Market Data

August 23, 2016

CFNAI Offers Reassurance for Economic Growth

Written by Sandy Williams

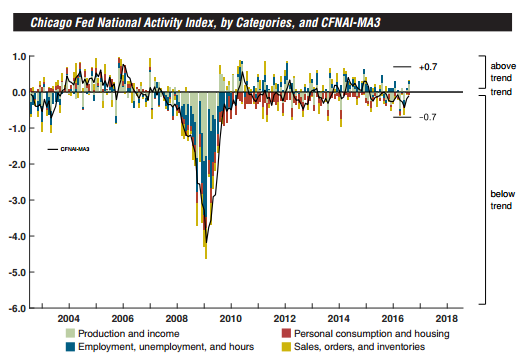

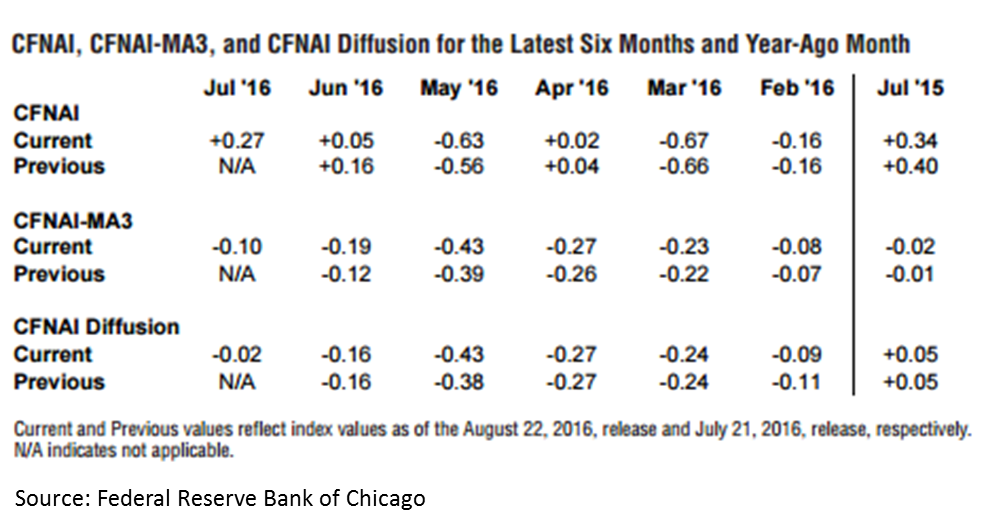

Economic growth increased for a second consecutive month in July according to the Chicago Fed National Activity Index (CFNAI). The index is a gauge of economic activity and inflation and is expressed by three separate index values: the CFNAI and two 3-month moving average indexes, the CFNAI-MA3 and CFNAI Diffusion Index. The 3-month averages help to smooth out volatility and give a clearer picture of economic growth. The headline CFNAI rose to +0.27 in July from +0.05 in June.

The three month moving average for the CFNAI-MA3 increased to -0.10 from -0.19, the highest level since February but slightly below its historical trend. The result from this index suggests that inflationary pressure will be subdued in the coming year.

The CFNAI Diffusion Index, also a three month moving average, increased to -0.01 in July from -0.16 the previous month. The Index is based on 85 individual indicators, 49 of which improved during the month. In July, 53 of those indicators made positive contributions to the index while 32 made negative contributions.

Highlights of the indicator results, as published by the Chicago Fed, are reprinted below:

The contribution from production-related indicators to the CFNAI rose to +0.23 in July from +0.07 in June. Manufacturing industrial production increased 0.5 percent in July after moving up 0.3 percent in June; and manufacturing capacity utilization increased to 75.4 percent in July from 75.0 percent in the previous month. The sales, orders, and inventories category made a contribution of +0.01 to the CFNAI in July, up slightly from –0.01 in June.

Employment-related indicators contributed +0.09 to the CFNAI in July, up from +0.05 in June. Civilian nonagricultural employment rose by 515,000 in July after increasing by 211,000 in the previous month. However, nonfarm payrolls increased by only 255,000 in July after rising by 292,000 in June.

The contribution of the personal consumption and housing category to the CFNAI was steady at –0.06 in July. Housing starts increased to 1,211,000 annualized units in July from 1,186,000 in June. However, housing permits decreased to 1,152,000 annualized units in July from 1,153,000 in the previous month.

The Chicago Fed provides the following explanation of what the numbers mean:

When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above –0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended. When the CFNAI-MA3 value moves above +0.70 more than two years into an economic expansion, there is an increasing likelihood that a period of sustained increasing inflation has begun.

Data that was available as of August 18, 2016 was used to construct the CFNAI. Estimates were used for any missing data.