Market Data

August 4, 2016

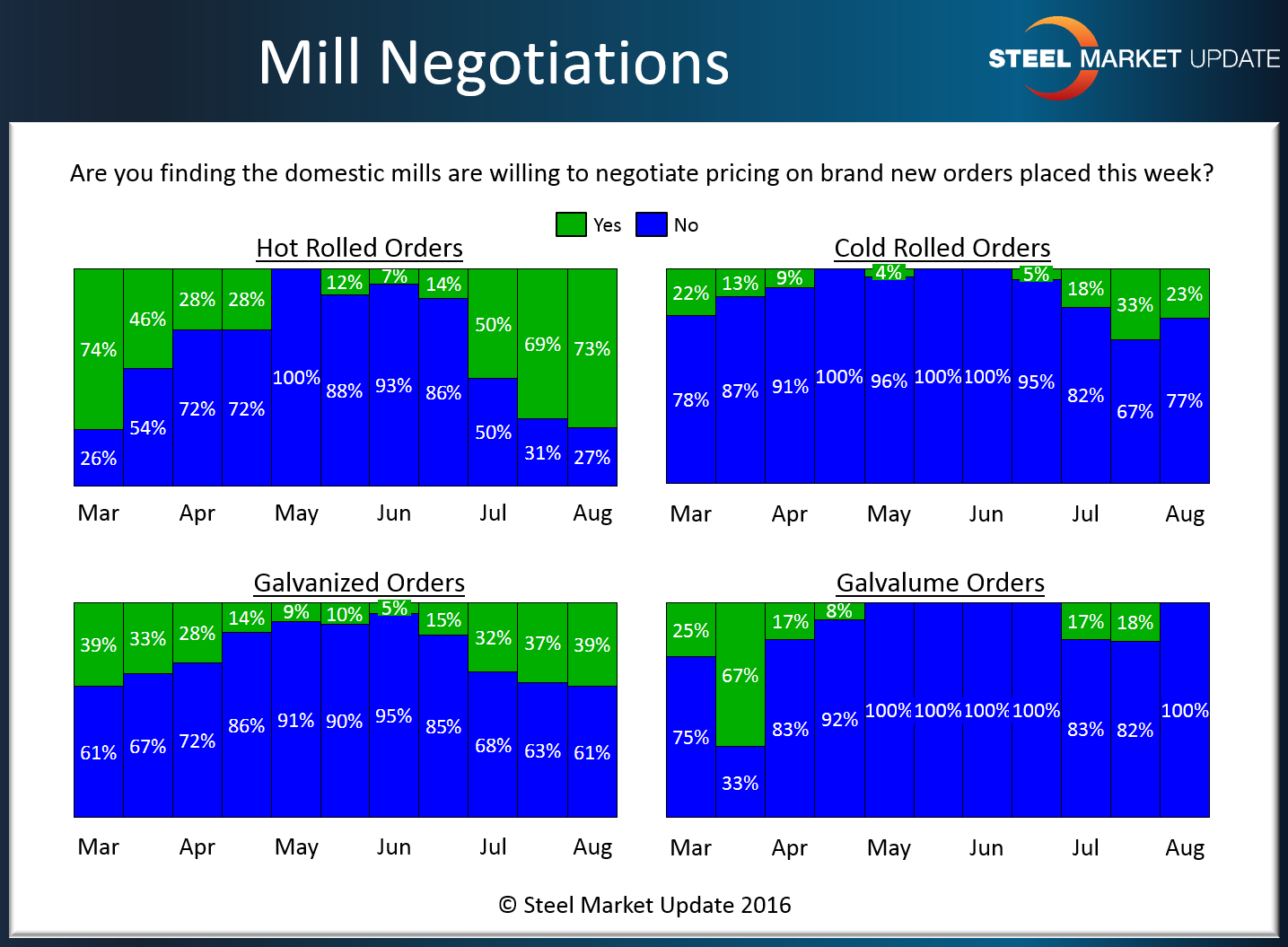

Steel Mill Price Negotiations: Hot Rolled Yes, Others Not So Much

Written by John Packard

The following information was collected from our flat rolled steel market trends survey which we have been conducting since Monday of this week. Much of the collection information is similar to the Lead Times article above as this question is posed to manufacturing companies and distributors.

What we are trying to discover is if there is any change in the trend for the steel mills to either negotiate or not negotiate spot flat rolled prices with their customers at this time. The blue bars represent those who are reporting the mills as not negotiable while the green bars are those reporting the mills as negotiable.

We produce this report by product and you can see why in the responses below. There is a very big difference between hot rolled and all of the other flat rolled products. Seventy-three percent of the respondents reported HR as being price negotiable. At the same time cold rolled (23 percent), galvanized (39 percent) and Galvalume (zero percent) were products that were less negotiable.

SMU will be watching hot rolled spot prices carefully over the coming weeks to see if the product breaks through the $590 level which we currently have as the bottom of the price range according to our HRC index.

We remind our readers these results are based on responses to our survey. Each individual mill may have different approaches to negotiations and steel markets can be quite volatile and change quickly. It is important to stay close to your suppliers to make sure you are being kept up to date as to what they are doing and how your company fits into their plans.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.