Government/Policy

August 2, 2016

Everyone Waiting for Hot Rolled Final Determination Ruling

Written by John Packard

Buyers and sellers of hot rolled steel are holding back on making any new offers (buy or sell) until the final determinations are announced on HRC later this week.

According to Steel Market Update sources, hot rolled steel spot prices were ranging from a low of $590 per ton up to $630 per ton. Lead times are reported to be shorter than they have been with one large service center reporting just about all Nucor and SDI locations having 2 week HRC lead times.

That same service center executive reported that they were holding back placing any spot orders until after the US Department of Commerce reports their Final Determination for hot rolled being exported to the United States by Brazil, Korea, the Netherlands, Australia, Turkey, Japan and the United Kingdom. The DOC is was originally scheduled to report on August 3rd and SMU sources are advising us that the actual announcement could be as late as Friday, August 5th. We learned there is a hearing on HRC on Thursday of this week. That hearing is at the ITC and not at the DOC and should not impact DOC’s announcement. However, all the HRC steel buyers as well as the domestic steel mills are waiting to see if the trend for more restrictive cash deposits continues on HRC products just as they did on cold rolled and coated steels.

A trading company told us, “HRC import offers are not easy to find this week as the excitement around the decision on Friday is building.”

A service center group told SMU this afternoon, “Dead quiet. Nobody is buying. All eyes to the trade case.”

Service centers are reporting the domestic mills as having “short” lead times on hot rolled coil. A buyer with a large distributor told us this afternoon, “As for lead times – Mini-Mill HR lead times are definitely short – but vary a little by region. I’d peg them at 3-4 weeks simply because most of them are taking some down time and working to run efficient schedules when they are up. USX and AM HR lead times are also shorter than normal – but again none of them are acting desperate.”

The question being asked is where will hot rolled prices move from here? Over the past few weeks HRC prices have been relatively stable with most buyers reporting spot price offers in the $610-$620 range (SMU range this week is $590-$630 per ton with a $610 average). There does not appear to be a lot of “wiggle room” in prices and one of the reasons why is, as one service center buyer put it, the game of “chicken” that is going on as buyers and mills wait each other out.

Besides waiting for Commerce to make their announcement on hot rolled, one of the other factors affecting pricing and the psychology of the market is indexed based pricing is still being conducted at below spot numbers. A service center explained the impact to SMU earlier today, “I agree with where you are pegging HR as today’s SPOT market but this is still above most Quarterly CRU based contract deals – so a lot of tons are being transacted below this. It seems to me that the mills have figured out that they aren’t going to create much demand by simply lowering their prices. Seems they are focused on the plant maintenance that they put off in 2nd QTR (quite a bit of that coming up in the next 2 months) – and playing a waiting game with distribution.”

Service center inventories are expected to continue to drop when the next MSCI data comes out on or about the 15th of August. However, it appears with shorter lead times, a quiet spot market and buyers willing to sit back and wait, we could be in for a prolonged stalemate when it comes to HRC prices.

None-the-less, the first shoe to drop will be the HRC final determination coming out of the US Department of Commerce at the end of this week.

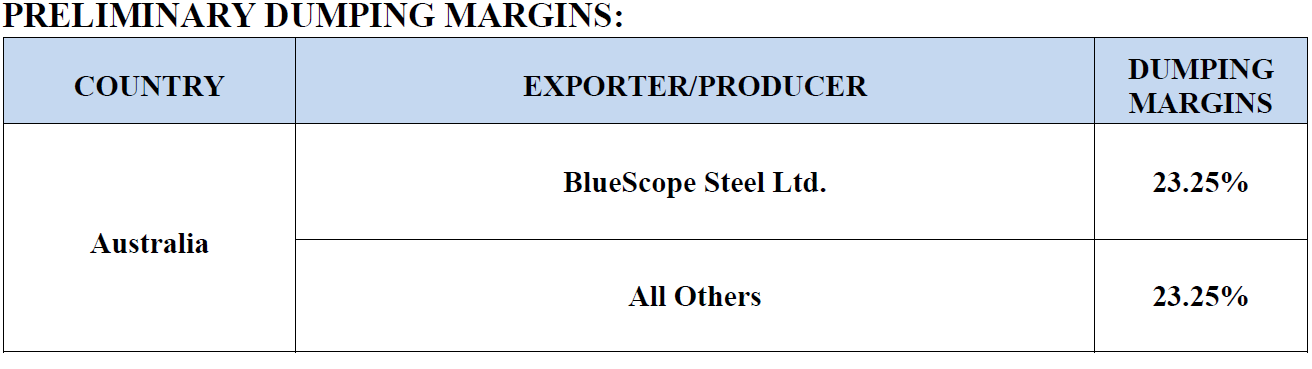

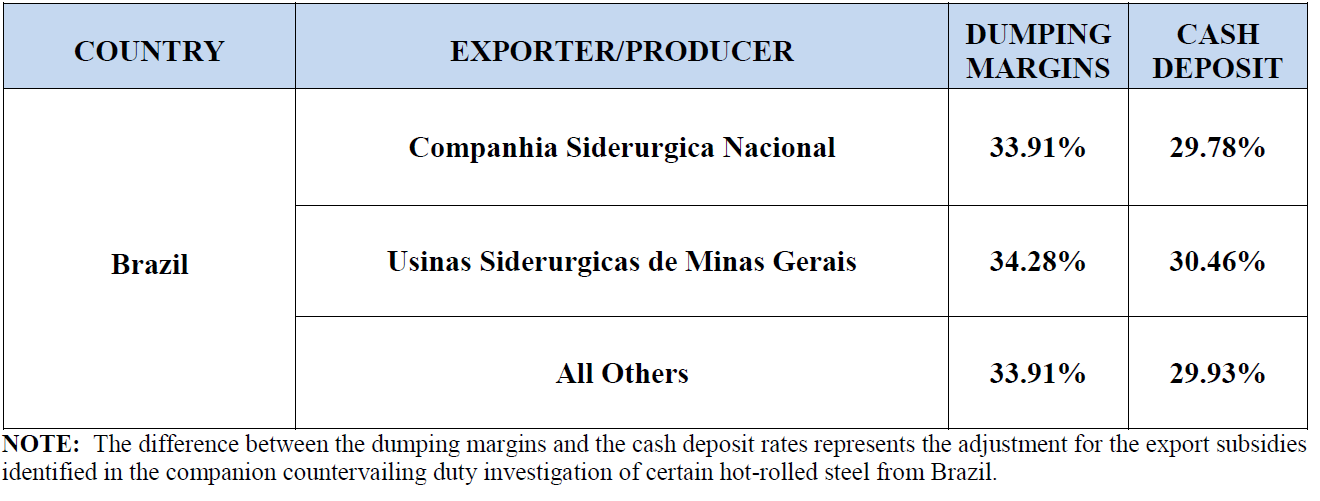

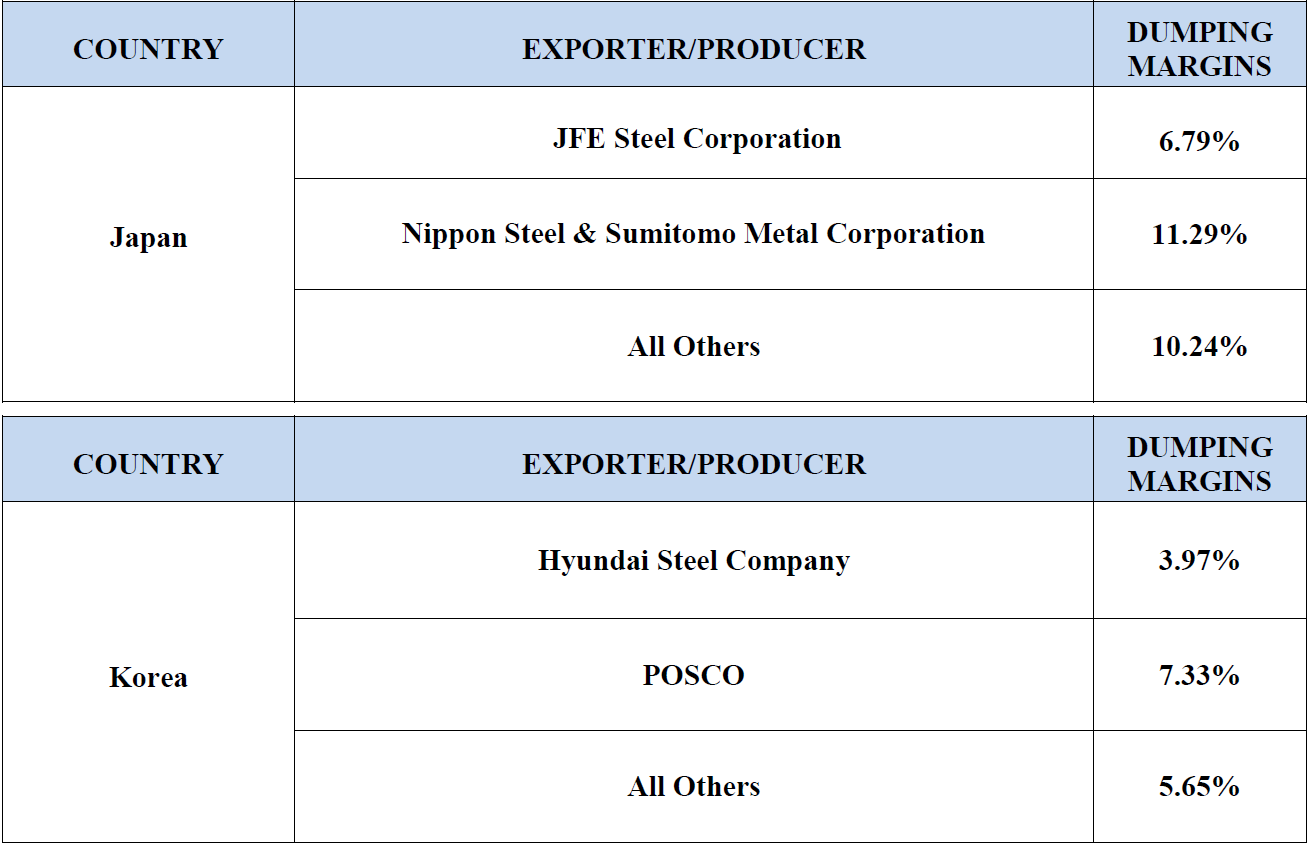

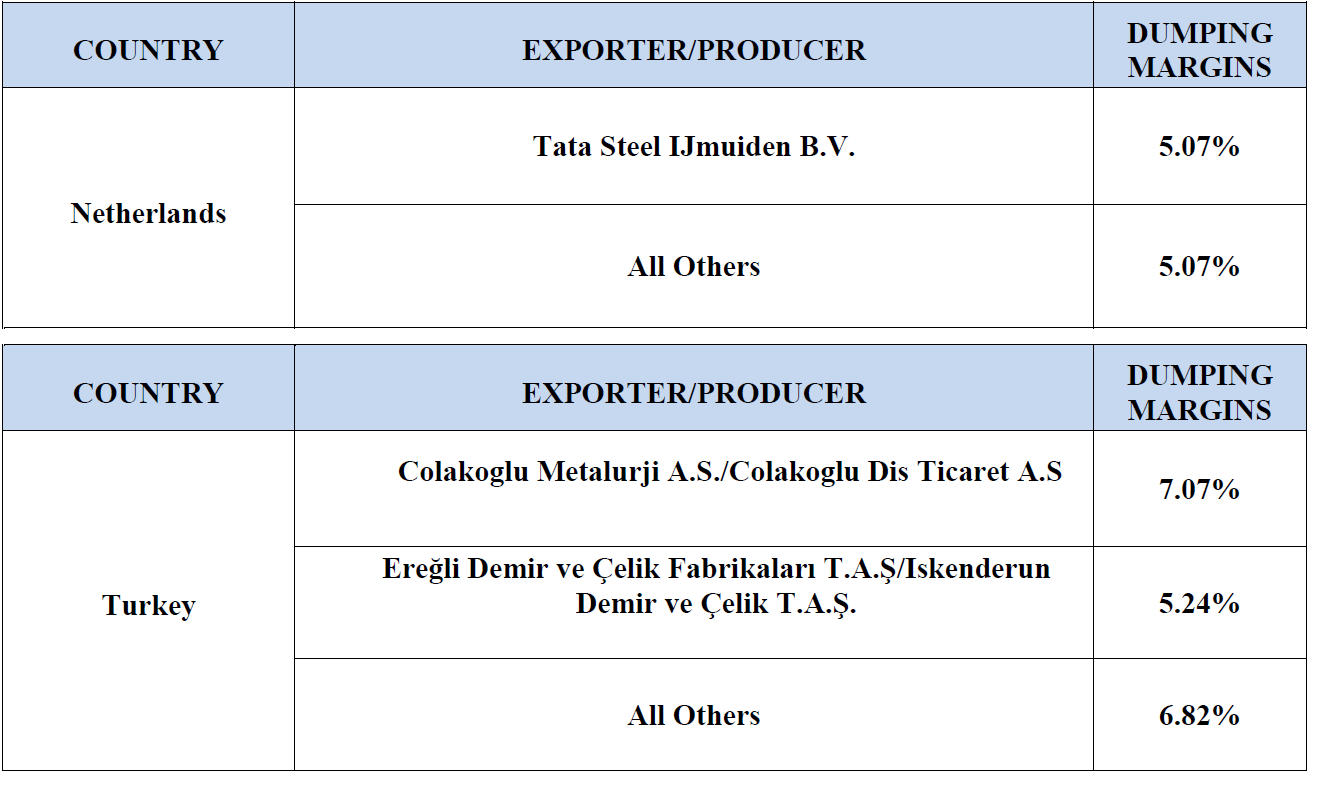

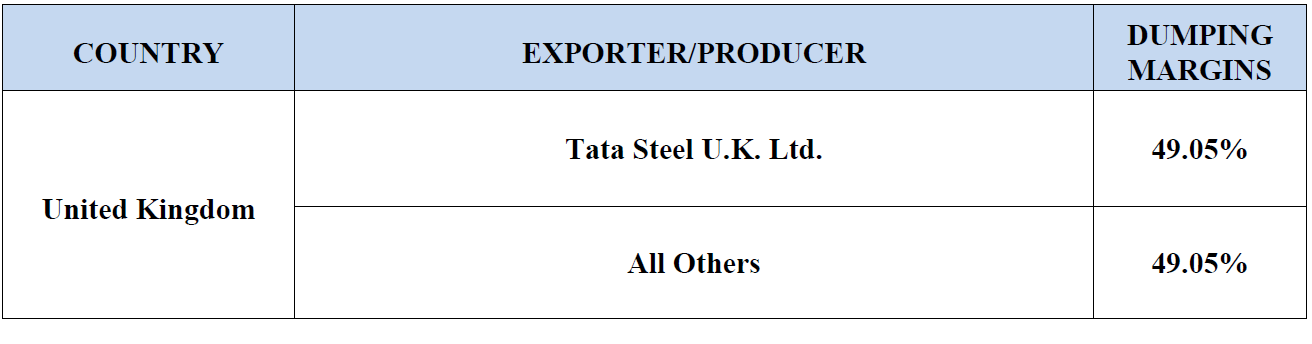

Here is what the preliminary determinations results looked like: