Market Data

September 9, 2016

Net Job Creation by Industry through August 2016

Written by Peter Wright

This month as we contemplate the August job creation performance we will lead off with the thoughts of J.G. Collins managing director of the Stuyvesant Square Consultancy.

![]() On September 2nd he wrote: The August jobs report released this morning was full of disappointment, with just 151,000 jobs created. Higher wage occupations continued to shed jobs or have just minimal jobs growth. Jobs continue to be added, though at a lower rate than prior months, to lower-wage occupations. Some of the strongest August jobs growth was in occupations that rely on government – like education, social services, and healthcare – for wage payments or supplemental support. Even higher wage sectors like financial services and professional services tend to have a number of jobs that are generated by the need for governmental and regulatory compliance. Meanwhile, higher wage private sector occupations in mining and logging, durable goods manufacturing, construction, utilities and telecommunications showed either net job losses or only modest job creation. The unemployment rate remained at 4.9 percent. The “U-6” alternative measure also remained steady at 9.7 percent. The labor participation rate remained at 62.8 percent, near a forty-year low. I wrote last month that it was highly unlikely the Fed would raise rates until December, and more likely, not until 2017 (if then.) Nevertheless, it’s clear that at the zero bound of interest rates, monetary policy is now of only diminishing marginal utility and fiscal policy, in the form of tax, regulatory, and government reform — mostly absent in the current recovery — are the only way to advance jobs and economic growth.

On September 2nd he wrote: The August jobs report released this morning was full of disappointment, with just 151,000 jobs created. Higher wage occupations continued to shed jobs or have just minimal jobs growth. Jobs continue to be added, though at a lower rate than prior months, to lower-wage occupations. Some of the strongest August jobs growth was in occupations that rely on government – like education, social services, and healthcare – for wage payments or supplemental support. Even higher wage sectors like financial services and professional services tend to have a number of jobs that are generated by the need for governmental and regulatory compliance. Meanwhile, higher wage private sector occupations in mining and logging, durable goods manufacturing, construction, utilities and telecommunications showed either net job losses or only modest job creation. The unemployment rate remained at 4.9 percent. The “U-6” alternative measure also remained steady at 9.7 percent. The labor participation rate remained at 62.8 percent, near a forty-year low. I wrote last month that it was highly unlikely the Fed would raise rates until December, and more likely, not until 2017 (if then.) Nevertheless, it’s clear that at the zero bound of interest rates, monetary policy is now of only diminishing marginal utility and fiscal policy, in the form of tax, regulatory, and government reform — mostly absent in the current recovery — are the only way to advance jobs and economic growth.

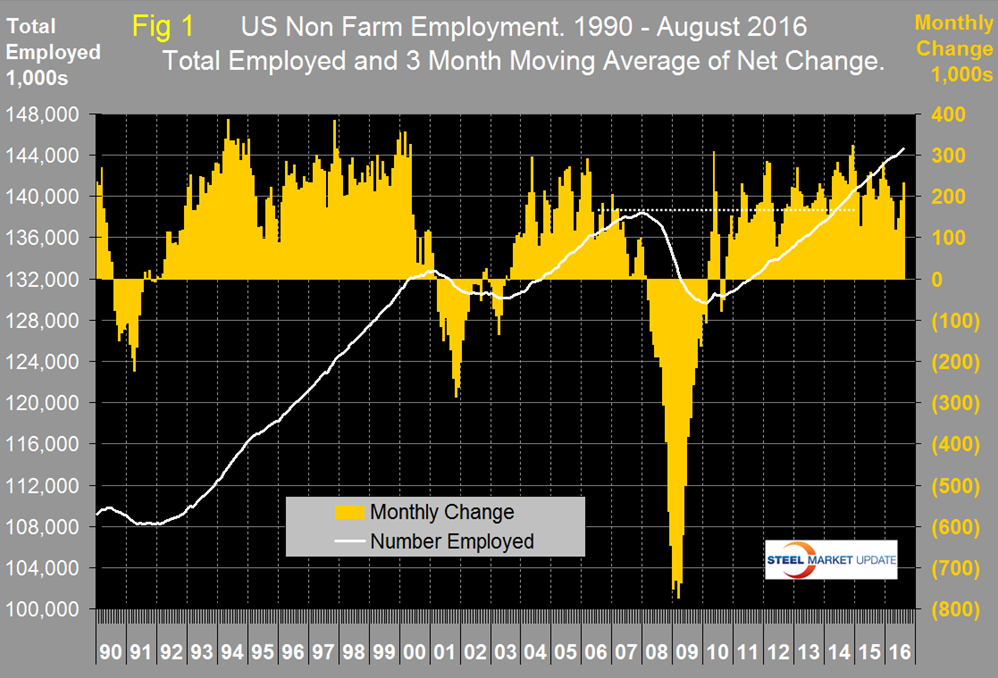

At SMU we almost always use three month moving averages to mitigate situations like the dismal and not credible May job creation statistics when even after two revisions only 24,000 jobs were created. In August net job creation was 151,000 and June jobs were revised down by 21,000 and July jobs were increased by 20,000. Using a 3MMA, the result for August was 232,000 which entirely wiped out the May aberration. Figure 1 shows the 3MMA of the number of jobs created as the brown bars since 1990.

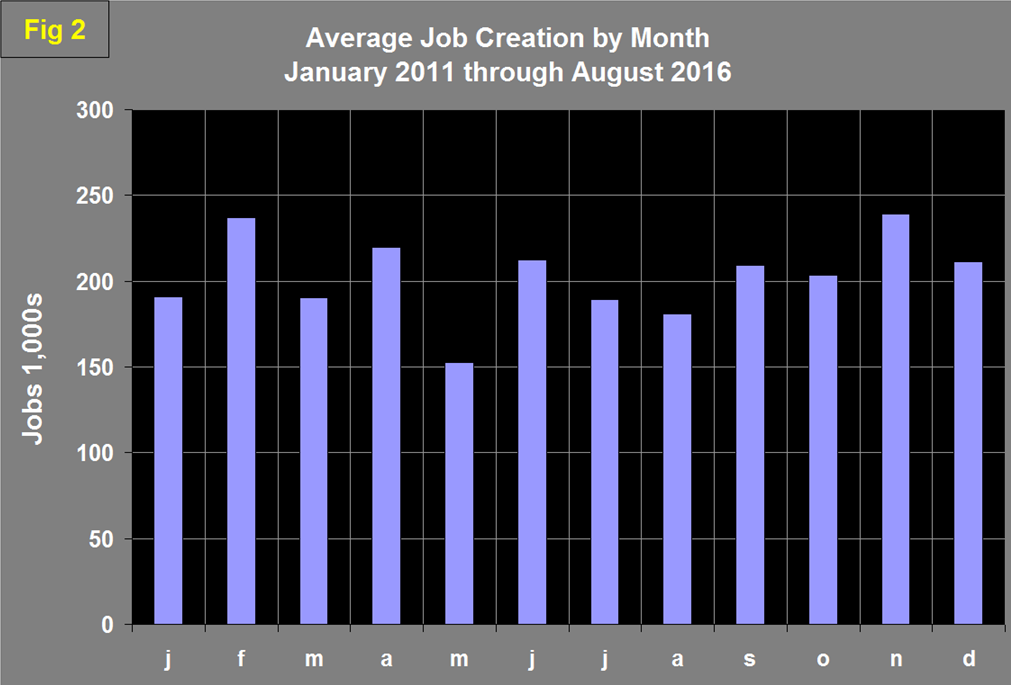

These numbers are seasonally adjusted by the BLS so to examine if any seasonality is left in the data after adjustment we have developed Figure 2.

The January dip is a weather effect and July is depressed by automotive plant re-tooling. Evidently the seasonal adjustment is less than perfect. Historically August declines by 5 percent from July, this year the decline was 45 percent. The disappointing August result will be a factor in the Fed’s decision making process as it contemplates a September rate increase. Total nonfarm payrolls are now 6,233,000 more than they were at the pre-recession high of January 2008.

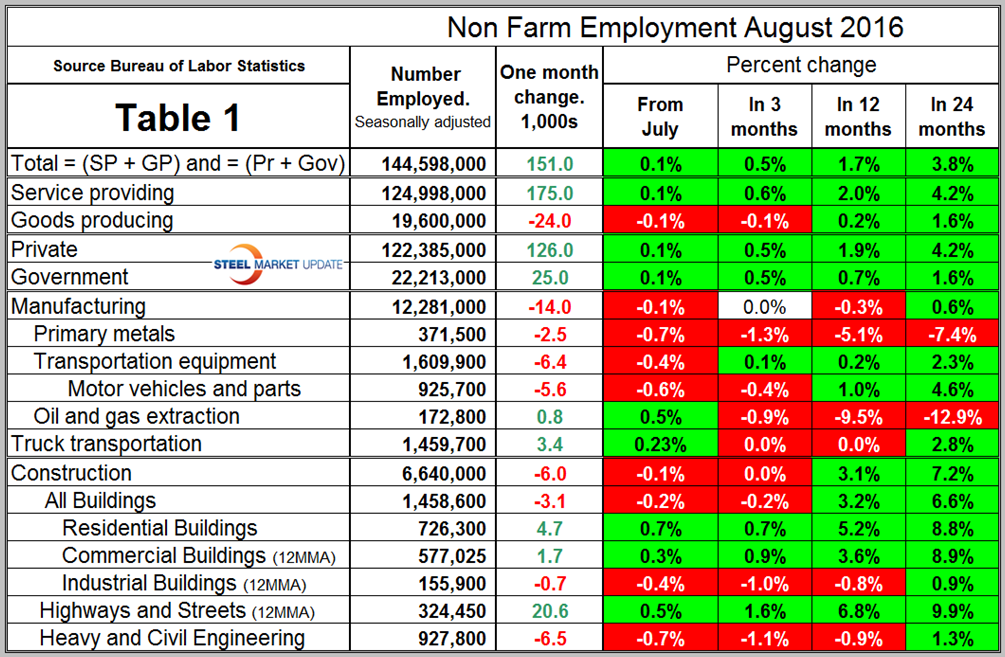

Table 1 slices total employment into service and goods producing industries and then into private and government employees.

Total employment equals the sum of private and government employees, it also equals the sum of goods producing and service employees. Most of the goods producing employees work in manufacturing and construction and the components of these two sectors that we consider to be of most relevance to steel people are broken out n Table 1. In August, 126,000 jobs were created in the private sector and 25,000 in government. The Federal government gained 1,000 as local governments gained 24,000. State government’s employment total was unchanged. Since February 2010, the employment low point, private employers have added 15,128,000 jobs as government has shed 263,000. In August service industries expanded by 175,000 as goods producing industries lost 24,000 people. Since February 2010, service industries have added 12,892,000 and goods producing 1,973,000 positions. This is part of the reason for stagnant wage growth since service industries on average pay less than goods producing such as manufacturing.

In August manufacturing lost 14,000 jobs and for the year as a whole is down by 39,000. August was particularly disappointing for manufacturing because June and July both had positive growth and were the first back to back months of manufacturing employment gains this year. In August total manufacturing employment was 0.3 percent less than a year ago but 0.6 percent higher than two years ago. Last month we reported that primary metals had positive job creation in July for the first time since June last year but after revision this gain went away and primary metals industries have lost jobs every month since June last year. Table 1 shows that in August oil and gas extraction had an employment turnaround and had positive growth for the first time since March last year. Truck transportation gained jobs in July and August after five straight months of job losses. Note the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those that we think have most relevance to the steel industry.

Construction was reported to have lost 6,000 jobs in August. After a string of 12 consecutive months of job growth, construction has only had one positive month since April which occurred in July. The construction employment data is not as positive as the construction expenditures report (CPIP) issued by the Department of Commerce. This maybe, as the Associated General Contractors of America continue to report, because of a lack of availability of skilled workers which is being ameliorated by longer work weeks.

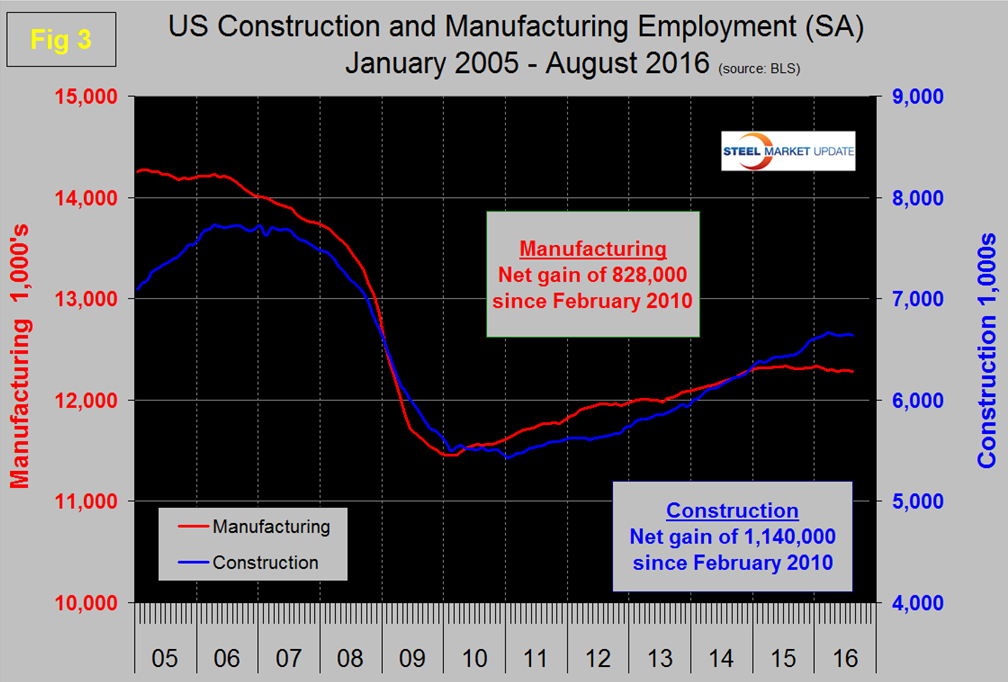

Some of the major construction sub categories are routinely reported one month in arrears which distorts the data in Table 1. These include, industrial buildings, commercial buildings and highways and streets. Construction has added 1,140,000 jobs and manufacturing 828,000 since the recessionary employment low point in February 2010 (Figure 3).

Construction has leapt ahead of manufacturing as a job creator but the growth of construction productivity is very low (or non-existent), in contrast to manufacturing where it is very high. The difference is the difficulty of automating construction jobs.

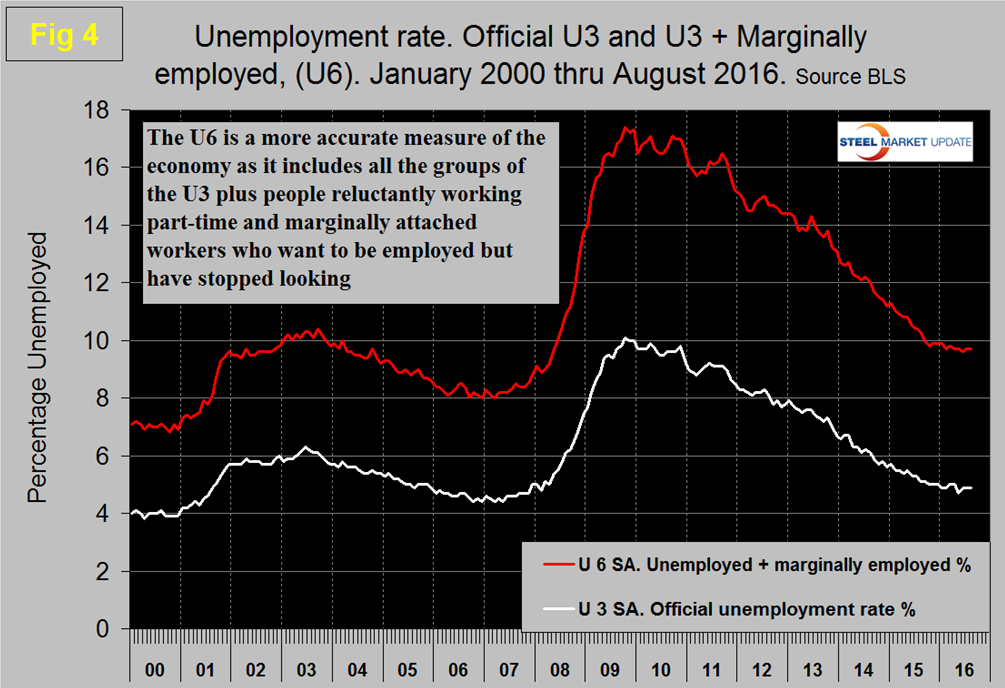

The official unemployment rate, U3, calculated from a different survey, was unchanged at 4.9 percent in June, July and August, up from 4.7 percent in May. This number doesn’t take into account those who have stopped looking. The more comprehensive U6 unemployment rate was unchanged at 9.7 percent in August (Figure 4).

U6 includes workers working part time who desire full time work and people who want to work but are so discouraged that they have stopped looking. The differential between these rates was usually less than 4 percent before the recession but is still 4.8 percent.

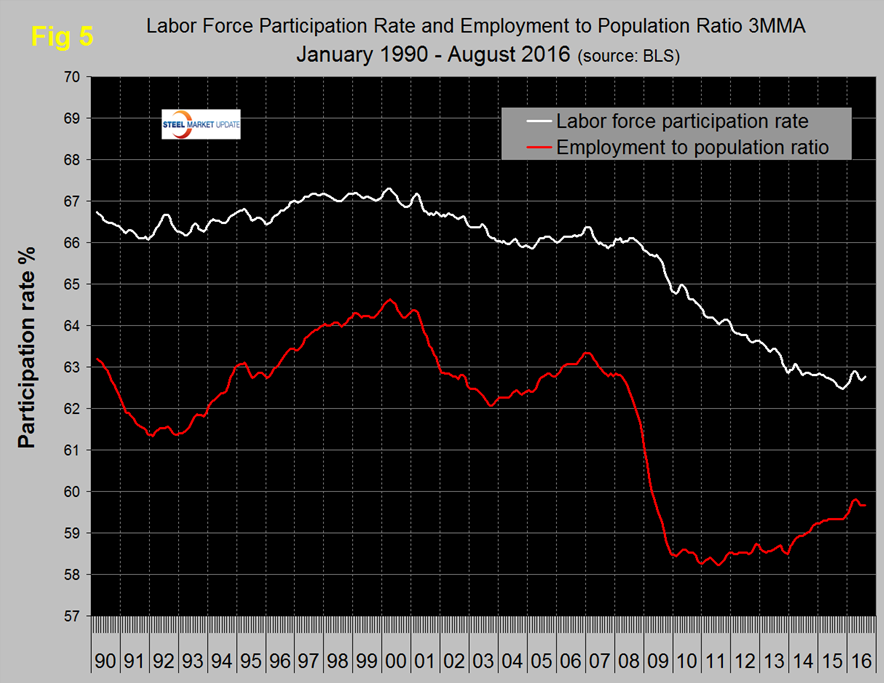

The employment participation rate is widely quoted in the press as going nowhere. In August 2016 the rate was 62.8 percent, with a 3MMA also of 62.8 percent. There was a small improvement from 62.4 percent in September last year to 63.0 percent in March but negative progress since then. We’re not sure that we understand what this is a percentage “of” because of the multiple descriptions of the labor pool. Another measure is the number employed as a percentage of the population which we think is much more definitive. In August this measure was unchanged at 59.7 percent with a 3MMA also of 59.7 percent which was down from 59.8 percent in March through May. Figure 5 shows both measures on one graph.

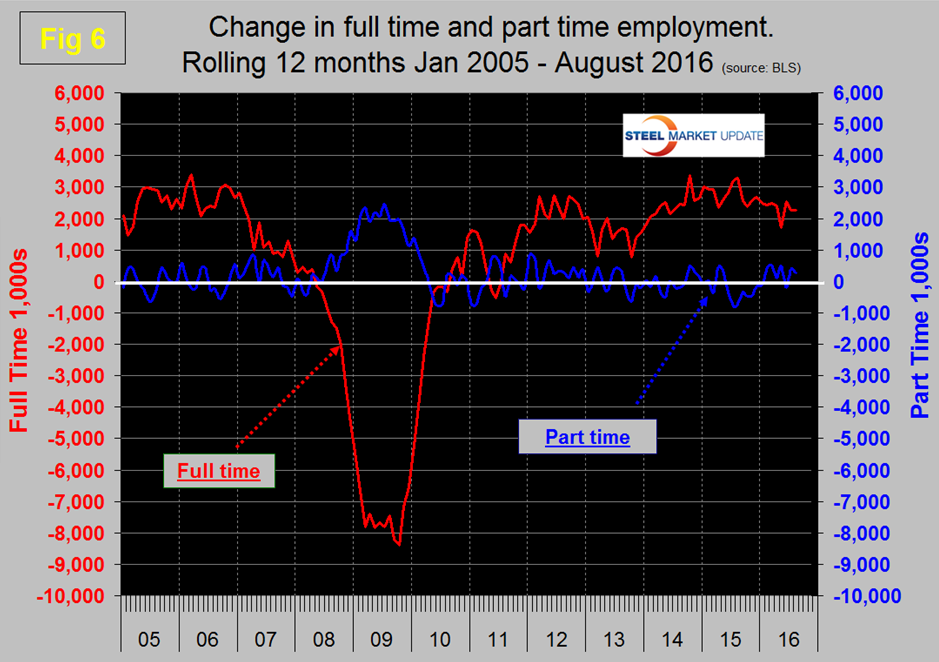

In the 20 months since and including January 2015 there has been an increase of 4,367,000 full time and a loss of 299,000 part time jobs. Figure 6 shows the rolling 12 month total change in both part time and full time employment.

Frequently in the press we read that a large part of job creation is in part time employment which in some months is true but the part-time numbers are extremely volatile. To overcome the volatility we have to look at longer time periods than a month or even a quarter which is why we look at a rolling 12 months for this component of the employment picture.

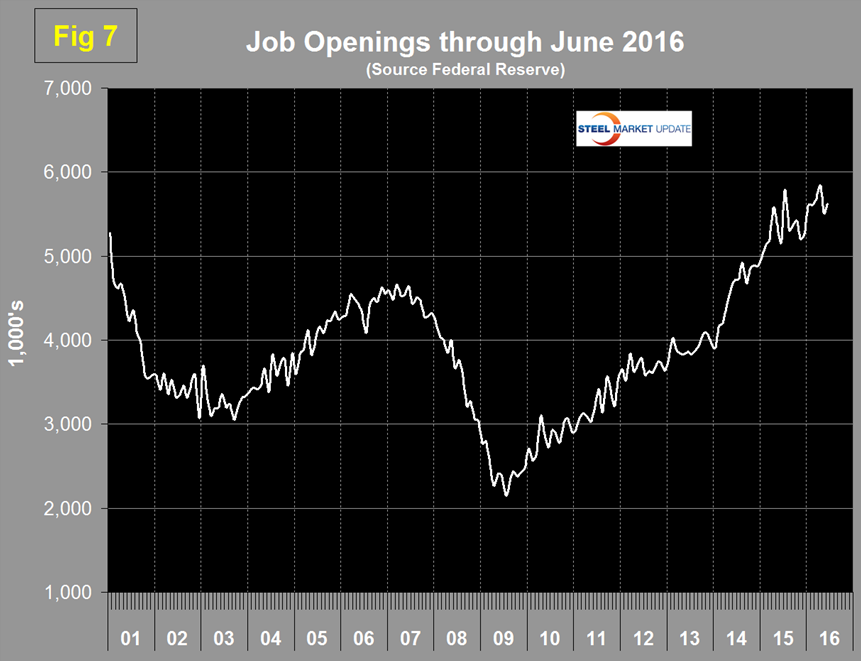

The job openings report known as JOLTS is reported on about the 10th of the month by the Federal Reserve and is over a month in arrears. Figure 7 shows the history of unfilled job openings through June. Openings declined in May, recovered somewhat in June and are still at a historically very high level.

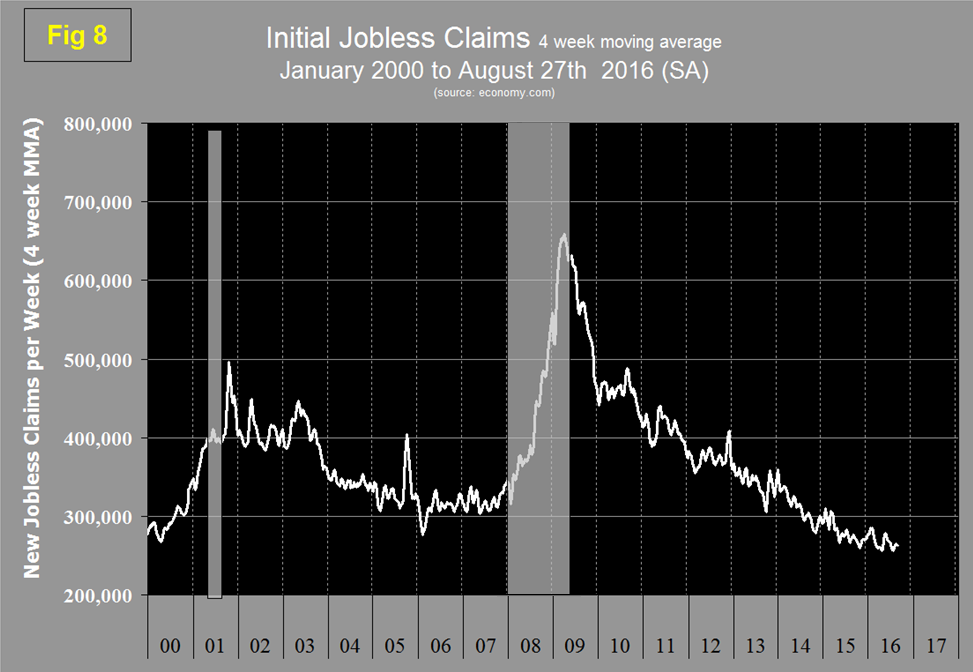

Initial claims for unemployment insurance, reported weekly by the Department of Labor have continued their downward drift this year and in w /e August 27th were 263,000 on a four week moving average basis. This marks the longest streak since 1973 of initial claims below 300,000. (Figure 8).

Michigan and Louisiana posted the largest increases in initial claims, at 2,625 and 2,280 respectively. These were the only two states to have increases greater than 2,000. California experienced the largest decrease in initial claims, dropping by 2,962. Virginia’s decrease of 1,168 was the second largest.

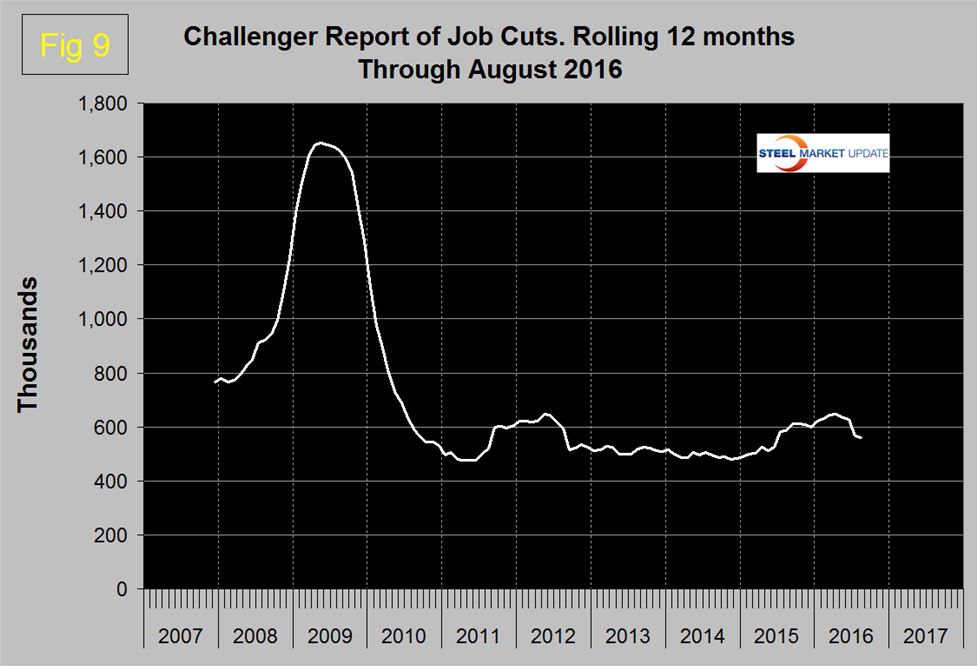

The last piece of the employment puzzle that we examine is the Challenger report which measures job cuts monthly (Figure 9).

This data also tends to be quite erratic therefore again we examine a rolling 12 months and can see that job cuts increased from late 2014 through April this year, declined in May and June, dived in July and were steady in August.

SMU Comment: Based on the dismal and unbelievable May report we have lost some confidence in this data stream as an input to our steel market analysis. August is another case in point with a surprisingly large decline in jobs created. Both the May and August data were feeds into the Fed’s decision on rate increases. (We didn’t say that!). The 3MMA of the August data was very strong at 232,000 therefore it remains to be seen if that positive number will be maintained in coming months. August data for both manufacturing and construction were disappointing. The 3MMA of the ISM manufacturing index which is considered to be a leading indicator is still flashing expansion and the CPIP report of construction expenditures has positive growth though construction appears to be slowing. Overall this August employment report doesn’t seem to be telling us a whole lot about future steel demand.

Explanation: On the first Friday of each month the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. At SMU we track the job creation numbers by many different categories. The BLS data base is a reality check for other economic data streams such as manufacturing and construction and we include the net job creation figures for those two sectors in our “Key Indicators” report. It is easy to drill down into the BLS data base to obtain employment data for many sub sectors of the economy. For example, among hundreds of sub-indexes are truck transportation, auto production and primary metals production. The important point about each of these hundreds of data streams is in which direction they are headed. Whenever possible we at SMU try to track three separate data sources for a given steel related sector of the economy. We believe this gives a reasonable picture of market direction. The BLS data is one of the most important sources of fine grained economic data that we use in our analyses. The States also collect their own employment numbers independently of the BLS. The compiled state data compares well with the federal data. Every three months SMU examines the state data and provides a regional report which indicates strength of weakness on a geographic basis. Reports by individual state can be produced on request.