Prices

September 1, 2016

Hot Rolled Futures: Almost Time to Wake Up…

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

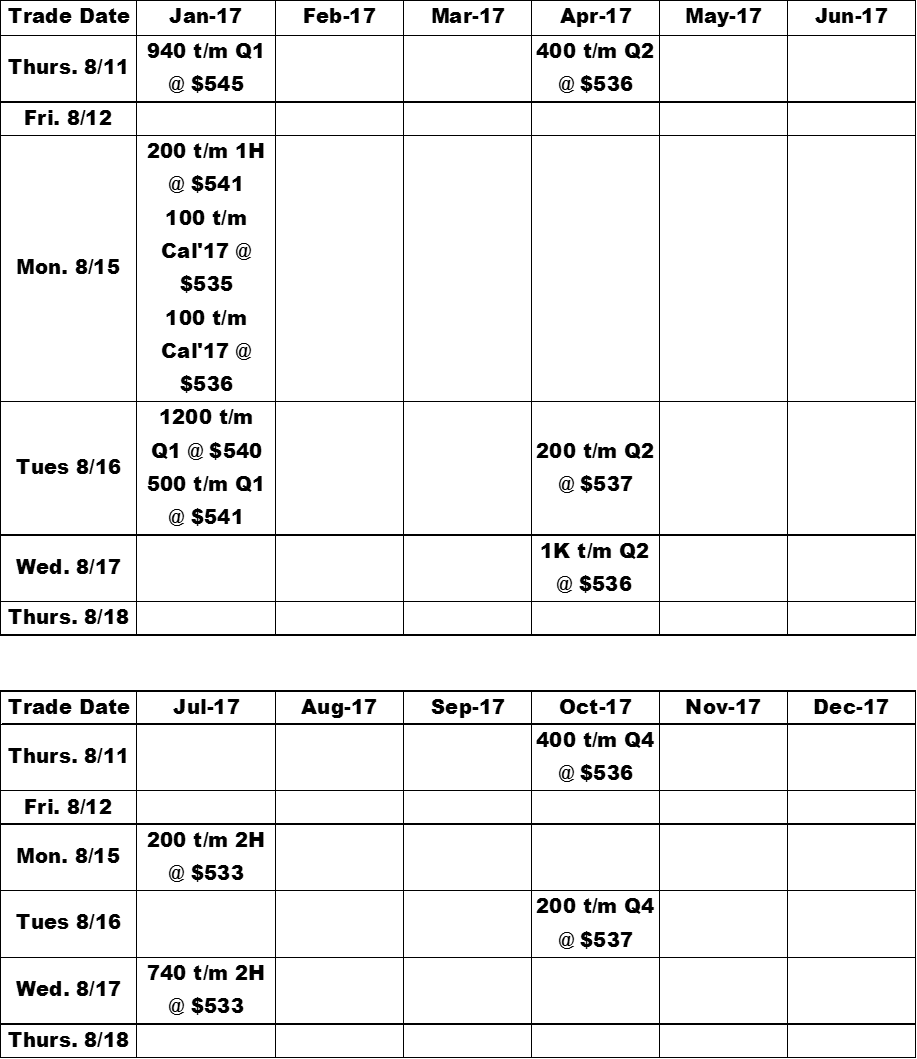

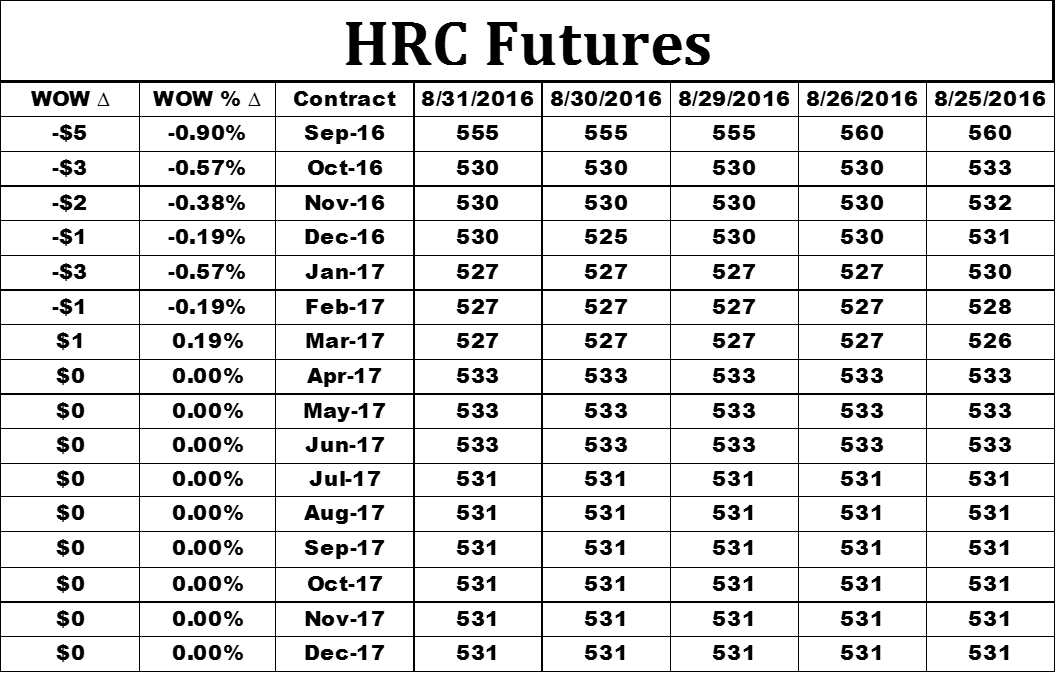

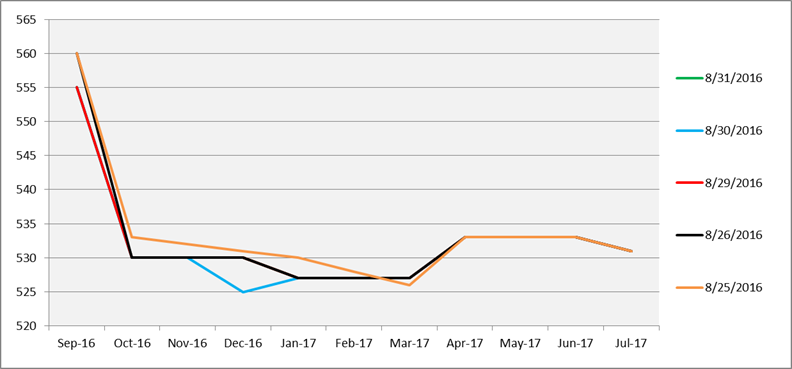

CME Midwest HRC futures limped toward Labor Day with not much trading (excluding one large 5kt/m Q4 trade last Friday) and not much price movement. Excluding September, the curve has flattened around $530/st through December of 2017. 19,160 short tons have traded hands since last Thursday. Open interest is currently at 401,300 st.

![]()

A strong bull case and a strong bear case could be made at this point, however today’s dreadful ISM PMI and disappointing auto sales are starting to concern this guy that the weakness on the demand side is more than a buyer’s strike and summer doldrums. A good 500 people from the steel industry were in Atlanta this week for the SMU conference while another lot was taking advantage of the last week of summer. Purchase orders were probably few and far between.

The bottom line is the weeks following Labor Day will tell us a ton about what we can expect for the rest of 2016 and as this information is fleshed out, it may lead to some palatable volatility in the futures. I can tell you for sure HRC prices will either go up, stay flat or head lower.

Below are the trades executed since last Thursday: