Prices

July 19, 2016

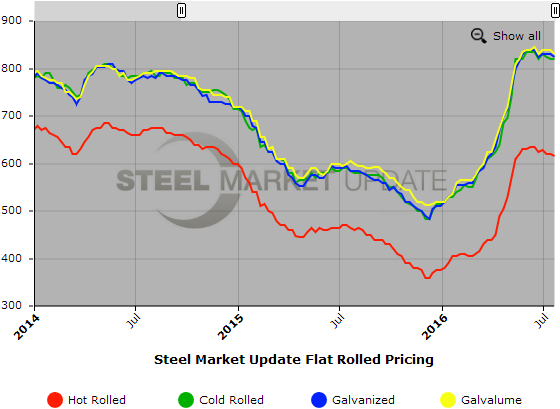

SMU Price Ranges & Indices: Prices Drifting as Buyers Try to Gauge the "Breeze"

Written by John Packard

Flat rolled steel prices have been “drifting” over the past few weeks. By that we mean there has been some minor adjustments to pricing on a weekly basis but nothing that would qualify as a trend in one direction or another. Steel buyers are trying to gauge the strength and direction of the breeze blowing prices with most standing back and waiting before making any major inventory adjustments (as in building inventories). It appears most service centers are content to hold inventories at modest levels (2.0 months) and to only buy what is needed.

Hot rolled continues to be the weakest product and our HRC average was down $5 per ton this week due to weakness in the upper end of the HRC range. We are catching adjustments in other products with one mill admitting to SMU earlier today that they took the low end of their base price on coated down to $40.00/cwt for large customers. A second mill told us they are waiting, “Let’s see what happens this week,” were their exact words. A third mill told us their numbers were closer to the high end of our range. So, the market continues to have some flex to it but the limb is not breaking.

The SMU Price Momentum Indicator is still at Neutral as we do not yet see a strong move (or breeze) pushing prices in any one direction. We are of the opinion the next 30 days will find more “drift” and prices will most likely be range bound (+/- $20 per ton).

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $600-$630 per ton ($30.00/cwt- $31.50/cwt) with an average of $615 per ton ($30.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $5 per ton over last week. Our price momentum on hot rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt- $42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on cold rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU Base Price Range is $40.00/cwt-$42.50/cwt ($800-$850 per ton) with an average of $41.25/cwt ($825 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end remained the same. Our overall average is down $5 per ton over last week. Our price momentum on galvanized steel is for prices to be range bound (+/- $20 per ton) over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $860-$910 per net ton with an average of $885 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU Base Price Range is $40.00/cwt-$43.00/cwt ($800-$860 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week while the upper end remained the same. Our overall average is down $10 per ton over one week ago. Our price momentum on Galvalume steel is for prices to be range-bound (+/- $20 per ton) over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1091-$1151 per net ton with an average of $1121 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.