Prices

June 20, 2016

Global Steel Production in May and Forecast through 2017

Written by Peter Wright

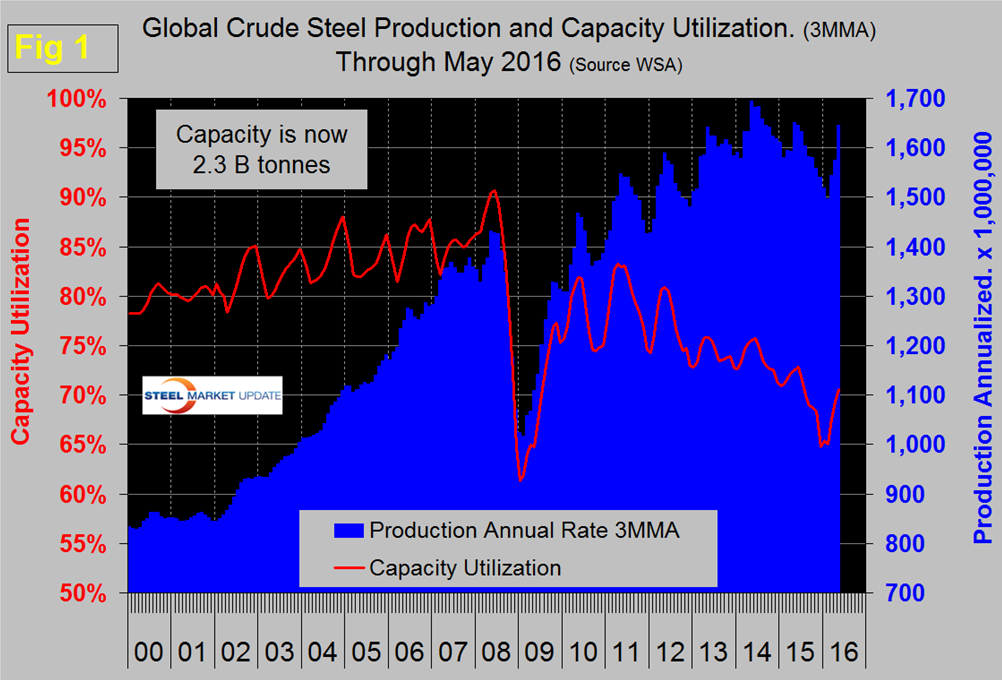

Production in the month of May, at 139,154,000 metric tons, was up by 3.2 percent from April and the three month moving average (3MMA) that we prefer as a measure was up by 4.5 percent. Capacity is 2.3 billion tonnes per year and the 3MMA of capacity utilization in May was 70.5 percent.

This report and the trend of the last four months indicates that the much desired slowdown in global steel production has almost ceased on a year over year basis. Figure 1 shows monthly production and capacity utilization since January 2000.

On a tons/day basis production in May was 4.489 million tonnes, down by 0.1 percent from April. Since the recession, capacity utilization has been on a steadily downward trajectory with an upward blip in the last three months. Capacity utilization in the three months through May was 70.6 percent, down from 72.3 percent in three months through June last year.

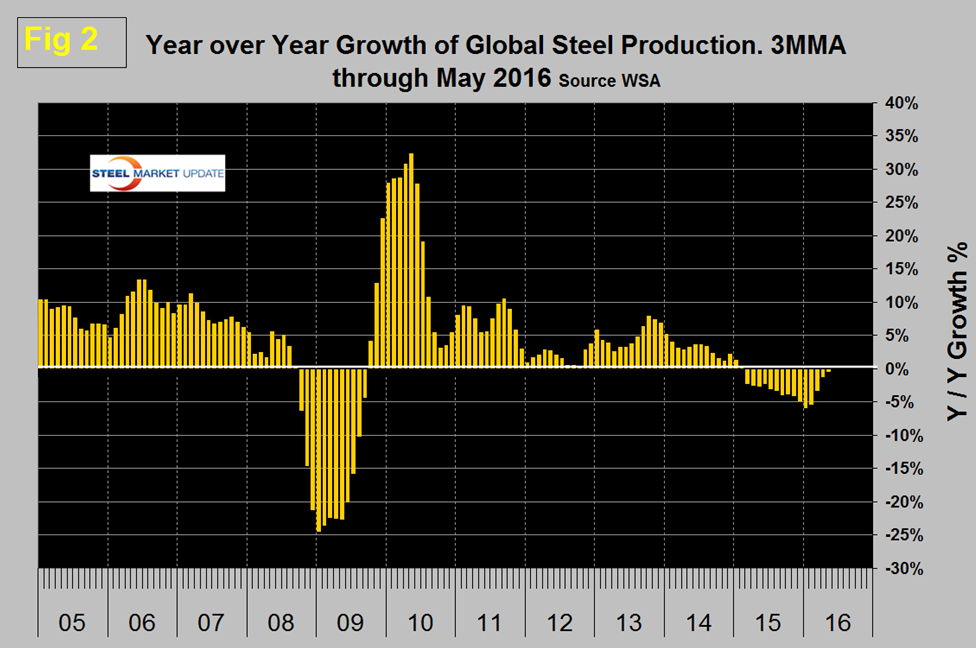

We believe it’s necessary to look at the year over year change in the three month moving average to get the real picture of changes in output and, on this basis, May was disappointing. Figure 2 shows the change in growth rate since January 2005.

Production began to contract in March last year and the contraction accelerated through January this year when it reached 5.8 percent. In the last four months the rate of contraction has declined and reached -0.3 percent in May. It looks as though we will be back to year over year expansion in the current month of June. In the last couple of years at the global level, steel supply has exceeded demand but it looks as though the much celebrated slowdown in production has just about ended.

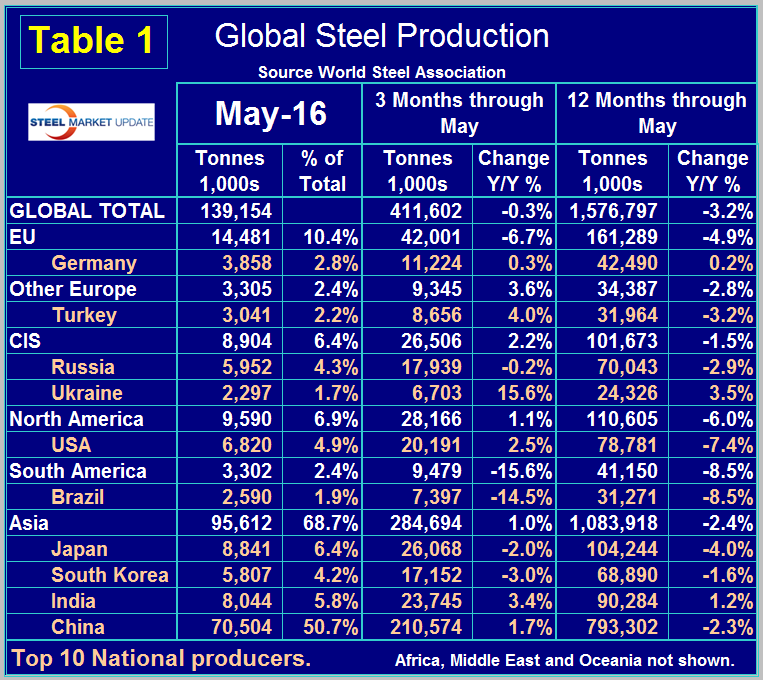

Table 1 shows global production broken down into regions and also the production of the top ten nations in the single month of May and their share of the global total. It also shows the latest three months and twelve months production through May with year over year growth rates for each. Regions are shown in white font and individual nations in beige.

The world as a whole has negative growth of 0.3 percent in 3 months and negative 3.2 percent in 12 months through May. If the three month growth rate exceeds the twelve month we interpret this to be a sign of positive momentum and accelerating growth. Momentum was negative for over 12 months through February, became positive in March at 0.2 percent and accelerated to 2.3 percent and 2.9 percent in April and May, respectively. The fact is that global steel production has now returned to an undeniable trend of accelerating growth.

China accounted for 50.7 percent of global production in May. As stated above, global production had a positive growth momentum of 2.9 percent in May but China’s growth momentum was 4.0 percent in May. The slowdown in Chinese steel production, that has been much written about and welcomed, is NOT happening. In March, China’s assistant commerce minister stated that China had cut 90M metric tons of capacity and had plans to reduce it by another 100M-150M. Reducing capacity is not the same thing as reducing production and there is no sign that the reported capacity reduction (if it is for real) is having any effect on output. China’s May production was the third highest on record at 70,504,000 tonnes. Their all-time high was 71,161,000 tonnes in May 2014.

On a regional basis in 3 months through May year over year, South America and the EU declined by 15.6 percent and 6.7 percent respectively. China’s production was up by 1.7 percent and Asia as a whole was up by 1.0 percent. Other Europe (mainly Turkey), the CIS and North America had positive growth in the latest data. North America was up by 1.0 percent in total with the US up by 2.5 percent, Canada up by 3.2 and Mexico down by 3.5 percent.

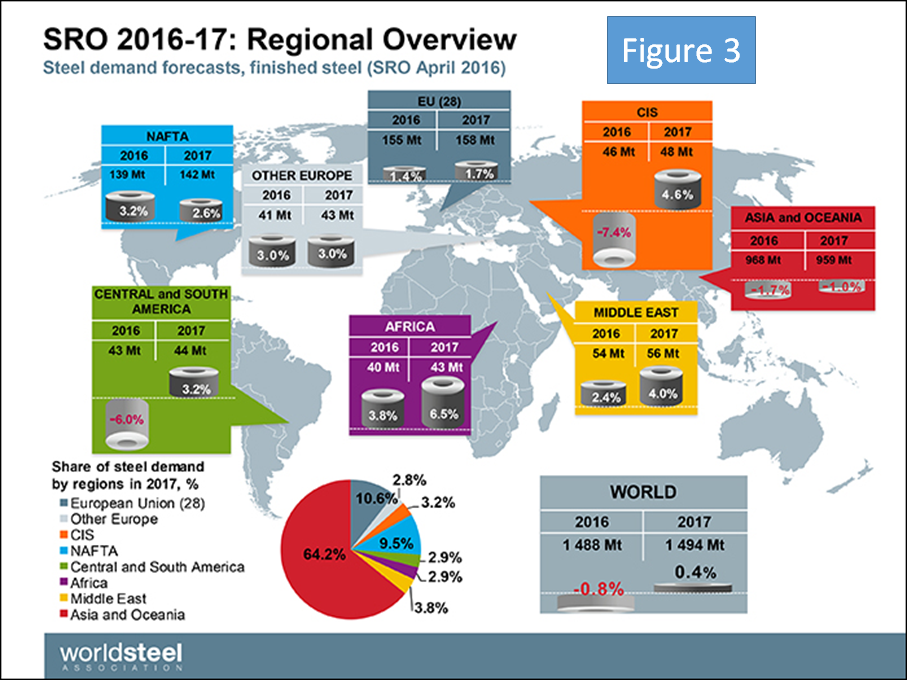

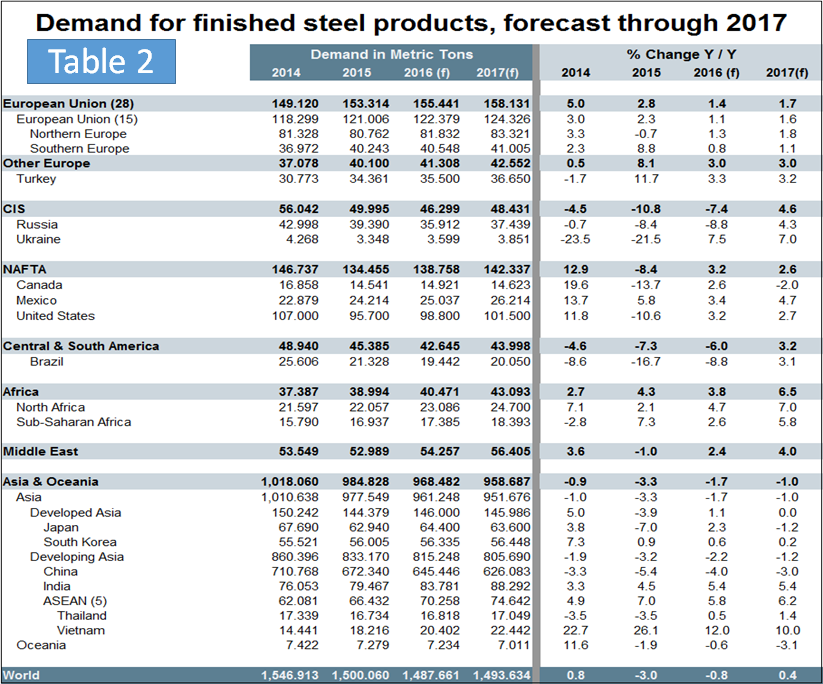

The October version of the World Steel Association Short Range Outlook (SRO) for apparent steel consumption in 2015 and 2016 had last year contracting at 1.7 percent and 2016 growing at 0.7 percent. What actually happened was that consumption contracted by 3.2 percent in 2015. In April the WSO updated its forecast. (Note this forecast is steel consumption, not crude steel production which is the main thrust of what you are reading now.) Figure 3 is a geographical view of production and growth in 2016 followed by Table 2 which shows the expectations by country and region.

We will leave these two figures in our monthly updates for reference until they are revised in October. The new WSA forecast has global demand in 2016 contracting at 0.8 percent and in 2017 growing at 0.4 percent. Based on this forecast, NAFTA will grow by 3.2 percent this year and 2.6 percent next. China’s demand will decline by 4.0 percent this year and 3.0 percent in 2017 therefore if their production doesn’t decline by at least that amount the flood of exports will only increase.

SMU Comment: We had really hoped and anticipated that excess global production would begin to evaporate but this is clearly not happening. With a global capacity utilization of less than 71 percent it may be that capacity reductions have a long way to go before they begin to reduce the market pressure of overproduction. China’s production has picked back up in the last three months and their volume far exceeds their needs. We said last month and still believe that oversupply and low capacity utilization won’t be resolved much before the end of this decade and that may be an optimistic estimate.

Source: World Steel Association with analysis by SMU.