Prices

July 12, 2016

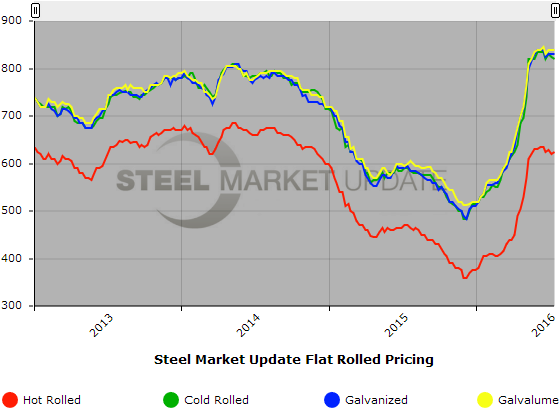

SMU Price Ranges & Indices: Range Bound

Written by John Packard

Flat rolled steel buyers reported steel prices as being essentially unchanged from this time last week.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $600-$640 per ton ($30.00/cwt- $32.00/cwt) with an average of $620 per ton ($31.00/cwt) FOB mill, east of the Rockies. Both the lower and upper end of our range remained the same compared to one week ago. Our overall average remained the same as last week. Our price momentum on hot rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Hot Rolled Lead Times: 2-6 weeks

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt- $42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $10 per ton. Our overall average is down $5 per ton over one week ago. Our price momentum on cold rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Cold Rolled Lead Times: 5-9 weeks

Galvanized Coil: SMU Base Price Range is $40.50/cwt-$42.50/cwt ($810-$850 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. Our price momentum on galvanized steel is for prices to be range bound (+/- $20 per ton) over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $870-$910 per net ton with an average of $890 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU Base Price Range is $41.00/cwt-$43.00/cwt ($820-$860 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on Galvalume steel is for prices to be range-bound (+/- $20 per ton) over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1111-$1151 per net ton with an average of $1131 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.