Prices

June 19, 2016

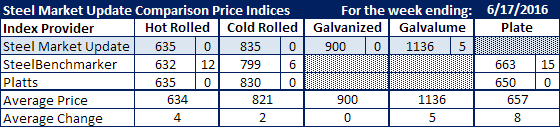

Comparison Price Indices: Moving Sideways

Written by John Packard

There was very little movement in the SMU and Platts indices this past week. SteelBenchmarker, which only produces their index pricing twice per month, saw a modest rise in their numbers as they catch up with the other indices in the market.

Hot rolled is about as close as it has been in many months with SMU and Platts at $635 per ton and SteelBenchmarker just behind at $632 per ton.

Our galvanized index, which is based on .060” G90, remained the same at $900 per ton ($45.00/cwt) while Galvalume was up slightly to $1136 per ton for .0142” AZ50, Grade 80.

SteelBenchmarker moved their plate prices to $663 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.