Prices

September 6, 2016

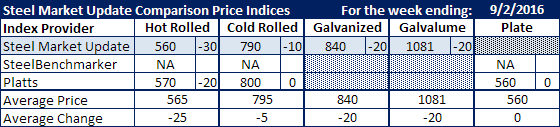

Comparison Price Indices: Big One Week Drop

Written by John Packard

Flat rolled steel prices moved lower last week according to the steel indexes followed by Steel Market Update. Our own index saw hot rolled down $30 per ton, cold rolled as being down $10 per ton, galvanized down $20 per ton and Galvalume down $20 per ton. Platts saw their hot rolled average as being $20 per ton lower while their other products (cold rolled and plate) did not move last week.

SteelBenchmarker did not report prices last week as they only release their indices twice per month.

The Steel Market Update (SMU) Price Momentum Indicator continues to point toward lower flat rolled prices over the next 30 to 60 days.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.