Analysis

June 2, 2016

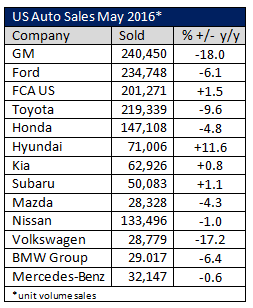

US Auto Sales Drop 6% in May

Written by Sandy Williams

U.S. auto sales may have finally reached the peak that that analysts have been predicting. Overall the market declined 6 percent for sales of 1,536,276 light vehicles. WardsAuto places May’s seasonally adjusted annual rate at 17.4 million units, up from 17.3 in April, but short of the 17.6 million from a year ago.

Of the big three Detroit manufacturers, only FCA US posted a gain, up 1.5 percent. GM sales slip 18 percent year-over-year and Ford was down 6.1 percent.

Hyundai sales were the strongest at a positive 11.6 percent for best all time sales for the month of May. Hyundai’s CUV line almost doubled its sales from last year.

WardsAuto calculated import penetration increased to 22.0 percent in May and the year-to-date share of 21.6 percent was the periods highest in four years.

GM said earthquakes in Japan in April led to a shortage of parts for some of its new vehicles. Four U.S. plants were idled for two weeks impacting production of the new Chevrolet Cruze, the Cadillac XT5 and the redesigned GMC Acadia.

“There’s no question we could’ve sold more, however, production was impacted at Fairfax, Lordstown and Spring Hill by the Japanese earthquakes,” Kurt McNeil, GM’s vice president of sales operations, said in a statement. “Current dealer inventories for launch products are about half of what we’d like for launch products, but availability is improving, which sets us up well for the second-half of the year.”

Part of the decline in sales for May was due to two less selling days during the month but analysts suggest that the prevalence of incentives may be an indication that consumer demand is waning.

IHS Automotive analyst Stephanie Brinley said the industry is still on track to beat last year’s sales record of 17.47 vehicles. IHS expects sales to top 17.8 million vehicles in 2016.

“Nothing in May’s results suggests otherwise,” said Brinley. “Despite a more difficult May, interest rates remain low and fundamentals solid.”