Market Data

July 24, 2016

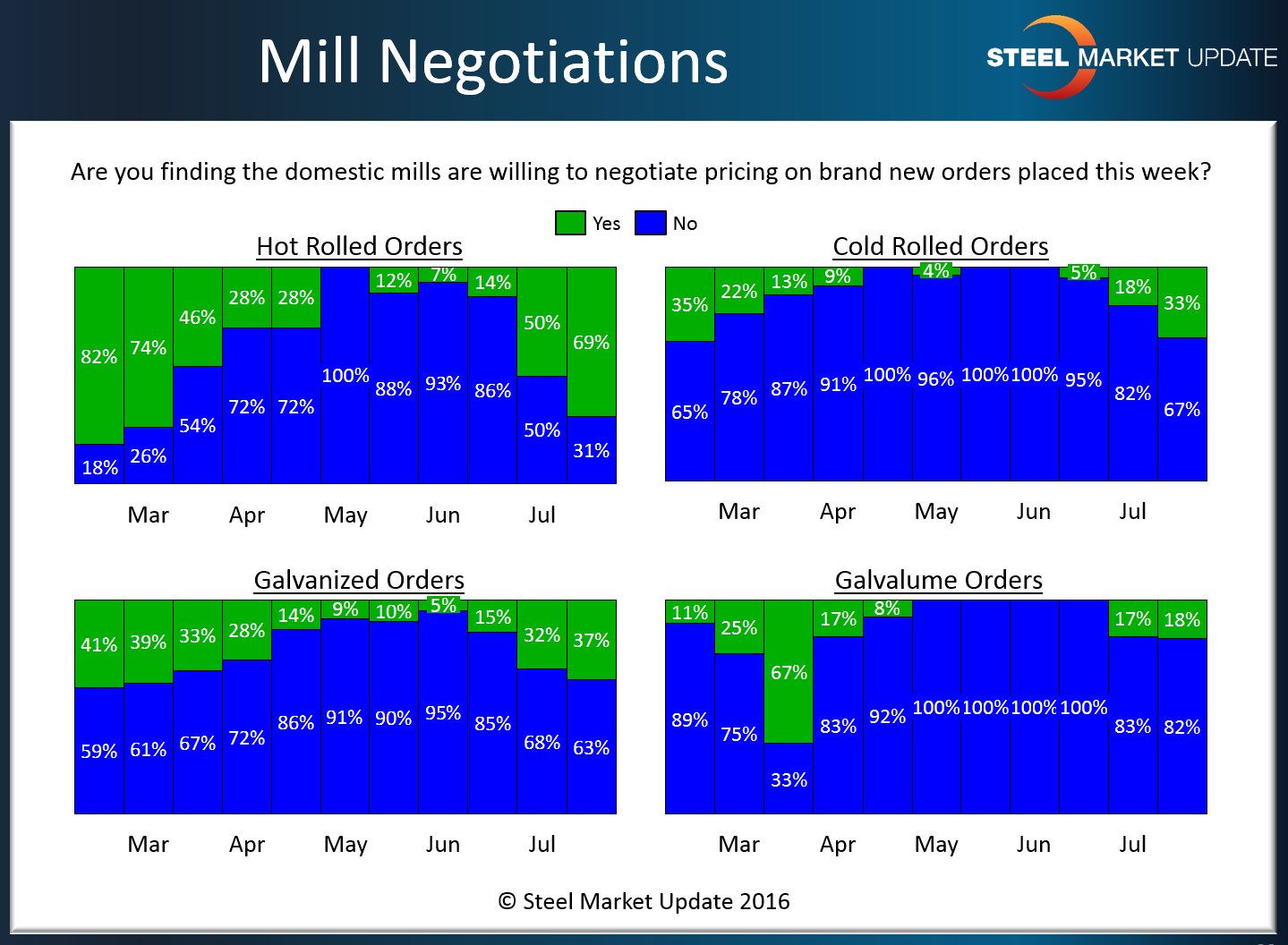

As Lead Times Slip Mills Beginning to Negotiate Steel Prices

Written by John Packard

As lead times begin to come back in (shorten), we are seeing an increase in the percentage of our flat rolled steel survey respondents who are reporting the steel mills as willing to negotiate steel prices.

Hot rolled continues to be the weakest product. It has the shortest lead time and we have heard from outside of our steel market survey that lead times on hot rolled can be as short as 2 weeks. The percentage of respondents reporting HRC prices as “negotiable” increased again this past week and now stands at 69 percent.

The other flat rolled products are not seeing such dramatic results as essentially one third of our respondents reported cold rolled (33 percent) and galvanized (37 percent) mill prices as negotiable. Galvalume came in at 18 percent and was the strongest product probably due to seasonal factors as well as having strong lead times.

Back in May and June, when lead times were close to their peak (extended), we saw negotiations as essentially being not available on all of the flat rolled products.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.