Market Data

July 1, 2016

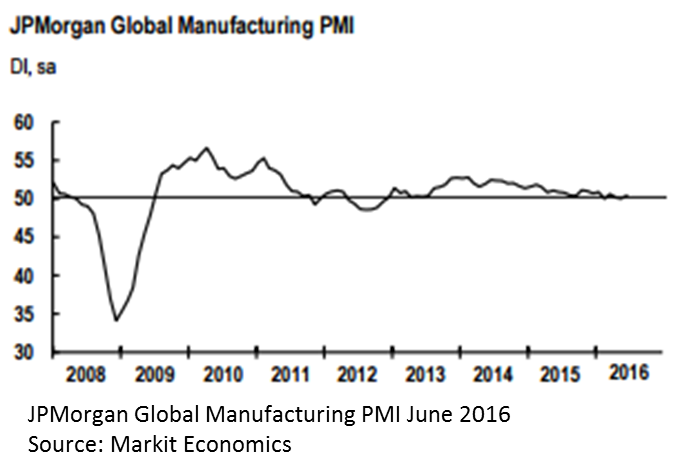

Global Manufacturing Nearly Stagnant in June

Written by Sandy Williams

Global manufacturing was subdued in June according to a reading of 50.4 on the JPMorgan Global Manufacturing PMI. The PMI gained just 0.4 points with most of the solid improvement in the European Union. It should be noted that the data for the report was collated before the vote by the UK to exit the EU. Global manufacturing output increased to 50.5 from the “no change” reading of 50.0 in April; new orders picked up 0.3 points. New exports orders continued to fall but at a slower rate in June. Pricing for both input and outputs rose but at a weaker pace.

China and Japan reported contraction in June and manufacturing conditions deteriorated in France, Brazil, Malaysia and Turkey.

“The PMI has been signalling a near-stagnant global manufacturing economy over the past year, with signs of the trend worsening rather than improving in recent months. Over the second quarter as a whole the rate of expansion slipped slightly lower to the weakest for three years,” commented Chris Williamson, chief economist, Markit.

Zack’s Equity Research commented on the PMI report: “Though this signifies growth as any reading at or above 50 suggests expansion in activity, such feeble growth and a deceleration definitely stoke concerns. Soft demand in the wake of global growth worries can be held responsible for the overall global manufacturing slowdown. Though the U.S. economy was better placed in the developed economies’ pack, the situation in the other big economies is somewhat unsteady.”

The Eurozone Manufacturing PMI reached 52.8 in June for a six month high. Production and new orders, both domestic and export, grew at the fastest rate this year. Germany and Austria led the region with France the only nation in contraction. Employment levels were up in most of the EU as production output expanded and backlogs accumulated at a faster rate. The data for the PMI was collected prior to UK’s exit from the European Union and does not reflect the impact of that event.

Chris Williamson, Chief Economist at Markit said: “Euro area manufacturers enjoyed their strongest growth so far this year in June. An upturn in the rate of production growth signals factory output is expanding at a near-2% annual pace, which should help to drive further modest economic growth in the second quarter. New orders and exports also rose at faster rates, prompting a welcome upturn in hiring.”

“Given the uncertainty caused by the prospect of Brexit, it seems likely that business and consumer spending will be adversely affected across the euro area in the short term at least, pulling growth down in coming months.”

In China, output fell at the fastest rate since February as new orders continued to decline. Employment levels were reduced for the 32nd month in a row. Export sales declined for the seventh month but at a moderate pace in June. Costs for raw materials eased but prices charged for finished goods remained mostly unchanged. The Caixin China General Manufacturing PMI registered 48.6, down 0.6 points from May.

Commenting on the China General Manufacturing PMI data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “Overall, economic conditions in the second quarter were considerably weaker than in the first quarter, which means there has been no easing of the downward pressure on growth. Against the backdrop of a turbulent external environment, and in order to avert a sharp economic decline, the government must strengthen its proactive fiscal policy while continuing to follow prudent monetary policy.”

The Nikkei Japan Manufacturing PMI was up slightly to 48.1 in June from 47.7 in May but was the fourth month below the 50 neutral point. Amy Brownbill, economist at Markit, commented: “Manufacturing conditions in Japan continued to worsen at the end of the second quarter of 2016. Total new orders declined sharply caused primarily by a marked drop in international demand. New export orders decreased at the same pace as May’s 40-month record, with evidence suggesting the stronger yen/dollar having detrimental effects on global competitiveness and reducing trade volumes. As a result, production contracted with some firms also mentioning the earthquakes that occurred back in April as still weighing on manufacturing output.”

Russia is making strides in turning around its manufacturing sector. The PMI registered 51.5 in June, the highest since November 2014. Solid expansion was note in output and new orders. Orders were limited to the domestic market as exports continued to decline. Input costs and output charges rose as manufacturers paid more for raw materials. “With backlogs also edging closer to stabilisation, Russia’s manufacturing sector could be set to shift into a higher level of growth over the second half of 2016,” said Samuel Agass, Economist at Markit.”

Conditions in Brazil continue to worsen as the manufacturing PMI posted its seventeenth month in contraction. The PMI registered at 43.2 in June. New orders and production fell sharply and employment saw its fastest drop in survey history. Higher input costs were reflected in selling prices with the strong U.S. dollar continuing to push prices of imported raw materials higher. Brazil has not had an increase in manufacturing output in one and half years and recovery is not expected soon.

U.S. manufacturers saw a rise in production volume and new work in June. The PMI, at 51.3, was a three month high for the survey although growth was relatively subdued according to Markit. Export sales rebounded for the fastest increase since September 2014.

Commenting on the final PMI data, Chris Williamson, chief economist at Markit said, “Although the manufacturing PMI ticked higher in June, the latest reading rounds off the worst quarter for goods producers for six years.” He added “Producers are struggling in the face of the strong dollar, the energy sector decline and presidential election jitters. With companies craving certainty, heightened tensions between the UK and the European Union are likely to unsettle the global business environment further in coming months, and therefore risk dampening growth in the US and export markets. The data flow in the next two months will therefore be critical to policymakers in gauging the appropriate outlook for interest rates.”

Manufacturers in Mexico saw business conditions weaken in June with the PMI falling to 51.1 from 53.6. Slower rates for new orders and employment, along with a reduction in output levels, influenced the downward change in the headline PMI. Output levels dropped for the first time since October 2013. New export orders rose only marginally and were at the weakest rate since early 2015. Markit noted that manufacturers commented on a lack of pressure on operating capacity and ongoing efforts to boost productivity.

Canada manufacturing slowed in June to a PMI of 51.8, down from 52.1. Production growth was the weakest since March due to softer client demands and finished inventory reduction. Post production stocks fell at the steepest rate in more than five and one half years. New orders grew marginally during the month and were driven by domestic work as new export orders remained broadly unchanged.

“Currency weakness and stronger U.S. demand should drive further exports, however growing economic uncertainly means that the roller coaster we’ve experienced recently in the Canadian export market will likely continue,” commented Craig Wright, senior vice-president and chief economist, RBC.