Analysis

July 4, 2016

Auto Sales Pace Softens in June

Written by Sandy Williams

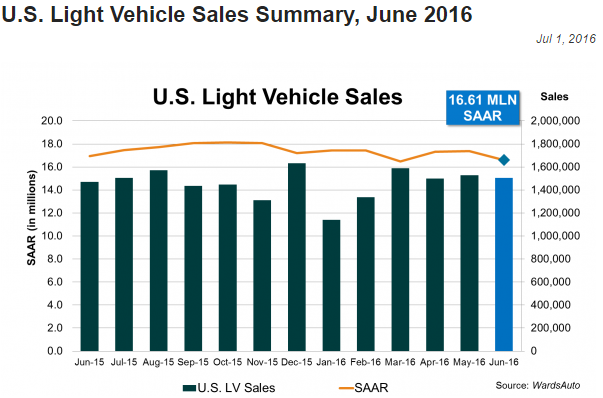

Despite a 2.5 percent year-over-year increase in June, U.S. automotive sales were slower than the 4.0 percent expected by most analysts. WardsAuto reports sales totaled 1.5 million units last month but the seasonally adjusted annual rate was 16.6 million units, well below the 17.0 million in June 2015 and at the slowest sales pace of the past year.

“What we’re seeing in June car sales is what we’ve predicted for some time. The hefty year-over-year increases are narrowing, which is expected after this unprecedented long stretch of gains,” said AutoTrader.com analyst Michelle Krebs as quoted by the Detroit Free Press.

Truck sales, including CUVs, small vans, and SUVs, increased 6.7 percent in June. Within the segment large pickups gained 5.5 percent while small pickups surged 26.8 percent. Year-over-year sales of passenger cars fell 12.1 percent.

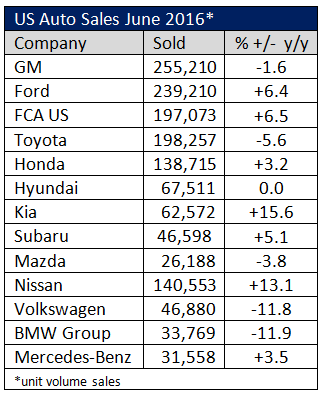

Ford and FCA sales increased 6.4 and 6.5 percent, respectively. General Motors sales dropped for the fifth consecutive month with June sales down 1.6 percent. Toyota sales also slipped last month, falling 5.6 percent.