Market Data

June 16, 2016

SMU Steel Buyers Sentiment Index Sets New Record High

Written by John Packard

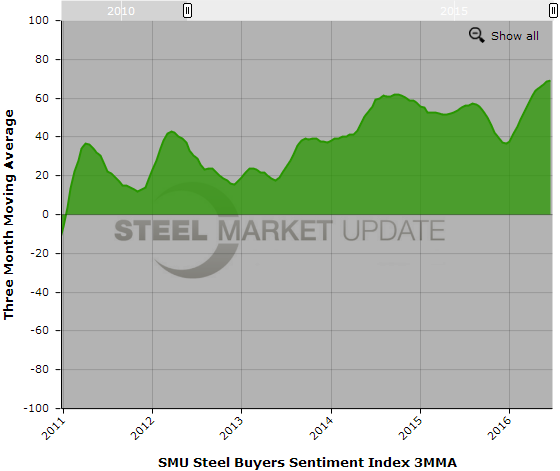

Earlier this week Steel Market Update began canvassing the flat rolled steel community to determine how buyers and sellers felt about their company’s ability to be successful in the current market environment. The result is the SMU Steel Buyers Sentiment Index which has been on a roll for a number of months setting new record highs (3MMA) every month since December 15, 2015.

The +69 reading for mid-June actually came in even with our measurement for Sentiment made two weeks ago. One month ago Current Sentiment was +67 and one year ago our Sentiment Index was reported to be +61.

Steel Market Update prefers to look at our data from a three month moving average perspective. This takes any “bumps” out of the numbers and provides a clearer picture as to the trend. On a three month moving average (3MMA) basis Sentiment is +69.00 a new record high. Two weeks ago our 3MMA was +68.67 and one year ago it was +55.17.

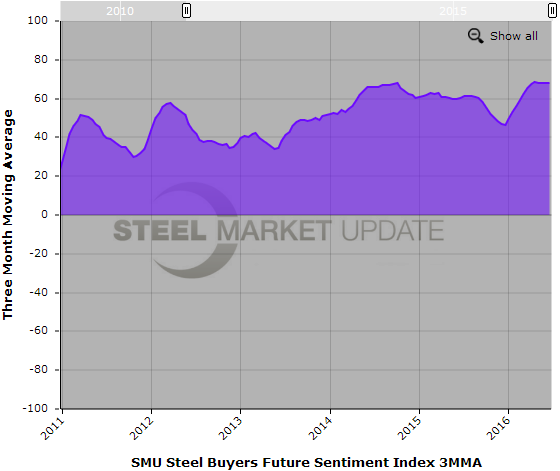

Future Sentiment Index

We also look at the how buyers and sellers of flat rolled steel feel about their company’s ability to be successful three to six months into the future. As a single data point, Future Sentiment was measured at +71 this week. This is up +2 points from two weeks ago, +10 points over mid-May and +6 points above last year at this time.

On a three month moving average basis, Future Sentiment continues to be flat having been measured at +68.17 unchanged from two weeks ago. Our Future Sentiment Index has been hovering around +68 since the middle of April 2016. At the beginning of this year the 3MMA for Future Sentiment was +49.33.

It is Steel Market Update’s opinion that Sentiment is very optimistic as steel prices have improved over the past six months improving inventory values and allowing companies to raise prices. At the same time, demand has remained relatively stable within the flat rolled steel segments of the industry.

What Our Respondents Are Saying

“The difference in “MY” market between foreign and domestic pricing has me at a disadvantage.” Service center

“Things seem to be slowing, rapid price increases put some construction on hold or slow downs we believe. GNP and GDP numbers dropping as well!” Service center who went on to say, “Market cannot bear it right now foreign poised to jump right back in strong with prices up will pay their duties and taxes, U.S. price still the highest in the world and dollar exchange rate helps them further!”

“If demand on plate increases in the second half of this year we are positioned well to serve our customers.” Service center

“Current pricing does not allow us good margins, very difficult getting all mill increases.” Service center

“There are very few qualified producers of quality light guage galvanized and GL products.” Trading company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 45 percent were manufacturing and 41 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.