Market Data

September 7, 2016

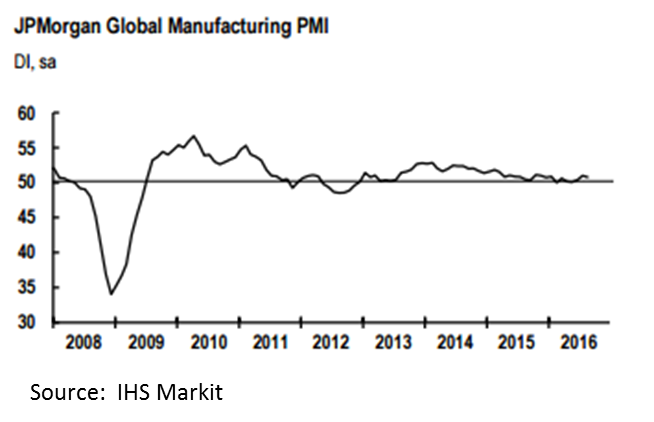

Global Manufacturing Sluggish In August

Written by Sandy Williams

Global manufacturing continued to grow in August although falling from an eight-month high of 51.0 in July to 50.8 in August. Growth was sluggish in developed markets but improved in emerging markets. Of the 28 countries surveyed in the JP Morgan Global PMI, only nine reported worsening conditions in August. Manufacturers in China reported no change. North America and Europe drove most of the expansion in August while Asian manufacturing was mostly flat. The UK rebounded in August after sharp declines in July attributed to the vote to exit the European Union.

Global output rose at the fastest pace since November 2015 and was consistent with a 2.5 percent annual rise in factory production, reported Markit. Order books grew a little slower in August but exports showed a modest gain.

Global output rose at the fastest pace since November 2015 and was consistent with a 2.5 percent annual rise in factory production, reported Markit. Order books grew a little slower in August but exports showed a modest gain.

Purchase of raw materials by factories was higher for the second consecutive month even as average input costs rose for the fifth month in a row. Selling prices, on average, were slightly lower. Employment levels dropped marginally after six months of expansion.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at JPMorgan, said: “The PMI points to some acceleration in global manufacturing this quarter. However, the August survey was a bit of a disappointment since it failed to deliver on improvements from July. The sluggish trends in new orders remains the main constraint and this will need to improve if global IP growth is to progress in the latter part of this year.”

The Eurozone saw a loss of momentum in August with rates for production, new orders and new export orders slowing. The PMI lost 0.3 percentage points to register 41.7 for the month. All of the countries surveyed in the Eurozone saw expansion in August except for Italy at 20-month low and France at a PMI reading of 48.3.

“Eurozone manufacturers reported a wavering performance in August, with signs that growth could slow further in coming months,” commented Chris Williamson, Chief Business Economist at IHS Markit. “Once again, it’s also a worryingly mixed picture across the region. Northern countries including Germany, the Netherlands and Austria are providing the main power to the expansion, but elsewhere the picture is looking more subdued. France and Italy are in decline, Greece is stagnating and both Spain and Ireland are enduring their worst growth spells since mid-2013.”

China manufacturing was essentially unchanged last month. The PMI fell from 50.6 in July to the no-change mark of 50.0 in August. The output index declined and new orders and input purchases fell into contraction. Employment levels continued to decline but at the slowest rate so far in 2016. Markit suggest that temporary tightening of fiscal policy may have contributed to manufacturing’s lackluster performance in August. The Chinese government is continuing efforts to stabilize the economy.

Russia saw some improvement in manufacturing conditions last month with production and new orders expanding modestly. The PMI registered 50.8 up from 49.5 in August. Intensifying cost pressure has been the norm for the past 91 surveys and continued in August with a slightly softening to a four month low. Output prices increased for the thirteenth month. Markit commented that improvement needs to be seen in employment, inventory levels and backlogs before the sector can gain traction. Until then manufacturing growth in Russia is likely to remain inconsistent.

Japan had its highest PMI reading since February as production and buying activity picked up. The PMI was still below the neutral mark at 49.5 but up from 49.3 in July. New orders decreased for the seventh month in August but at the weakest rate since February. Export orders declined at a slower rate and firms noted a reduction in trade volume from China. Imported raw material prices were lower due to a stronger exchange rate. Commented Amy Brownbill, economist at IHS Markit, “Latest survey data signalled an increase in manufacturing production in Japan for the first time since February and follows on from previously slower declines following May’s sharp contraction. The improved trend matches the current IHS Markit forecast of year-on-year growth in industrial production (1.0%).”

South Korea manufacturers saw production and new orders decrease sharply in August with the headline PMI falling into contraction to 48.6 from 50.1 in July. New export orders dropped sharply, dropping for the first time since April. Manufacturers noted a reduction in trade volume with China, Germany and Iraq. Input costs eased in August but selling prices continued to decline.

Brazil continues to struggle with its economy resulting in further declines in manufacturing in August. The headline PMI dropped to 45.7 from 46.0, signaling the 19th month of contraction for the sector. A sharp drop in new orders, domestically and abroad, was the primary reason for the declining PMI. Markit is forecasting a 3.1 percent fall in real GDP in Brazil, a slight improvement from the 3.9 percent reduction in 2015.

In North America, the Markit U.S. Manufacturing PMI registered 52.0 down from 52.9. New orders and employment growth were softer in August contributing to the decline in the headline index. Production volumes improved at the fastest rate of expansion since November.

Chris Williamson, Chief Economist at Markit, commented, “Despite the PMI falling in August, the survey suggests the third quarter is shaping up to be the best quarter so far this year for manufacturing, with output growth picking up compared to the first half of the year on the back of improved export sales.

“The overall rate of expansion remains only modest, however, and the upturn fragile. Weak domestic demand remains a drag on order books. Concerns about the outlook have also resulted in a marked reduction in the rate of job creation.

“There’s anecdotal evidence to suggest that this at least in part reflects a slowing in the economy in the lead up to the presidential election, meaning there’s scope for growth to revive later in the year. In the meantime, the overall sluggish pace of expansion signalled by the survey, and the slacking of inflationary pressures, provides support to those arguing that interest rates should remain on hold.”

Mexico manufacturers reported subdued conditions in August. The PMI rose to 50.9 from 50.6. New orders growth was the best in three months but still considered “underwhelming.” A slight drop in production was recorded and spare capacity was noted as backlogs decreased sharply in August. Input prices were higher last month and blamed on an unfavorable exchange rate increasing the cost of imported goods.

Canada manufacturers experienced steady but weaker growth in August. Production rose at the slowest level in six months as subdued demand and strong competition created softer growth in new orders at home and abroad. Input costs rose sharply as firms noted higher steel prices and exchange rate depreciation. The PMI dipped to 51.1 from 51.9 in July.

About the PMI:

The Purchasing Managers’ Index™ (PMI™), published monthly by IHS Markit, is a composite index based on five of the individual indexes with the following weights: New Orders – 0.3, Output – 0.25, Employment – 0.2, Suppliers’ Delivery Times – 0.15, Stocks of Items Purchased – 0.1, with the Delivery Times Index inverted so that it moves in a comparable direction. The diffusion indexes show the prevailing direction of change. An index reading above 50 indicates an overall increase in growth, below 50 an overall decrease.