Prices

June 23, 2016

Hot Rolled Futures: Quiet Week

Written by Jack Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how they saw trading over the past week:

Hot Rolled Coil (HRC)

With spot hot rolled (HR) hovering around the $630 per short ton (ST), HR futures interests have been focused primarily on the Q4’16 period this past week. Exchange cleared volume represented 15,000 ST at a rough average price of $545/ST, basically unchanged from last week. Buyers have been relatively scarce this week in most periods and the lighter activity suggests we have entered summer markets.

Participants have been reticent to act without stronger signals on 2H’16 market direction especially given that spot turned this past week. The markets will surely be focused on next week’s reported spot transactions to get a better read on whether they can take advantage of the current shape of the futures curve.

HR futures open interest rose from 21,390 contracts to 21,990 contracts or 439,800 ST.

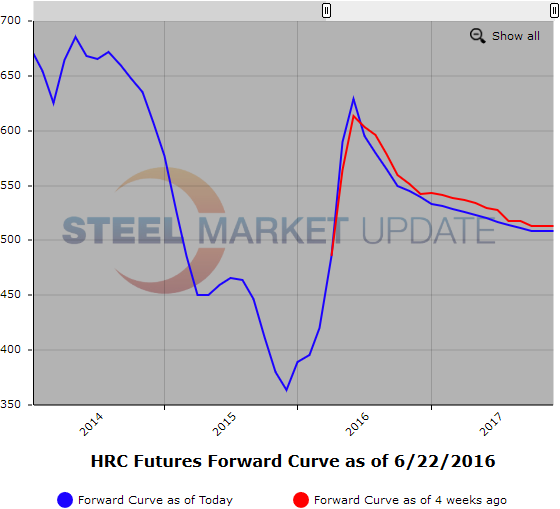

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Scrap

Early market talk suggests obsolete grades will probably be off $10to$20/GT. While market chatter for busheling scrap (BUS) is firm due to tight mid-summer supply. The current futures curve as reflected in bid/offer interests reflect a modest discount to spot. In BUS futures curve we are seeing 2H’16 BUS $250 bid/$260 offered per GT. Last week 1H’17 BUS traded @ $257/GT. This week 1H’17 $250 bid.

The spread between HR and BUS is fairly well discounted in future months as you can see in the table below , however when compared to historic levels it is still quite high.

LME Steel Scrap sees lower levels again this week. Wednesday TSI reported benchmark for CFR at $220/MT. In spite of talk that Chinese rebates for billet might be removed which could lead to a reverse in scrap demand, Q3’16 CFR remains just north of $200/MT. Not sure what reverses the bearish market sentiment and the backward sloping futures curve.

Another graphic is below, but of the BUS Futures Forward Curve.