Market Data

June 19, 2016

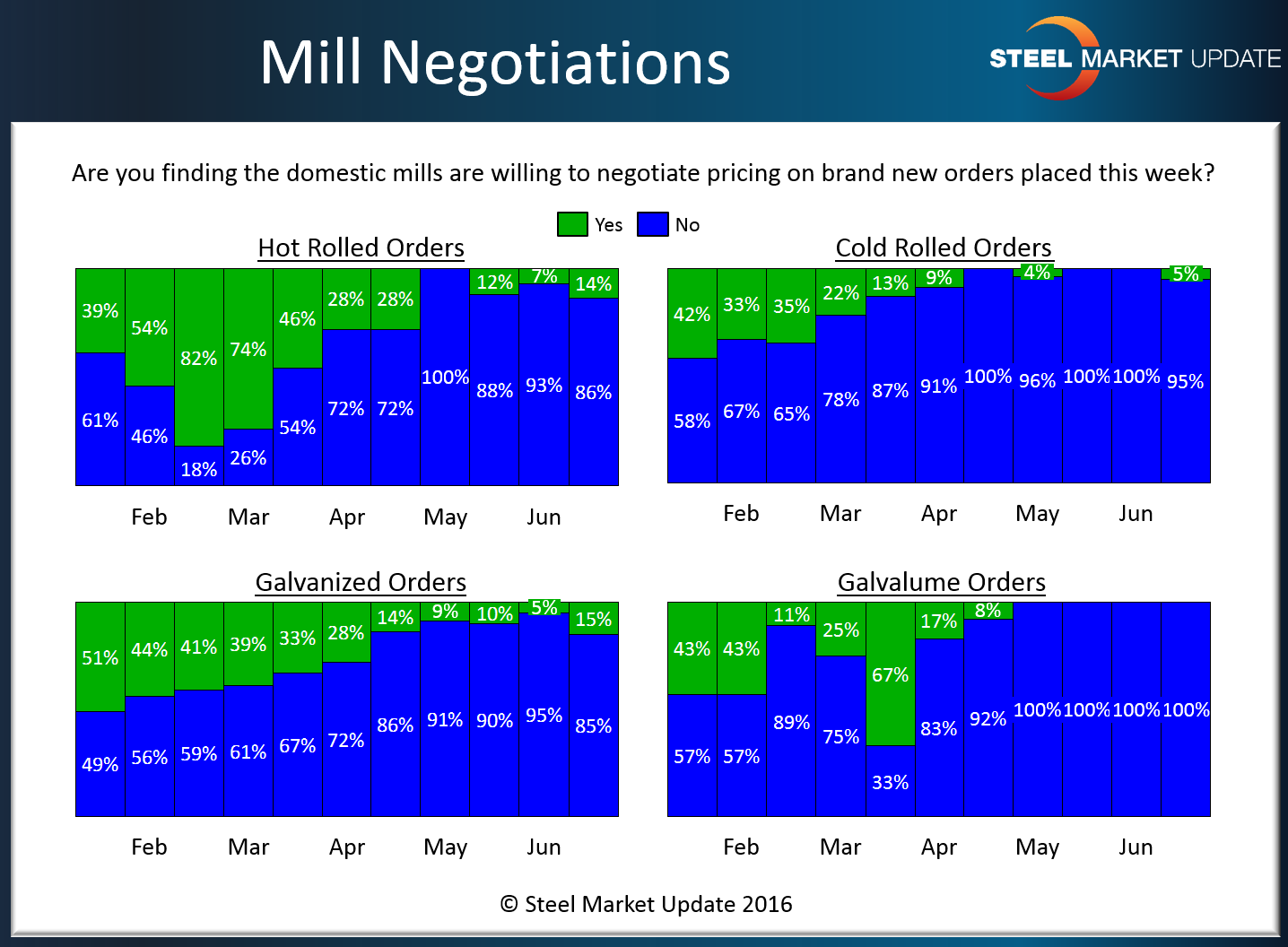

Steel Mills Barely Break a Sweat During Price Negotiations

Written by John Packard

The domestic steel mills are barely breaking a sweat as they have minimal need to negotiate flat rolled steel prices according to those taking our mid-June flat rolled steel market trends survey.

Last week we invited hundreds of companies associated with the steel industry to provide their opinions on the flat rolled steel market. Over the past couple of months our survey respondents have been telling us that there is little negotiating going on regarding hot rolled, cold rolled, galvanized or Galvalume steels.

We did note small changes in the pattern associated with hot rolled, cold rolled and galvanized. The changes are not large enough to suggest any but a blip in the data but, it is worth watching these numbers in future surveys.

Those reporting the steel mills as willing to negotiate hot rolled prices grew from 7 percent at the beginning of the month to 14 percent this past week. Cold rolled went from zero percent to 5 percent, galvanized from 5 percent to 15 percent while Galvalume remained at zero percent.

We remind our readers these results are based on responses to our survey. Each individual mill may have different approaches to negotiations and steel markets can be quite volatile and change quickly. It is important to stay close to your suppliers to make sure you are being kept up to date as to what they are doing and how your company fits into their plans.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.