Prices

August 7, 2016

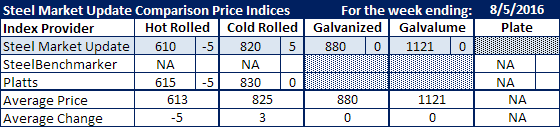

Comparison Price Indices: Only Minor Adjustments

Written by John Packard

We saw minor erosion in hot rolled prices this past week according to the steel indexes followed by Steel Market Update. Both our own index as well as Platts dropped their HRC average by $5 per ton. As of the end of last week Steel Market Update was showing hot rolled as averaging $610 per ton ($30.50/cwt) and Platts was at $615 per ton ($30.75/cwt).

Cold rolled averaged $820 on the SMU index ($41.00/cwt) and $830 at Platts ($41.50/cwt). The Platts number was the same as the prior week while the SMU cold rolled average was up $5 per ton.

SMU kept our .060” G90 galvanized average at $880 per ton ($44.00/cwt). The $880 number includes the $60 per ton extra used for the cost to apply zinc to the surface of the substrate to make a G90 product. There was no change in our average from the previous week.

We also kept our Galvalume .0142” AZ50, Grade 80 average at $1121 per ton ($56.05/cwt) the same as the prior week.

We did not receive any plate pricing this past week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.