Market Data

July 27, 2016

Durable Goods Orders Fall in June

Written by Sandy Williams

Durable goods orders fell sharply in June to $9.3 billion or a seasonally adjusted 4.0 percent. Orders were down for the second month with transportation equipment leading the decrease. May’s estimate was revised downward to 2.8 percent.

Demand was weaker in June for civilian aircraft and defense, which fell 58.8 percent, and 20.7 percent, respectively. Orders, excluding transportation, fell 0.4 percent from May, and excluding defense were down 3.9 percent.

With almost every category for new orders falling, automotive orders were a bright spot in the June report, up 2.6 percent from a 3.1 percent decline the previous month.

Shipments of manufactured durable goods increased $0.9 billion or 0.4 percent to $232.5 billion after decreasing 0.3 percent in May.

Bloomberg Markets writes, “Anecdotal reports on the factory sector have been less negative than this report, which however is a definitive report. And the monthly headline decline in today’s report is the most severe since August 2014. The factory sector may not be coming be alive as hoped going into the second half of the year.”

The July 27, 2016 report from the Department of Commerce follows:

New Orders

New orders for manufactured durable goods in June decreased $9.3 billion or 4.0 percent to $219.8 billion, the U.S. Census Bureau announced today. This decrease, down two consecutive months, followed a 2.8 percent May decrease. Excluding transportation, new orders decreased 0.5 percent. Excluding defense, new orders decreased 3.9 percent.

Transportation equipment, also down two consecutive months, led the decrease, $8.5 billion or 10.5 percent to $72.2 billion.

Shipments

Shipments of manufactured durable goods in June, up two of the last three months, increased $0.9 billion or 0.4 percent to $232.5 billion. This followed a 0.3 percent May decrease.

Transportation equipment, also up two of the last three months, drove the increase, $1.1 billion or 1.4 percent to $81.2 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in June, down following three consecutive monthly increases, decreased $9.7 billion or 0.9 percent to $1,127.9 billion. This followed a virtually unchanged May increase.

Transportation equipment, also down following three consecutive monthly increases, led the decrease, $9.0 billion or 1.1 percent to $774.9 billion.

Inventories

Inventories of manufactured durable goods in June, down eleven of the last twelve months, decreased $0.7 billion or 0.2 percent to $381.5 billion. This followed a 0.4 percent May decrease.

Transportation equipment, down five consecutive months, drove the decrease, $1.1 billion or 0.9 percent to $123.0 billion.

Capital Goods

Nondefense new orders for capital goods in June decreased $8.2 billion or 11.3 percent to $64.8 billion. Shipments decreased $1.0 billion or 1.3 percent to $71.8 billion. Unfilled orders decreased $7.0 billion or 1.0 percent to $700.5 billion. Inventories decreased $1.1 billion or 0.6 percent to $169.6 billion.

Defense new orders for capital goods in June decreased $1.9 billion or 20.7 percent to $7.3 billion. Shipments increased $0.4 billion or 3.8 percent to $10.3 billion. Unfilled orders decreased $3.0 billion or 2.1 percent to $136.9 billion. Inventories decreased $0.4 billion or 1.8 percent to $20.4 billion.

Revised May Data

Revised seasonally adjusted May figures for all manufacturing industries were: new orders, $454.1 billion (revised from $455.2 billion); shipments, $456.6 billion (revised from $456.5 billion); unfilled orders, $1,137.6 billion (revised from $1,138.9 billion); and total inventories, $619.6 billion (revised from $619.7 billion).

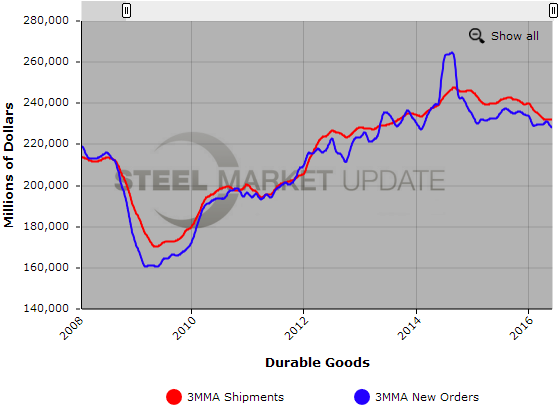

Below is a graph showing the history of durable goods shipments and new orders on a three month moving average basis. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.