Analysis

August 2, 2016

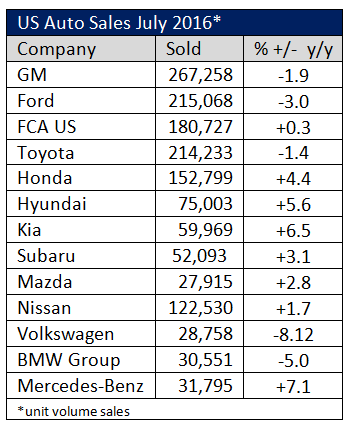

July US Auto Sales Disappoint Big 3

Written by Sandy Williams

Auto sale volume for July was mixed, with the largest manufacturers slipping in volume year-over-year and most of the smaller ones gaining by single digit percent but still below analyst estimates. FCA US picked up just 0.3 percent over July 2015, while GM sales dipped 1.9 percent, Ford dropped 3 percent, and Toyota sales decreased 1.4 percent.

According to WardsAuto and AutoData, the seasonally adjusted annual rate for July is 17.8 million, right between analyst estimates of 17.5 to 18.1 million, and an 8-month high for the SAAR. Auto manufacturers are still hoping that 2016 will surpass the 2015’s record of 17.38 million units.