Government/Policy

August 7, 2016

SMU Analysis of HRC Final Determination Ruling

Written by John Packard

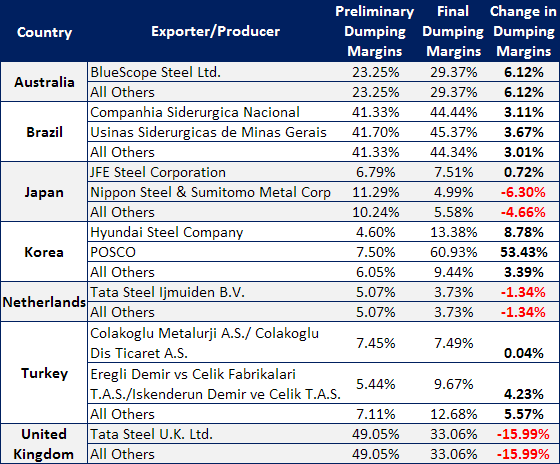

On Friday the U.S. Department of Commerce announced their final determination findings on hot rolled steel dumping margins and countervailing subsidy rates for Brazil, South Korea, Australia, Turkey, Japan, United Kingdom and the Netherlands. In the article above we reproduced the press release provided by the Commerce Department. In this article we are going to compare the preliminary determinations with the final and see if there are any surprises that could impact U.S. customers.

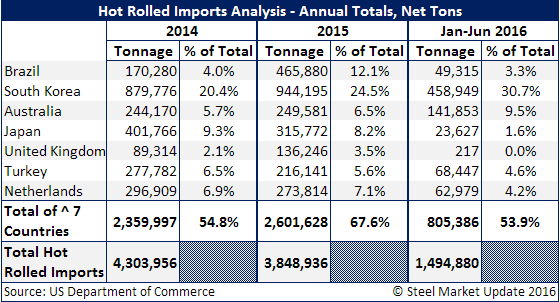

We shared the following data with you last Tuesday but we thought it would be valuable to you as we discuss each of the countries listed below and if the adjustments made by the U.S. Department of Commerce could potentially affect exports from these countries moving forward.

The biggest surprise associated with Commerce’s announcement has to be with POSCO out of South Korea. In the past POSCO was exempt from many of the dumping suits because of its joint venture partnership with US Steel. Jointly, POSCO and US Steel own a steel mill (USS/POSCO or UPI) close to San Francisco, California.

In the preliminary determination phase Commerce & the ITC assigned POSCO a 7.50 percent total margin and with this latest announcement that number shot up to 60.93 percent. A change of +53.43 percent (50.7 percent of the POSCO change was related to Commerce not being able to verify key elements of the responses provided to Commerce). SMU communicated with trade attorney Lewis Leibowitz about the POSCO situation and he advised us that POSCO has the ability to post the cash deposits and continue to supply USS/POSCO if they choose to do so. That is a question that remains to be answered. One year after the CVD order is entered, which probably will be sometime in October 2016, POSCO will be able to get a review of the CVD order and get the duty reduced. The expectation is that review could take until the end of 2018 to complete.

Brazil also saw their final determination results rise slightly (see below) as did Australia, Korea (other than POSCO) and Turkey.

The United Kingdom saw the biggest reductions at -15.99 percent but still at a very high percentage (33.06 percent). Japan and the Netherlands also saw their percentages drop (see below).