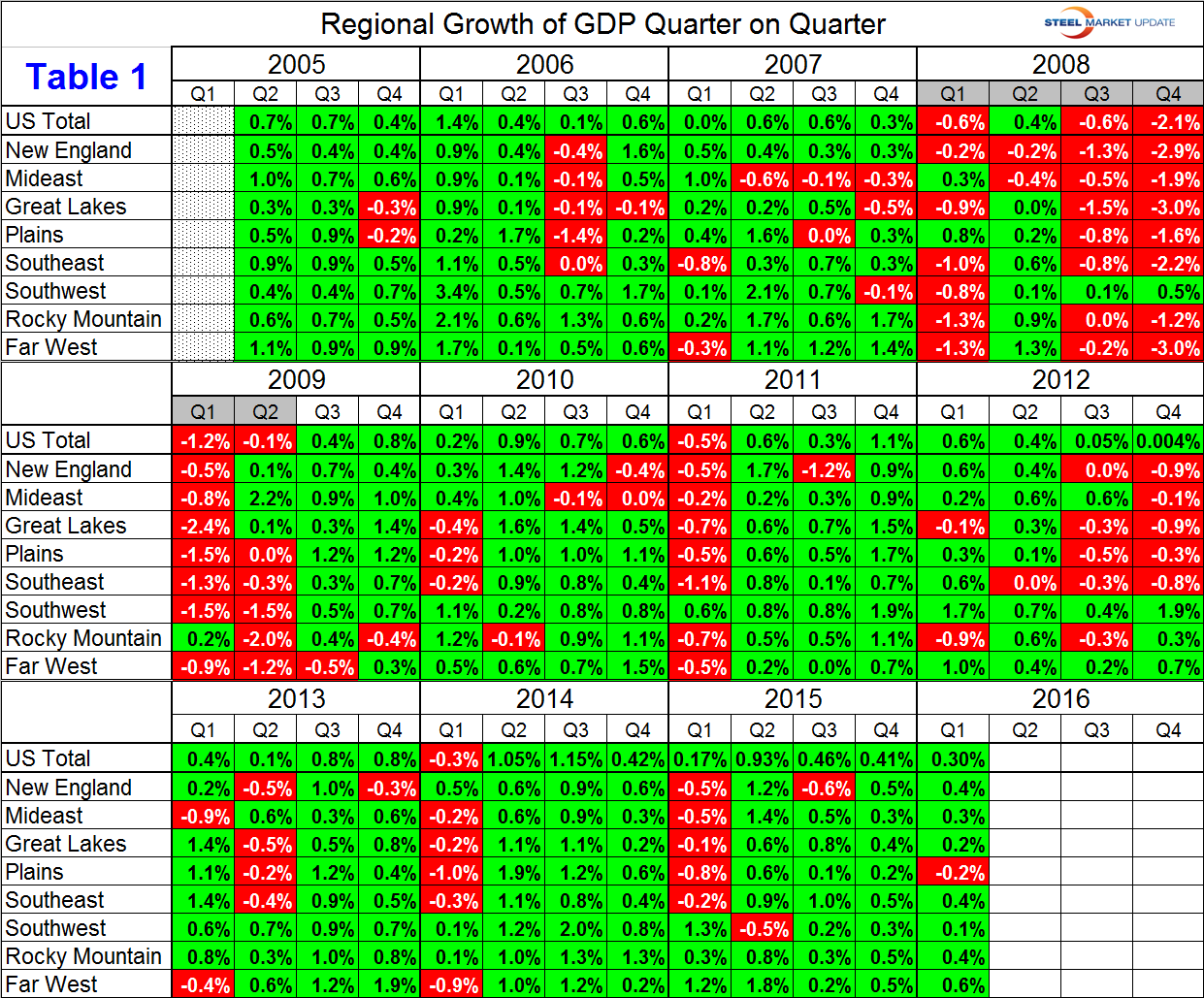

We at SMU plan to analyze the data and report to our subscribers quarterly by region. Should anyone wish to see data and graphs for an individual state, we will supply on a one off basis. Table 1 show the growth of regional GDP in chained 2009 dollars quarter on quarter (these numbers are not annualized as is the case for published reports of the growth of national GDP).

Our first impression of this data is that it is spottier than we expected. Some points to note are that naturally the great recession is very obvious, the definition of a recession is two or more quarters back to back with negative growth. The winter effect in the northern regions also stands out. Four regions were in recession in the second half of 2012. The South West region flipped from the highest growth rate in Q1 2015 to negative growth in Q2 as the situation in the oil patch hit home. In the first quarter of 2016, the Far West had the highest growth rate at 0.6 percent followed by New England at 0.4 percent. The Plains was the only region to experience contraction in the first quarter.

Regions as defined by the BEA are as follows:

New England: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont.

Mideast: Delaware, DC, Maryland, New Jersey, New York, Pennsylvania.

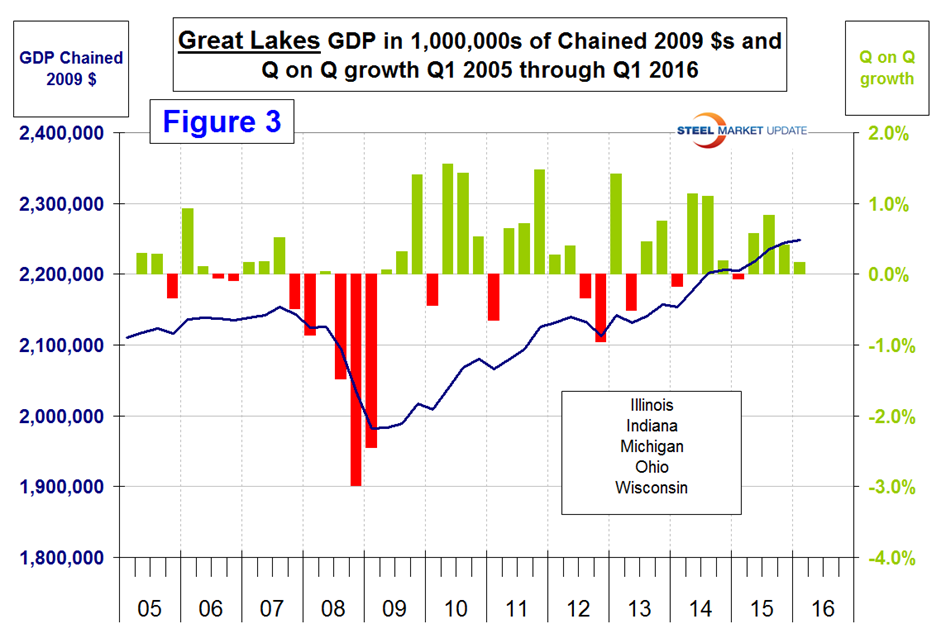

Great Lakes: Illinois, Indiana, Michigan, Ohio, Wisconsin.

Plains: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota.

Southeast: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia.

Southwest: Arizona, New Mexico, Oklahoma, Texas

Rocky Mountain: Colorado, Idaho, Montana, Utah, Wyoming.

Far West: Alaska, California, Hawaii, Nevada, Oregon, Washington.

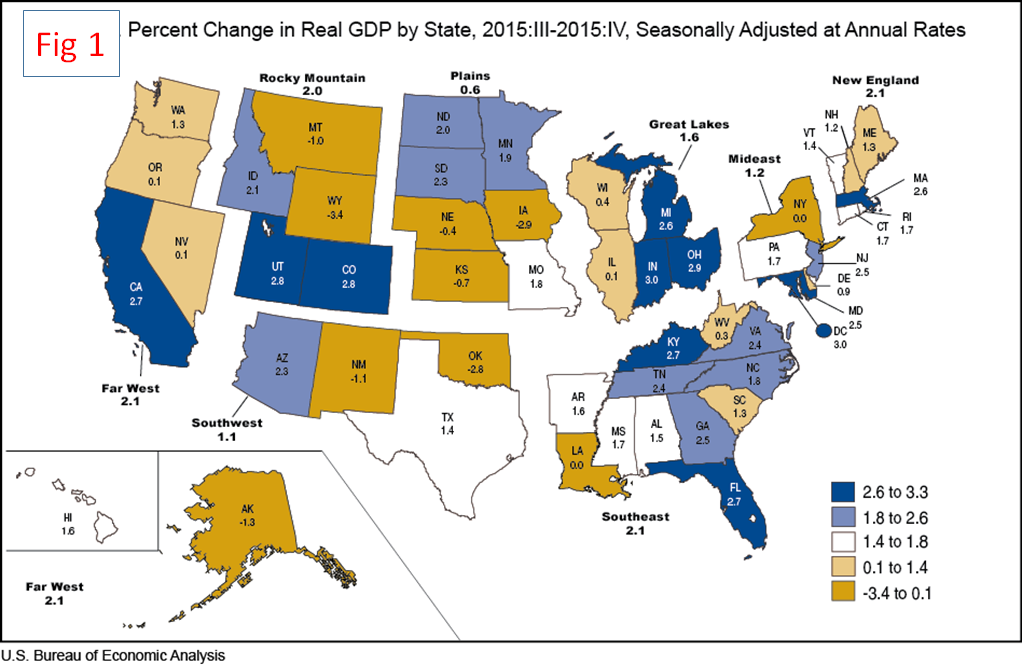

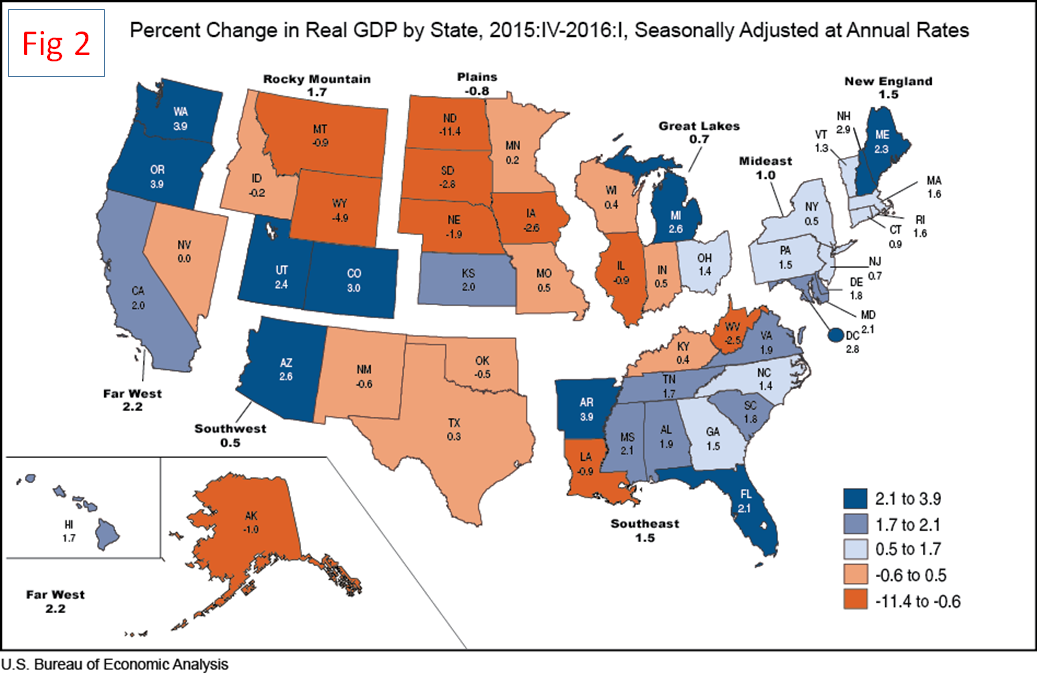

The BEA produces a map of the United States showing Q/Q growth by state within each region. We have included here the maps for Q4 last year and Q1 this year to show the extent of the slowdown by region. These maps are Figure 1 and Figure 2.

Once a quarter we at SMU publish a report of regional job creation which we hope along with this analysis of regional GDP will enable subscribers to compare their own corporate results with those of their region to establish whether their business is swimming up or down stream.

Figure 3 is included to show readers an example of the graphs that we can produce on request for individual regions and states.

The U.S. values in this report are quite a bit different and lower that the official report published in the National Income and Product Account (NIPA) reports partly because the GDP-by-state numbers exclude Federal military and civilian activity located overseas (because it cannot be attributed to a particular state). The official quarterly report of national GDP is also annualized which as we always report in our quarterly analysis increases the value by a factor of four.