Market Data

September 8, 2016

SMU Steel Buyers Sentiment Index Wavering Yet Still Optimistic

Written by John Packard

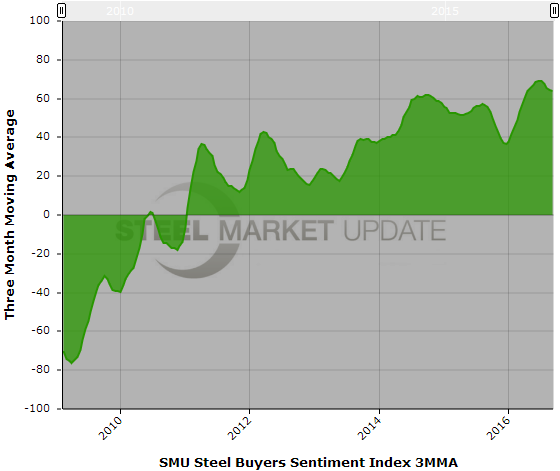

The SMU Steel Buyers Sentiment Index has been showing signs of a rebound as our Current Index is being released as +63 this week. This is a +2 point improvement from the middle of August and +5 point improvement since the beginning of August.

However, SMU prefers to look at our Current and Future Sentiment Indexes based on a three month moving average (3MMA). This helps take any single data point gyrations out of the data and provide a clearer picture of the underlying trend.

The 3MMA for Current Sentiment, which is how buyers and sellers of steel feel about their company’s ability to be successful in today’s market, came in at +63.67 which is -2 points lower than the 3MMA produced at the beginning of August 2016. The trend has been for buyers and sellers of flat rolled steel to be slightly less optimistic going back to the beginning of July 2016 when our Current Sentiment Index set a record for being the most optimistic we have measured since we began measuring Sentiment back in 2008.

The 3MMA at +63.67 is still at a very optimistic level and well above year ago levels when Current Sentiment was recorded as being +55.67 (see below for full explanation of our Sentiment index).

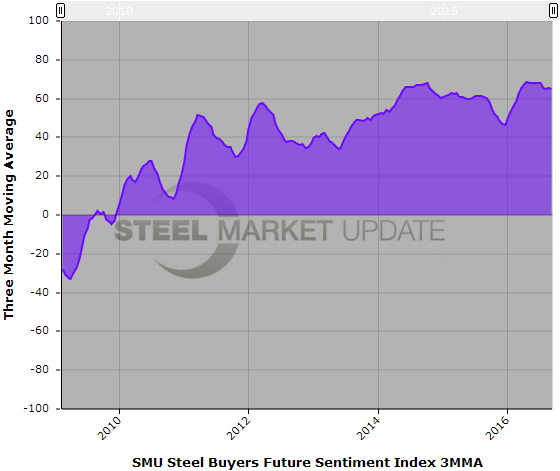

SMU Future Steel Buyers Sentiment Index

Future Sentiment, how buyers and sellers of flat rolled steel feel about their company’s ability to be successful three to six months into the future, is being reported as being +64 which is unchanged going back to the beginning of August 2016. The +64 is also well above the +56 recorded one year ago.

Looking at Future Sentiment on a three month moving average (3MMA) basis, we are finding that the trend line is wavering since the middle of July. We measured our Future Sentiment Index this week at +64.83 which was slightly lower than the +65.17 recorded at the beginning of August. Last year at the beginning of September the Future Sentiment Index was reported to be +60.33.

What our Respondents are Saying

“Market has slowed down in the near-term as service centers await price trend duration.” Steel mill

“Volume is still a concern.” Service center

“Currently strong sales.” Manufacturing company

“Contract releases are somewhat weaker than anticipated in automotive, stronger than expected in office furniture and robust in industrial storage.” Service center

“Although impacted by the trade cases we have a unique combination of domestic and offshore mill products. This should allow us to be successful in the next 6 months.” Steel mill

“Nervous about impact of political rhetoric.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 44 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.