Analysis

September 12, 2016

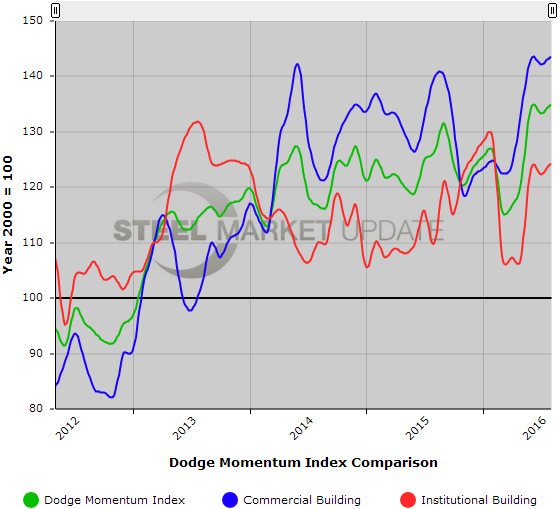

Dodge Momentum Index on 5-Month Streak

Written by Sandy Williams

The Dodge Momentum Index rose 1.3 percent in August to 134.9. Institutional construction planning gained 1.7 percent last month and commercial planning 1.0 percent. The index has made gains for five consecutive months.

The Momentum Index is up 16 percent from August 2015 due to a 22 percent growth in institutional planning and 22 percent by commercial planning.

“That both sectors are showing such improvement suggests that developers are shrugging off sluggish economic data and the uncertainty surrounding the November elections, and moving ahead with plans for new projects,” said Dodge Data & Analytics.

Fourteen projects exceeding 100 million entered the planning phase in August.

The Dodge Momentum Index, published by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.