Market Data

August 4, 2016

SMU Steel Buyers Sentiment Index Still Optimistic but Trending Lower

Written by John Packard

According to the results of our latest flat rolled steel market trends analysis survey, as steel prices flatten out and lead times begin to come back in, flat rolled steel buyers and sellers are slightly less enthusiastic about their company’s ability to be successful in both the existing market environment as well as 3 to 6 months into the future.

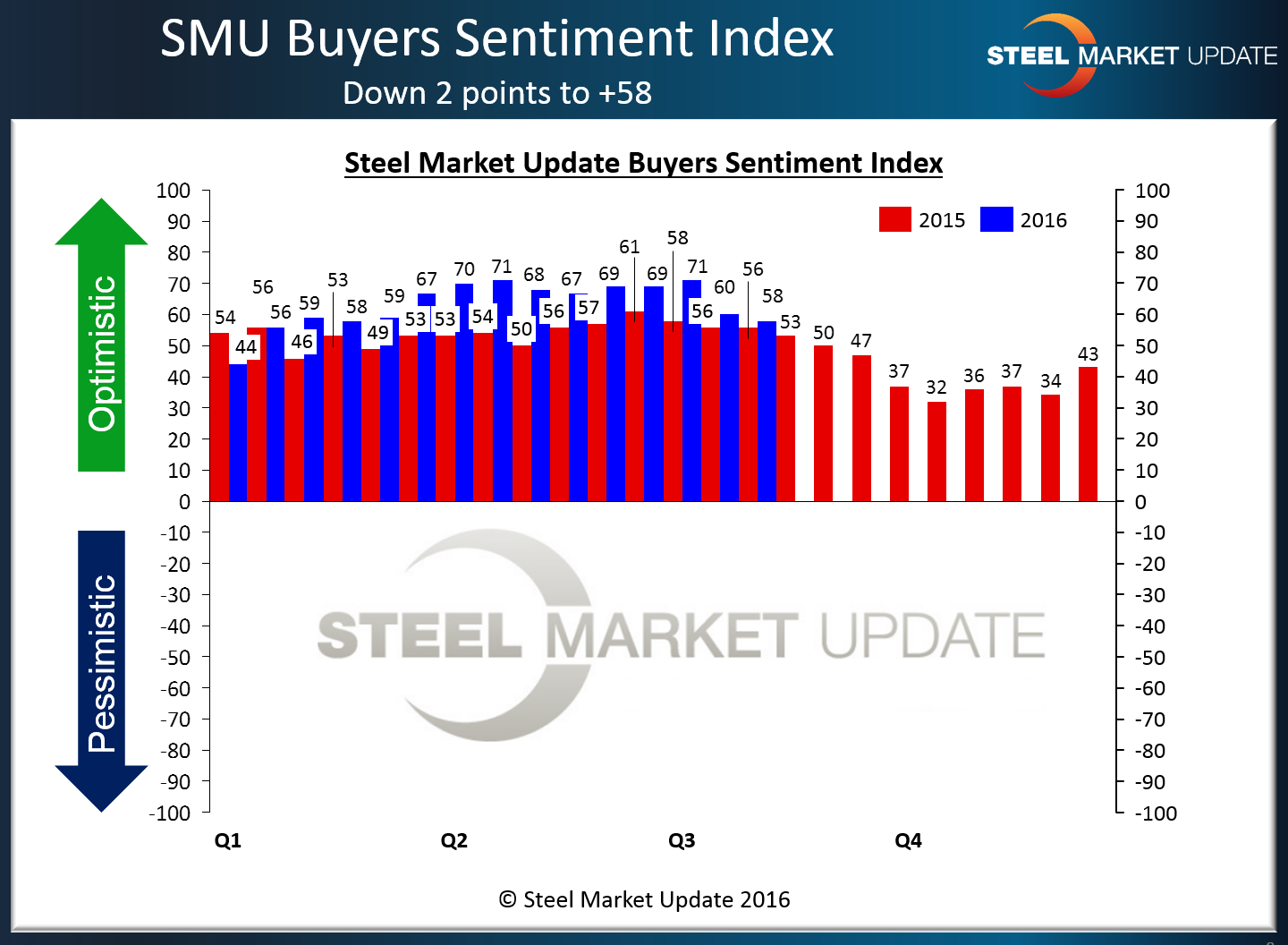

Unbridled optimism is becoming slightly tarnished as the SMU Steel Buyers Sentiment Index dropped to +58, down 2 points from the middle of July and down 13 points from one month ago when Sentiment set a record high of +71.

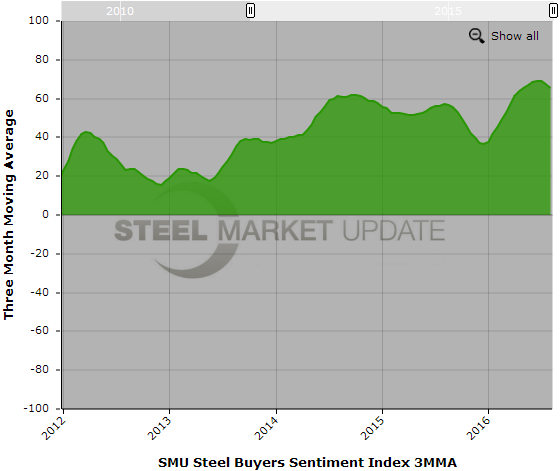

When looking at Current Sentiment (how buyers and sellers feel about their company’s ability to be successful based on today’s market conditions) we prefer to use a three month moving average (3MMA). This takes the “bumps” out of the data and provides a better view of the trend. The 3MMA for Current Sentiment is +65.67 down 1.66 points from the +67.33 posted during the middle of July and 3.5 points below the record high recorded one month ago.

Future Sentiment Index

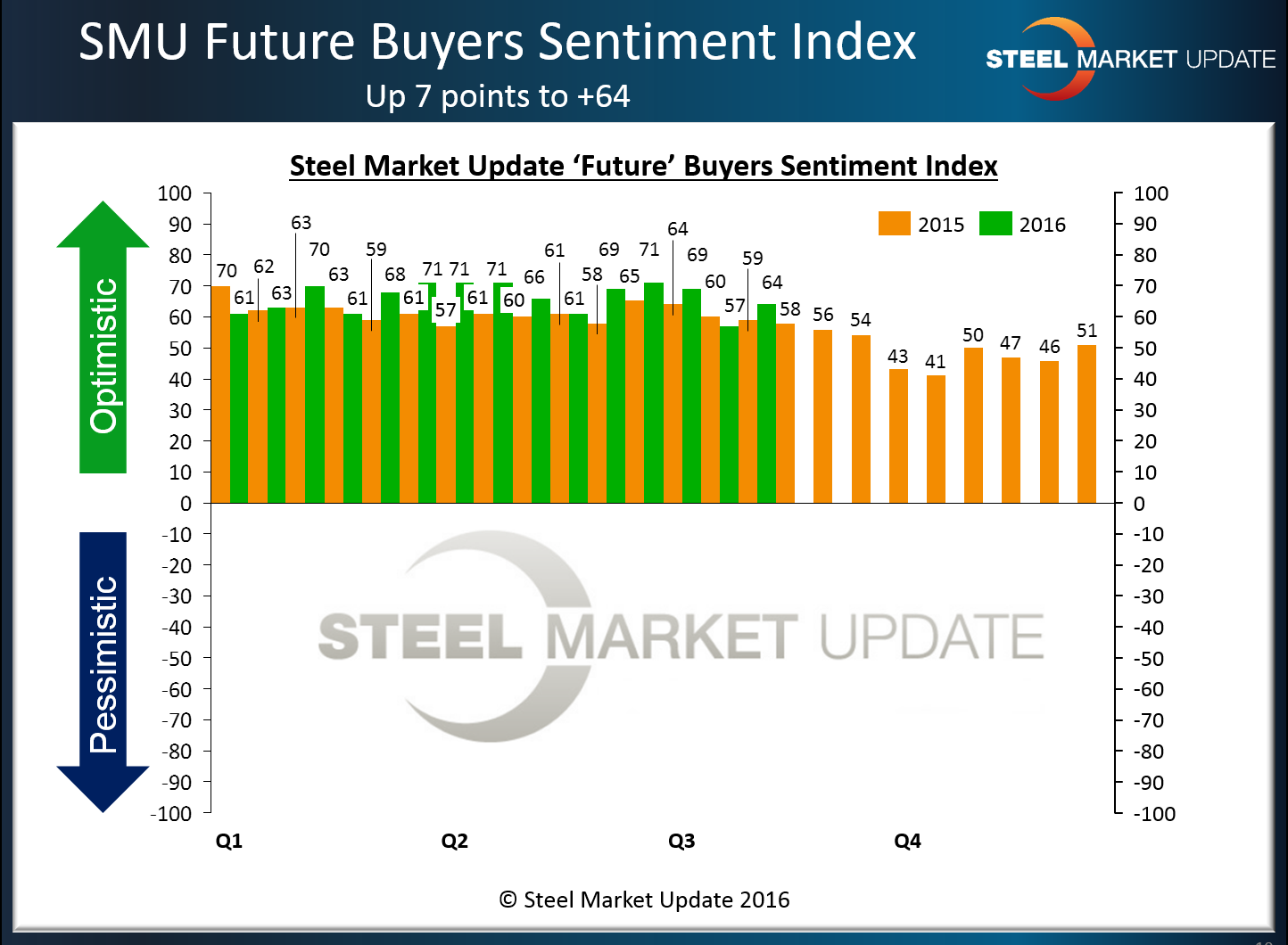

When looking at Future Sentiment (how buyers and sellers feel about their company’s ability to be successful 3 to 6 months into the future) we did get a bounce in this week’s number which came in at +64 (single data point). The +64 is up 7 points over mid-July but is 7 points below the cycle high of +71 achieved during the middle of June.

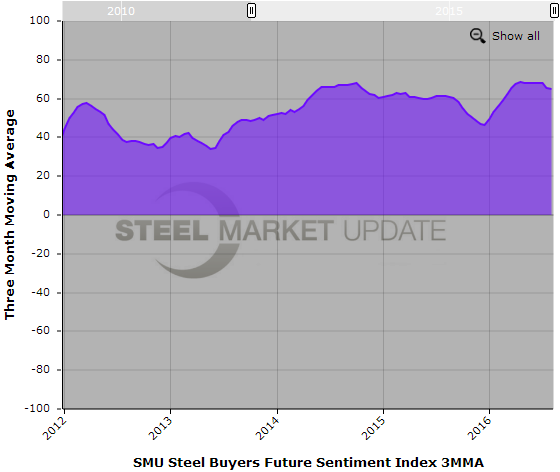

Looking at Future Sentiment based on a three month moving average (3MMA) the index came in at +65.17 which is slightly less optimistic than the +65.50 reported during the middle of July and 3.5 points below the record high of +68.67 recorded during the middle of April.

Steel Market Update believes that part of the reasoning for the erosion in our Current Sentiment Index is due to the wide spread between domestic and foreign steel prices. This is especially true in cold rolled and coated products where the domestic mills have been able to widen the spread between hot rolled and cold rolled/coated spot base pricing. One of our survey respondents addressed this issue in a comment left behind while responding to our Sentiment questions, “’WE’ as in SSC’s are caught between what our customers expect to pay, foreign prices and domestic prices. Foreign Cold Roll is .32c Domestic Cold Roll .43c WHY IS DOMESTIC STEEL .43c?? This mentality strains relationships. I feel no loyalty to domestic steel mills.”

What Our Respondents Are Saying

“July was off 10% from last year.” Manufacturing company

“We are well positioned to capture new business.” Steel mill

“From what I see in the steel market no one knows what they’re doing. People say prices will go up…they go down, people say prices will go down…they go up. A lot of volatility.” Manufacturing company

“We are seeing a slowdown in momentum.” Manufacturing company

“Very quiet.” Service center

“Business Conditions need to improve.” Service center

“We are booking 3 months out now.” Manufacturing company

“The unpredictability in the market makes it challenging for us to proactively adjust pricing in the market.” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 47 percent were manufacturing and 41 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.