Prices

August 21, 2016

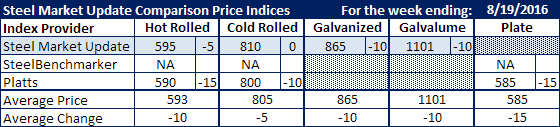

Comparison Price Indices: Slide Continues

Written by John Packard

The pace of the slippage in flat rolled prices accelerated this past week with many products being reported down $10 per ton or more by the indexes followed by SMU. Benchmark hot rolled was reported to be $15 per ton lower by Platts at $590 per ton while SMU had it down $5 to $595 per ton.

Cold rolled was $10 per ton lower on Platts at $800 per ton with no change at SMU who reported CR to be averaging $810 per ton.

Galvanized dropped $10 per ton to $865 per ton for .060” G90 which carries a $60 per ton extra.

Galvalume also dropped $10 per ton to $1101 per ton on .0142” AZ50, Grade 80.

Platts plate prices were reported to average $585 per ton.

SteelBenchmarker did not report prices this past week.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.