Prices

July 21, 2016

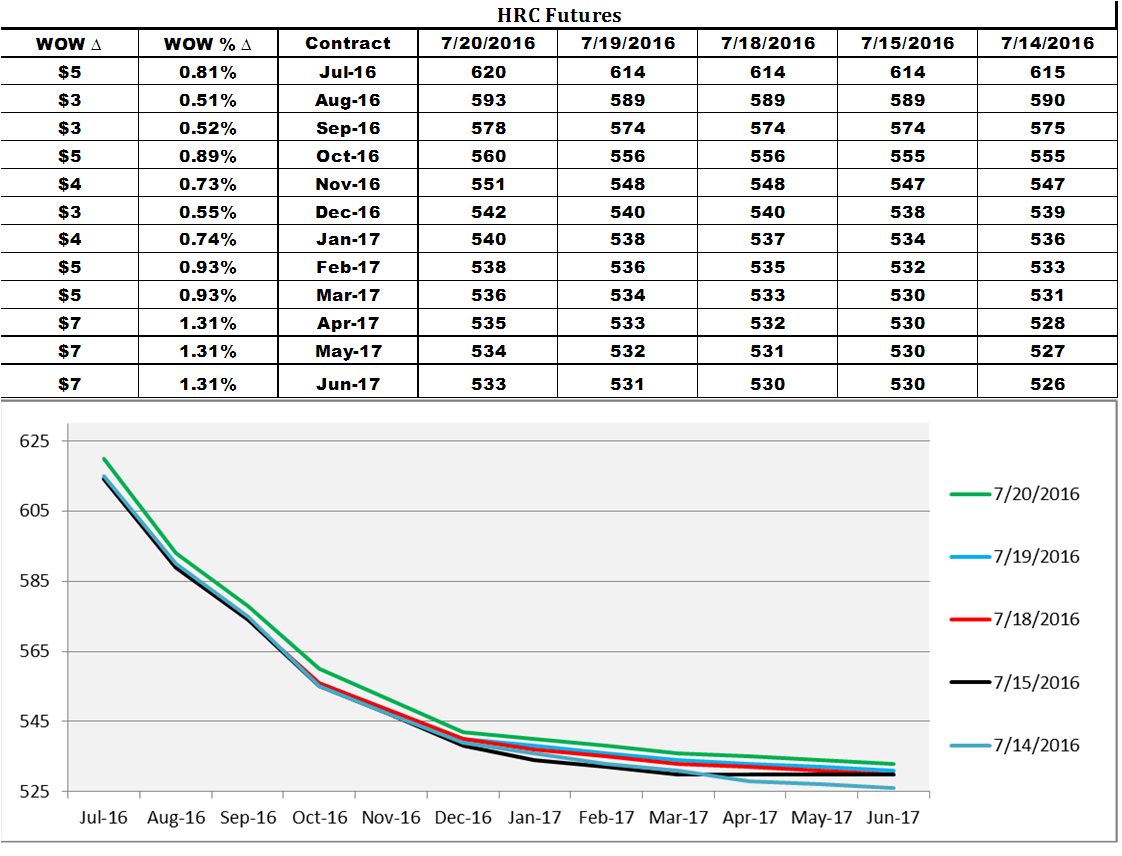

Hot Rolled Futures Move $3 to $7 Higher in Past Week

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

CME HRC futures have moved up between $3 and $7 in the past week. The CME HRC futures curve remains steeply backwardated, but as physical prices remain in the $620 – $630 level, futures prices are increasing as they are literally being pulled up the curve with every passing day. Considering August’s first print is less than two weeks from today, prices would have to fall around 5 percent to reach last night’s settlement at $593.

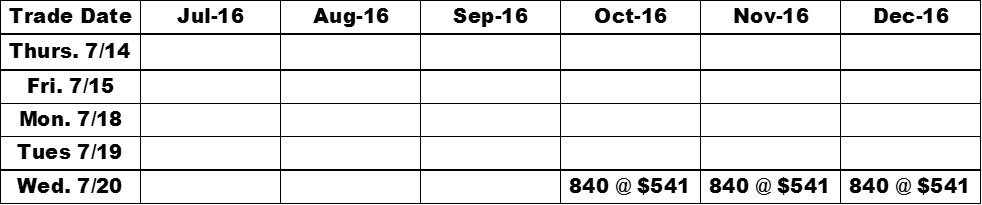

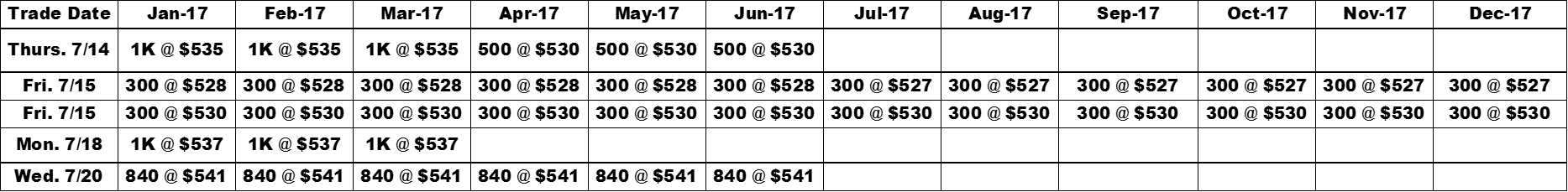

A total of 22,260 short tons traded last week with the main focus on the first half of 2017. Currently, open interest stands at 391,360 st.

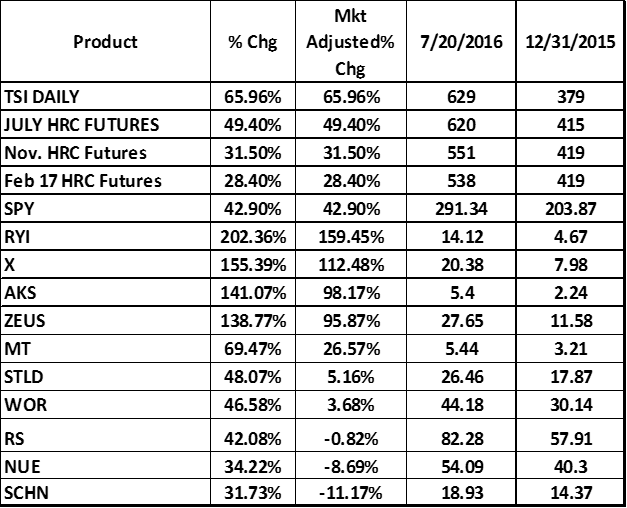

Steel stocks have rallied dramatically in the past few weeks. Considering the forward curves steep backwardation, it’s been interesting to watch the steel stocks run higher. The chart below shows the YTD percentage return for the TSI Daily Midwest HRC Index, July 16, Nov. 16 and Feb. 2017 CME HRC futures and a sample of steel stocks. Are the steel stocks overvalued or are futures undervalued?

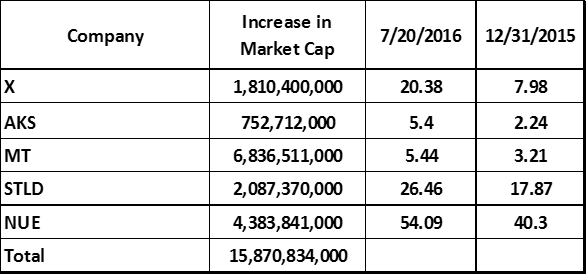

The five domestic publicly traded steel mills have seen their market capitalization increase by almost $16 BILLION dollars in 2016. How much leverage does this provide the mills with, to forego tons to keep prices at current levels?