Market Data

July 21, 2016

SMU Steel Sentiment Index Now Trending Lower

Written by John Packard

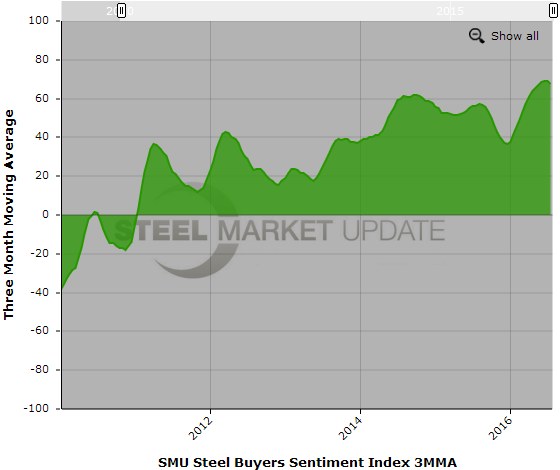

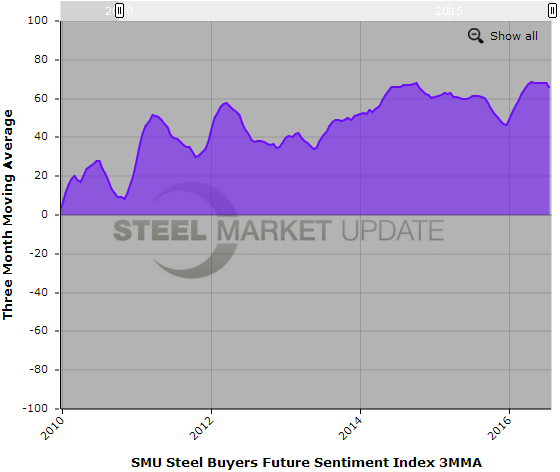

Since 2008, Steel Market Update has been measuring how steel buyers and sellers feel about their company’s ability to be successful in the existing market environment (which we call “Current Sentiment”). We also probe the same group of manufacturers, steel service centers, steel mills, trading companies and toll processors on how they feel about their company’s ability to be successful three to six months into the future (“Future Sentiment”). Our analysis is done twice per month and we have just completed our analysis of the responses received since Tuesday of this week. An explanation of the Index values are explained at the end of this article.

Buyers and sellers of steel continue to be optimistic about their company’s ability to be successful both in the current as well as the future market environments. Ever since the beginning of December 2015 Steel Market Update had seen optimism expanding based on our SMU Steel Buyers Sentiment Index.

Our Sentiment index officially “peaked” earlier this month when Current Sentiment matched a previous one month high of +71 and a three month-moving-average (3MMA) record high of +69.17.

We are now reporting that our Current Sentiment is +60, down -11 points from the first week of the month and the biggest drop since the first week of September 2012 (dropped -15 points from the middle of August 2012).

We prefer to look at our data based on a three month moving average as this tends to smooth out the data. Our 3MMA was at a record high as of the first week of July 2016 at +69.17. Our 3MMA has now rolled over breaking a 7 month long up cycle trend. At +67.33 our 3MMA is down -1.84 points from our last analysis.

Future Sentiment Index Drops

Future Sentiment is being reported this week at +57 which is the lowest one week reading since the middle of December 2015 when it was reported to be +51. The +57 is -12 points below the +69 reported at the beginning of this month.

On a three month moving average basis Future Sentiment is now +65.50 and is down for the second time since the middle of June.

Steel Market Update wants to make sure our readers understand that these readings well above +50 are firmly in the optimistic range of our Index. We do not know if we are seeing the beginning of a longer term down cycle and we will need to watch the numbers carefully in the coming weeks.

What Our Respondents Are Saying

“There exists an imbalance between foreign and domestic that makes spot buys or domestic buys impossible. My customers are getting processed and delivered prices at the same level I am paying for steel. Both are below domestic prices. Yeah, I have no idea what is happening and it is frustrating. FOR INSTANCE; I feel a processed price for 16ga CR 10,000#’s or better should be about $41.90 based on what I am paying ($36/cwt) from foreign. I get some orders but many customers tell me they are paying $36/36.50 for processed and delivered.” Service center

“The high domestic pricing is causing our customers to look offshore for their products and you can’t blame them. We can offer the best service and delivery but when offshore goods are 25% to 30% below our costs, we can’t compete.” Manufacturing company

“Orders are trending lower and margins are squeezed by the on-going steel price increases.” Manufacturing company

“Wish demand was a bit stronger, and that customers felt more confidence in their purchasing decisions and their own production and sales forecasts. But having ample inventory, available state of the art faculties and equipment, candid market data to share with customers, and consistent, fair and appropriate pricing allows us to remain successful in today’s market.” Service center

“Some uncertainty has slipped into the market.” Service center

“This [ability to be successful in the future] depends on how long domestic mills intend on torturing us.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 47 percent were manufacturing and 40 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.