Market Data

September 11, 2016

SMU Flat Rolled Market Trends Analysis Overview

Written by John Packard

Twice per month, Steel Market Update (SMU) conducts a review of the flat rolled steel market in our quest to better understand market trends which affect steel pricing and purchasing. We invite approximately 550-600 steel people to participate in our questionnaires. Those invited come from the manufacturing segment of the industry (approximately 45 to 50 percent of our respondents), steel service centers/wholesalers (37 to 47 percent), steel mills (4 to 8 percent), trading companies (3 to 6 percent) and toll processors/suppliers to the industry (1 to 5 percent).

Last week we conducted our early September analysis and the make-up of the pool of individuals responding was 47 percent manufacturing companies, 40 percent service centers/wholesalers, 6 percent steel mills, 4 percent trading companies and 3 percent toll processors/suppliers to the industry.

The process of collecting data lasts 4 days. Due to the Labor Day Weekend Holiday we started the process on Friday, September 2nd. The last day responses were collected was on Thursday, September 8th.

On Friday afternoon we provided a 49 slide power point presentation with a good portion of the results from the questionnaire to our Premium level members as well as those who responded to our invitation to participate in the questionnaire.

Again, the purpose of our survey is to look for changes in market trends which ultimately impact flat rolled steel prices and purchasing.

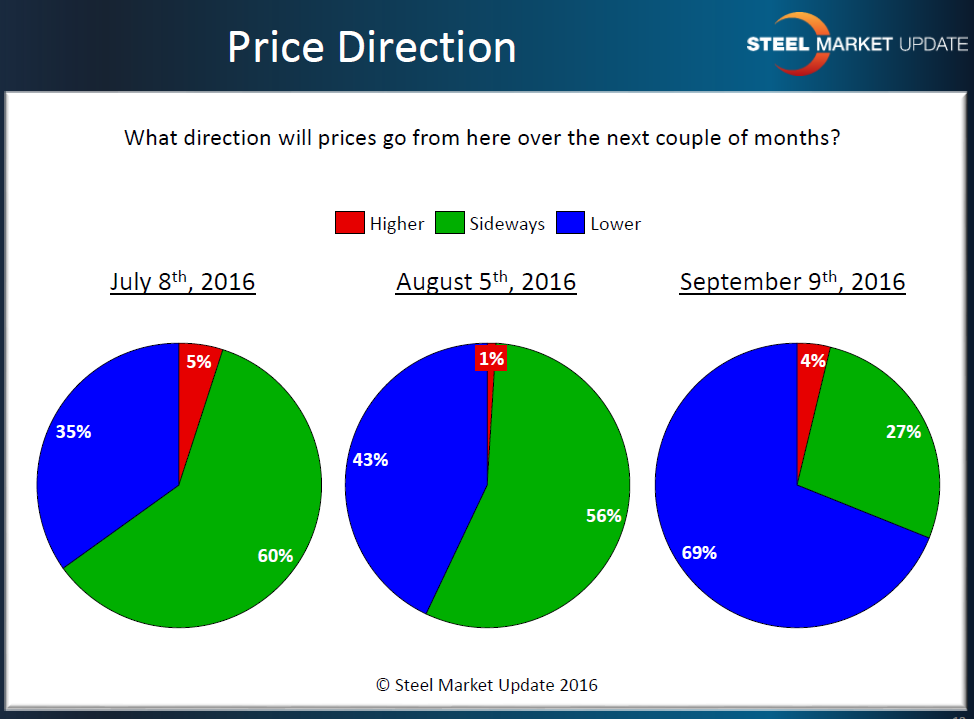

With the slowdown in order entry at the domestic steel mills and with carbon flat rolled inventories now at 2.5 months supply (according to MSCI data, our survey has service center inventories averaging 2.36 months supply) we have seen lead times shrink and mill negotiations heat up. One of the questions asked early on during our survey process is what direction do our participants believe flat rolled steel prices will go from here (higher, lower or remain the same)?

As you can see from the results from this past week, there is a growing belief that prices will move lower over the next couple of months with 69 percent of our respondents supporting that position. Back in July 60 percent of our respondents believed prices would move sideways (which they did on cold rolled and coated for a period of time). Only 4 percent of our respondents believe prices will reverse course and move higher from here.

Looking at the same timetable (early July, August and September) we also probed our respondents to see what percentage were having difficulties getting deliveries out of their domestic steel mills. Back in July almost one third (29 percent) were reporting late deliveries. As of last week that scenario has dropped to 5 percent as mills deliver steel early or on time.

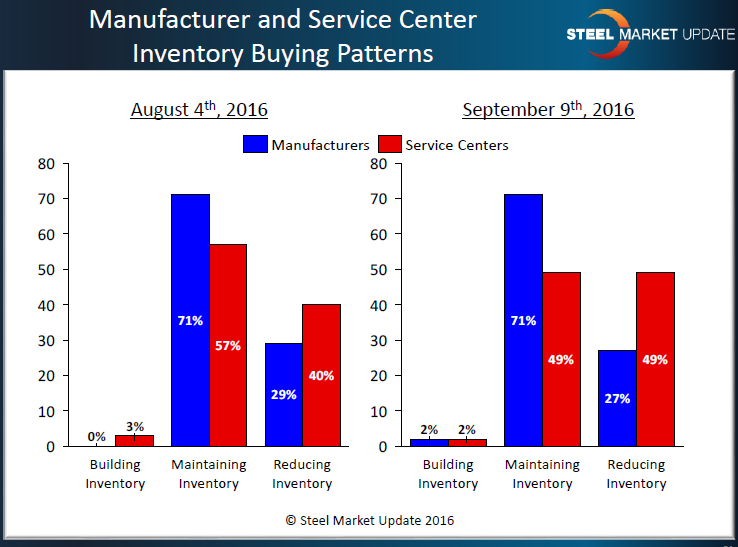

How are companies reacting to shorter lead times and steel mills that are more willing to negotiate steel prices? One way is for service centers in particular, to move to reduce inventories. This is something we see when prices begin to drop at the mill level – service center reduce inventories and one of the ways they accomplish that is by reducing their spot pricing (see separate article on service center spot pricing). As of last week 49 percent of those service centers participating in our questionnaire advised that their company was in the process of reducing inventories. This is up from 40 percent reported at the beginning of August.

If you would like to learn more about how you or your company can participate in our twice monthly trends questionnaires please contact John Packard at: John@SteelMarketUpdate.com.

If you would like to learn more about our Power Point presentations and how you can access this information as a Premium level customer please contact Brett Linton at: Brett@SteelMarketUpdate.com.