Government/Policy

July 21, 2016

Taiwan Takes Surprise Hit on Coated Steel Dumping Duties

Written by John Packard

Steel buyers purchasing foreign galvanized or Galvalume steels out of Taiwan will be paying higher prices due to a surprise change in the AD duty rate by the US Department of Commerce. Citing “ministerial errors” The US Department of Commerce International Trade Commission has adjusted the corrosion resistant (galvanized/Galvalume) duties for Taiwan from 3.77 percent to 10.34 percent.

According to one trading company SMU spoke with during the course of the day today, the new duties average about $75 per ton ($3.75/cwt) and the expectation buyers can have is for higher prices out of Taiwan.

“…they [Taiwan mills] were not happy with the 3.77% and were discussing challenging that finding. As of yesterday we were not working with any current offers. Too early to tell what the mill’s response will be. We currently have orders with 2 producers in Taiwan and sent Emails last night but they did not respond. Orders already confirmed are a question. Mill/trader can either absorb the extra duty, try to renegotiate higher price with buyer or cancel the shipment. Longer term, my guess is that as long as the USA has huge price premiums compared to international market they may be able to, if they choose, keep a smaller presence with paying the additional 10.34%, approximately $75/t.”

We discussed this issue with a number of traders around the country. We spoke with the traders because they are the importers of record and the most impacted by the new duty rates.

“…There are a few traders that are likely on the hook for significant tons on the way from Taiwan. Most will try to renegotiate with their customers for a higher price. I think mills in Taiwan will adjust future prices down to some extent as the traders are typically the importer of record and pay the duties. Bottom line it will keep coated prices in the US propped up.”

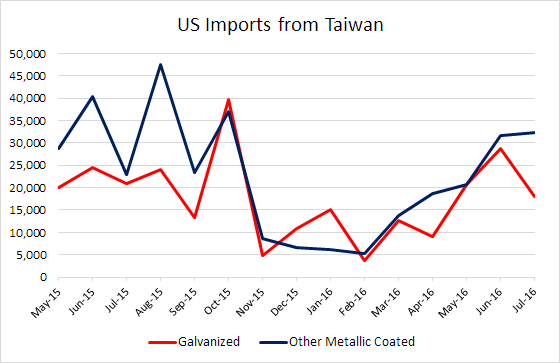

“The Taiwanese have been exporting coated products to the US for many years. They have a strong customer base, mainly end users and focus on added value products. The increase duty is not much of a deterrent. They get a higher price than the competition: $782/mt average CFR US ports in June for HDG as opposed to $515 for Vietnam. They have been increasing their exports to the US: 40,000mt in May, 60,000/mt in July ( HDG + Galvalume + PPGI). There is no reason for them to slow down. They do not compete with Vietnam or other new comers.”

We also spoke with an end user of coated steels from Taiwan who told us their Taiwanese suppliers were “shocked” at the decision to raise the duties on coated steels. We were told by this end user that they were able to purchase Galvalume material today only and after that their price quotes were no longer valid. The end user was told they could not buy galvanized at this time. No orders were being cancelled at this time.

The change in the duty was after AK Steel pointed out ministerial errors in the duty calculations made by the Department of Commerce.

Steel Market Update did speak with trade attorney Lewis Leibowitz on the subject and he explained that the ministerial errors had to do with the control numbers (detailed definition of the products involved – control numbers are much more detailed than SIC Codes). The documents explain that yield strength was misreported and the SAS program used by the Department included a number of errors. The documents get quite technical but the bottom line is the duty rate for all Taiwanese mills is going to be 10.34 percent not 3.77 percent.

SMU does have the documents which we can send to those who request them: info@SteelMarketUpdate.com.

Trade attorney Lewis Leibowitz will speak on the subject of trade, trade suits and trade remedies at our 6th Steel Summit Conference in Atlanta on August 29-31, 2016. Details can be found on our website: www.SteelMarketUpdate.com.