Prices

July 14, 2016

Traders Point to Vietnam & Turkey as Price Leaders for Cold Rolled into USA

Written by John Packard

Steel traders have not been shy about pointing at Vietnam and Turkey as the leaders for cold rolled export pricing into the United States. Since the antidumping suits were filed against China in particular, first Vietnam and then Turkey have been quick to offer cold rolled into the United States and are building market share.

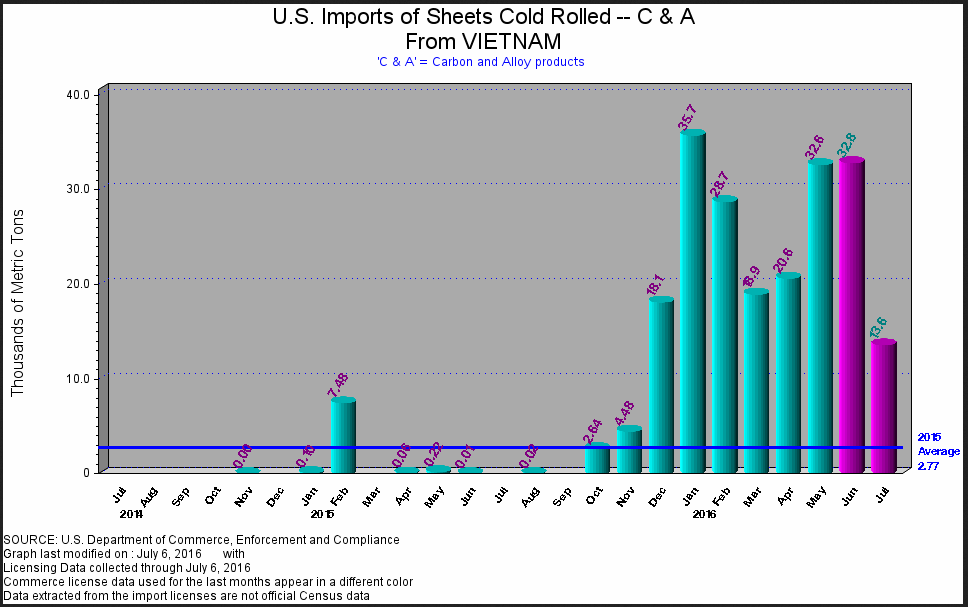

As you can see by the graph below provided by the U.S. Department of Commerce, Vietnam was a non-factor in the United States cold rolled market. In May and June Vietnam shipped 36,000 net tons (graph below is in metric tons) and was the single largest exporter of cold rolled to the U.S. during this time period. The graph below has data through the 6th of July. As of July 12th Vietnam was on pace to ship more cold rolled to the United States in July than it did in May and June (based on license data).

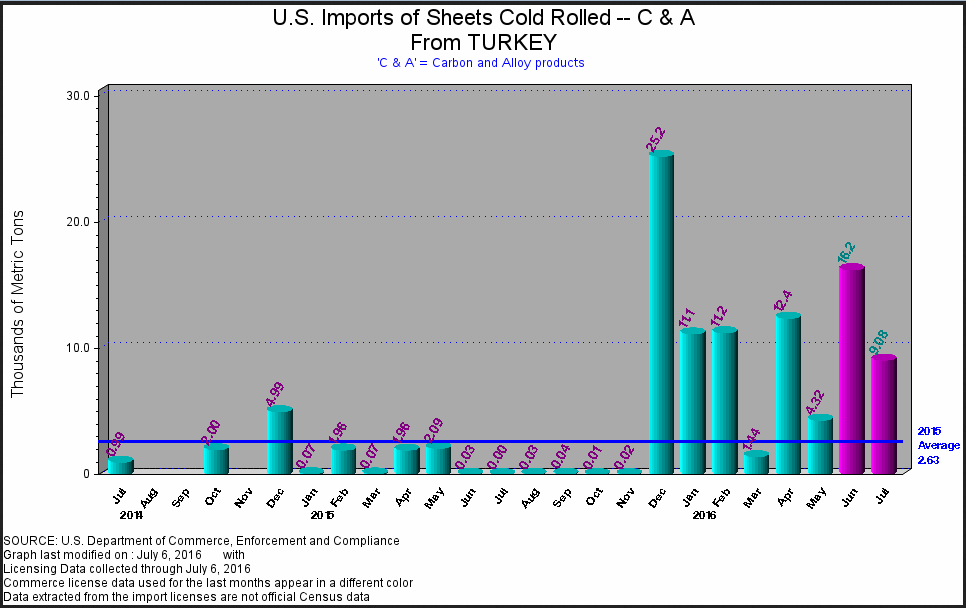

Turkey has a similar looking graphic although the tonnage is lower than that coming from Vietnam. For the month of June Turkey exported approximately 18,000 net tons (tonnage shown below are metric tons) and as of the 12th of July Turkey already has 17,500 net tons of license requests for the month.

How does a country go from zero to leading the pack in such a short period of time (Vietnam is largest supplier of CR to USA while Turkey was #4 in June)? According to the trading companies themselves the answer is price.

“CRC is all about Vietnam and Turkey these days,” is what one trading company told SMU this morning. “They’ve taken up where the Chinese left off and have created a market of their own. Other (smaller) suppliers need to either address the pricing these two countries have put forth or get out of the way.”

A second trading company advised SMU, “The Vietnamese re-rollers are dominated the CRC import market , mainly the Posco and China Steel Vietnamese subsidiaries. The Turks had been in and out until recently due to the fact that they had a strong domestic market . But, market in the EU and Turkey have slowed down and Erdemir as well as Borcelik have been more aggressive recently.”

Traders point to the high domestic (USA) prices as being one of the main reasons why Vietnam, Turkey and other countries are sending material here. A number of traders are of the belief that with the high domestic prices for both spot and contract and the limited number of tons coming from outside the country (now averaging about 150,000 to 180,000 net tons per month) are not hurting the industry and will most likely continue.

Not all traders are happy with the price levels being offered by the Vietnamese and Turkish mills or the thought process being used when quoting. When asked one trader told us, “I can’t remember a week where I didn’t know of a customer or competitor who is visiting Vietnam. Sure looks and feels the same way the Chinese approached the market, namely a general lack of interest in market pricing over here. As long as the pricing is favorable to the mills, they’re willing to take orders. Given that all of them are re-rollers, the pricing trend is pretty much predicated on HRC pricing in Asia with only cost+ considerations. How else can you justify offers at +/- $200/ton below U.S. domestic mill price levels?”

SMU asked a number of trading companies for their opinion as to whether it is the mill’s responsibility or the trader’s responsibility for the prices being offered into the U.S. marketplace. One trader summed up his opinion this way, “It’s both. As for the mill(s), with info availability these days, they should be adequately informed enough to decide how to position their products at reasonable discounts, what I don’t see are reasonable discounts happening. This leads one to then point to the broker as being equally if not more complicit in this decision. Either the broker doesn’t care about creating a sustainable model and is simply wringing out whatever they can as quickly as they can before domestics decide to file, or they’re just stupid. I’ve seen more stupidity these past few years that it boggles the mind. Gordon Gecko…’greed is good’, we know how that ended.”

Current offers for cold rolled out of Vietnam are reported by the trading companies to be $29.00/cwt to $31.50/cwt ($580-$630 per ton) with Turkish numbers being about $10 to $20 per ton higher. We learned from one trader that Mexican cold rolled was recently offered by their company at $35.50/cwt ($710 per ton).

To put this into perspective the current domestic base price, before extras, is averaging $820 per ton ($41.00/cwt)…