Prices

July 7, 2016

Hot Rolled Futures: Don't Get Caught Napping

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Dave Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

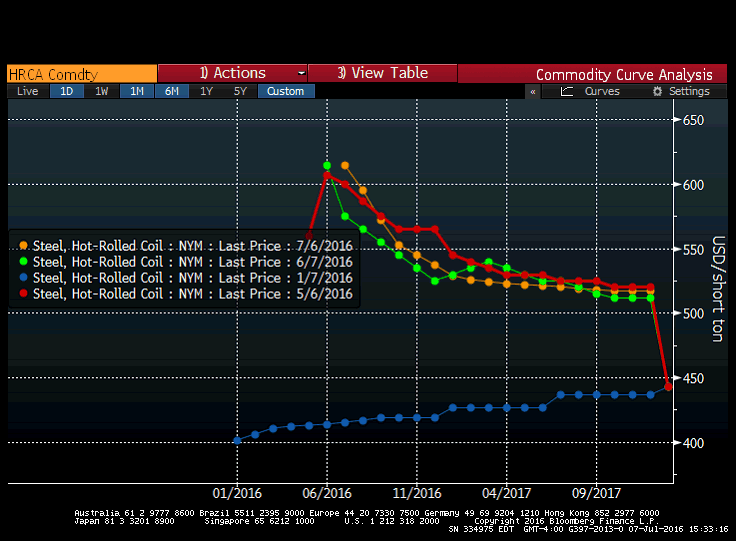

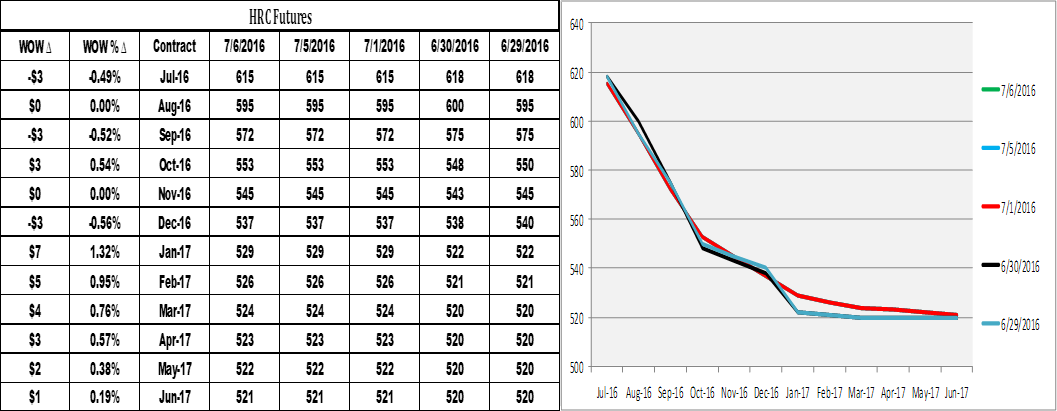

CME Midwest HRC Futures

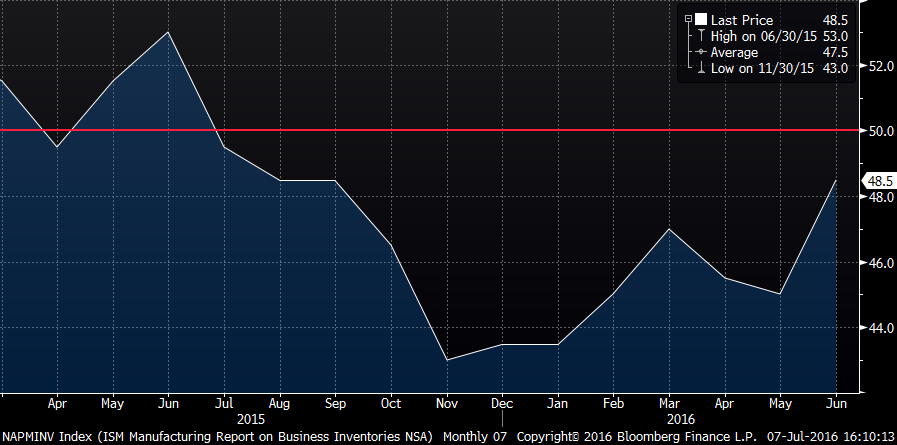

My favorite time to nap is about midway through the afternoon NFL games on Sunday. Now is a good time as well as the HRC futures markets slips into the summer doldrums. In fact, pricing really hasn’t moved in months. But as they say, the early bird catches the worm so don’t get caught napping for too long because “life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” So take a look at this, The ISM Manufacturing Purchasing Managers Index. It’s pretty important.

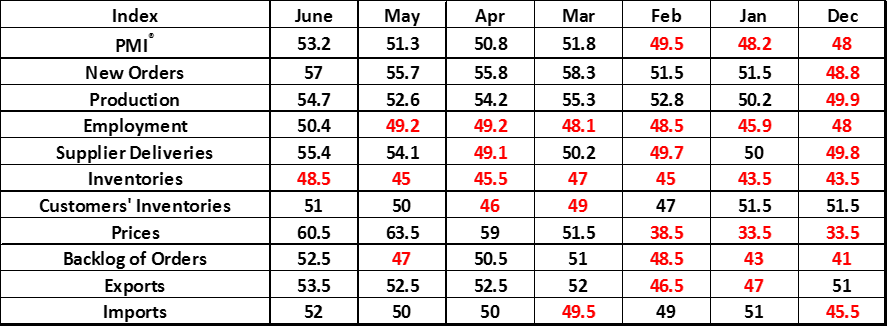

* A reading above 50 percent indicates expansion, below 50 indicates contraction

* A reading above 50 percent indicates expansion, below 50 indicates contraction

The index shows a nice uptrend led by strength in the “new orders” and “prices” sub-indexes. “Backlogs” popped nicely this month, which is telling that not only is demand not going to collapse, but on the contrary is likely improving. Most importantly, look at the (wholesale) “inventories” and “customer’s inventories” sub-indexes. Wholesale inventories have been shrinking since July of 2015!

ISM PMI Inventories Sub-index

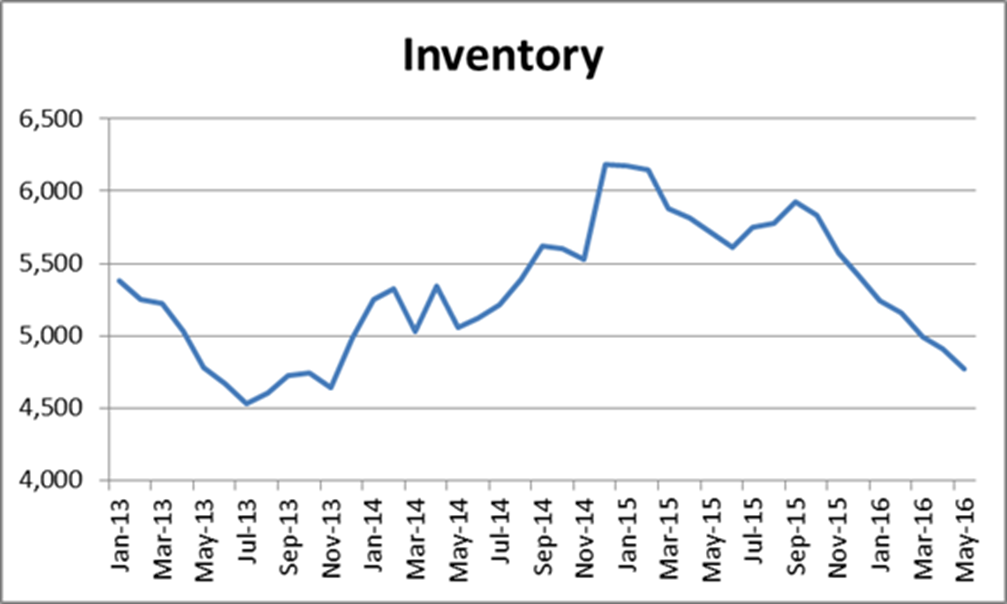

This confirms the sharp downtrend in flat rolled inventory levels released in June’s MSCI report.

MSCI Service Center Flat Rolled Inventory

The ISM PMI report shows “customer’s inventories” look to be neither here nor there. But, everyday those factories are pumping out product and using up steel. That steel will have to be replenished.

STRONG PMI + STRONG NEW ORDERS + IMPROVED BACKLOGS + LOW INVENTORY = ???

a. A favorable set up for the manufacturing industry for the second half of 2016

b. Higher probability of a failed “buyer’s strike”

c. Short squeeze

d. Interesting time to look at the HRC futures market

e. All of the above

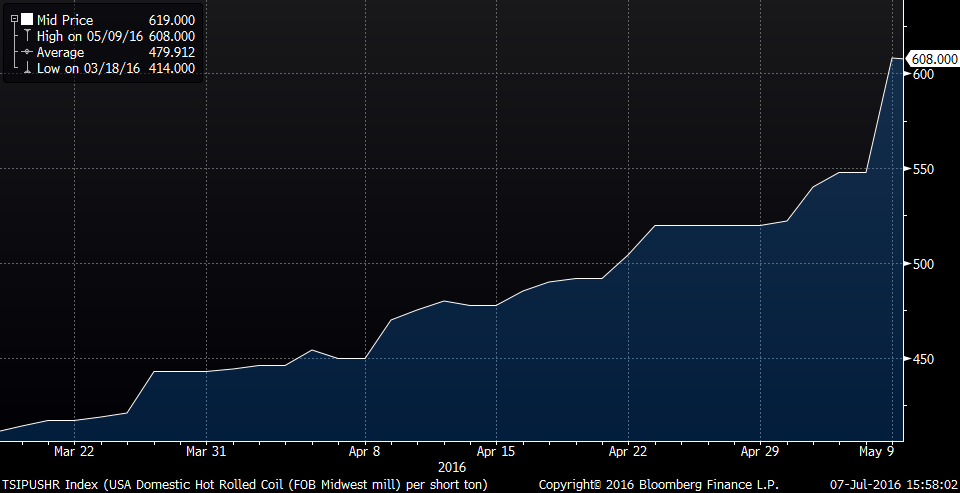

It’s too soon to know the answer, but “e” is looking better by the day. If there are enough buyers refusing to buy steel at these prices to warrant a “buyer’s strike”, what happens if said strike fails? That would be a short squeeze Bob. See chart below.

CME Midwest HRC Futures

Considering current US fundamentals, it might be a good time to hedge that outcome to some degree and you can do it here:

No one can predict the future consistently, but smart folks can consistently make prudent business decisions. Locking in some amount of your Q4 purchase at $545 is definitely one of those prudent business moves.