Market Data

August 18, 2016

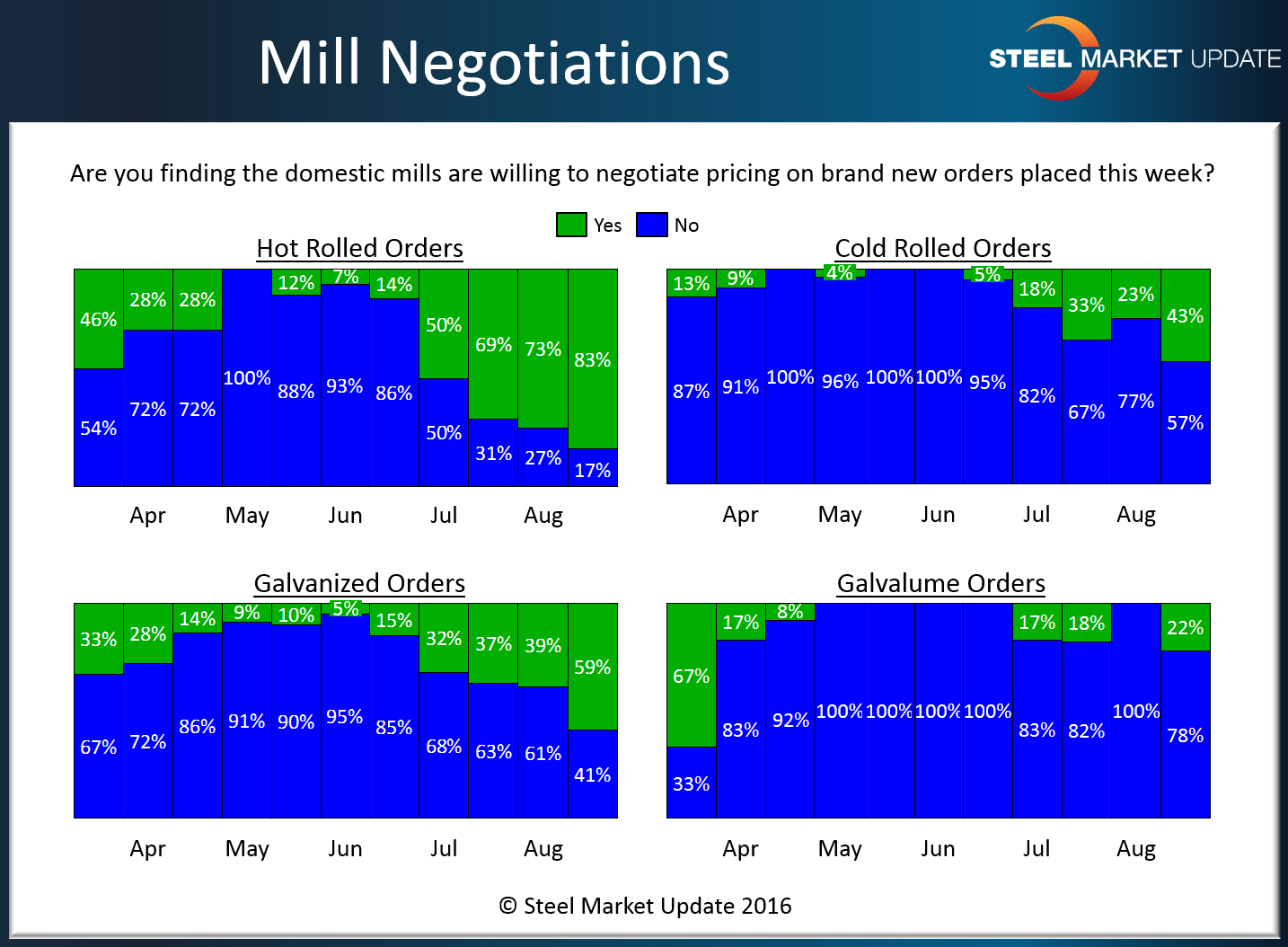

Mill Price Negotiations on Flat Rolled Vary by Product

Written by John Packard

Based on the results of our flat rolled steel market trends survey that Steel Market Update (SMU) conducted all week, steel mills are receptive to negotiate steel prices on some products and less so on others. We are seeing the mills being fairly aggressive on hot rolled price negotiations with 83 percent of our survey respondents reporting the mills as willing to negotiate. On the other end of the spectrum is Galvalume, used in metal buildings and other building products that are in peak season right now, where only 22 percent of our respondents reported the mills as willing to negotiate price on AZ products.

Cold rolled, which has seen lead times slipping over the past two weeks, saw the percentage of respondents reporting the mills as willing to negotiate rise to 43 percent. This is up 20 percent since early August and up 43 percent since June.

Galvanized is another product where lead times have shrunk and the percentage of those reporting the mills as willing to negotiate pricing rose from 39 percent to 59 percent. Back in June, GI was reported at 5 percent.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.