Market Data

July 20, 2016

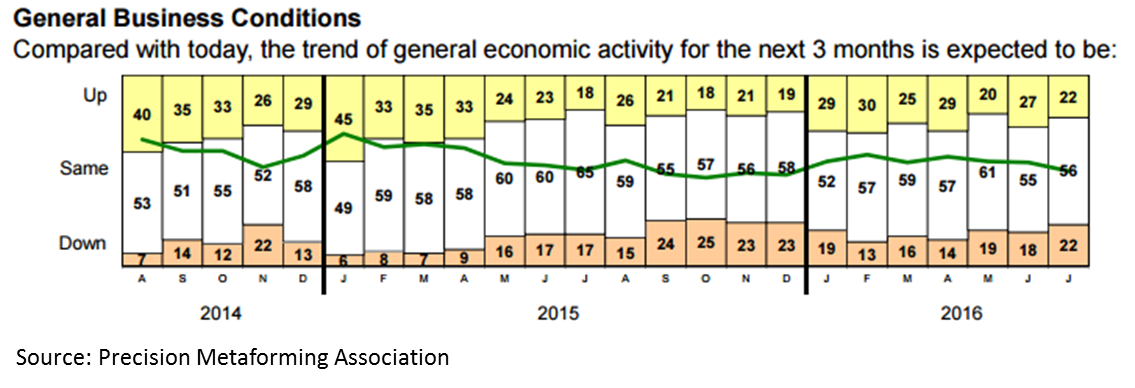

July PMA Shows Business Weakening in Next 3 Months

Written by Sandy Williams

Metalforming companies are expecting somewhat weaker business conditions during the next three months. The July survey by the Precision Metalforming Association showed only 22 percent of participants are expecting an improvement in conditions (down from 27 percent in June); those expecting no change remained relatively steady in July at 56 percent compared to 55 percent last month. New orders are also expected to decline slightly in the next three months.

Current average daily shipping levels remained the same in July. Short time or layoffs were reported by 13 percent of companies compared to 12 percent in June and 11 percent in July 2015.

“Metalforming companies reflect the ongoing challenges of a strengthening dollar, continued softening in demand throughout the manufacturing sector and significantly higher material costs as prices for hot- and cold-rolled steel have risen sharply after the imposition of antidumping duties against major steel importers over the past several months,” said William E. Gaskin, PMA president. “The automotive sector, the largest market for stampings and assemblies for PMA member companies, is softening modestly, while other major markets for stampings and fabricated metal products continue to reflect the year-over-year 3.4 percent decline of U.S. factory orders over the last 14 months. Uncertainty created by the presidential race in the United States and the unexpected Brexit vote in the UK also have created additional concern about weakening orders for U.S. manufacturers.”

The PMA survey is conducted monthly by the Precision Metalforming Association. June’s survey sampled opinions from 120 metalforming companies.