Market Data

June 2, 2016

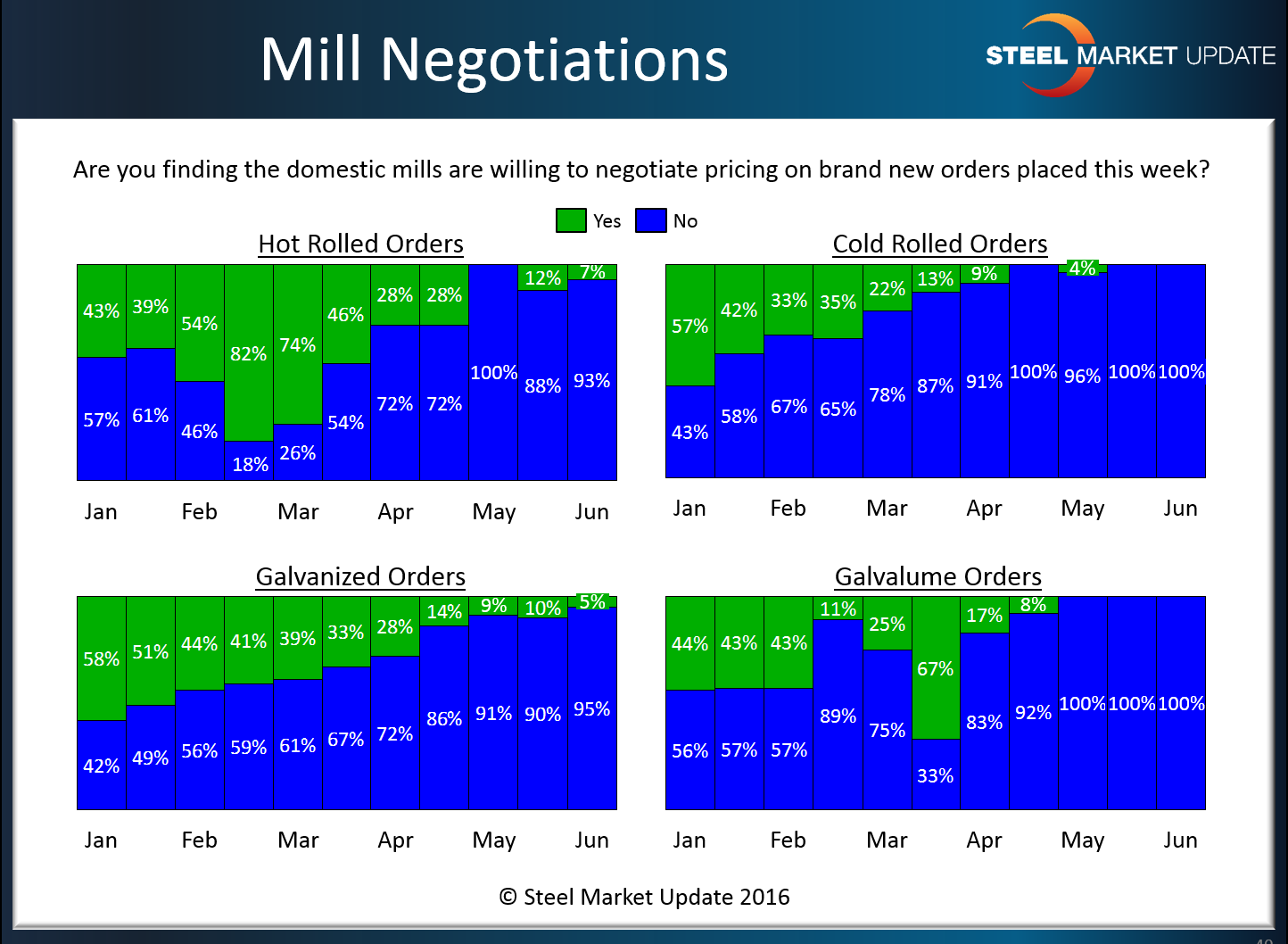

Steel Mill Negotiations: Buyers Beware

Written by John Packard

Blue is the color of the sky and that may be the limit when it comes to domestic steel mills need to negotiate flat rolled steel pricing. Based on the results from this week’s flat rolled market trends analysis produced by Steel Market Update, steel buyers and sellers are reporting, almost unanimously, that all of the steel price negotiating cards are in the hands of the domestic steel mills.

With lead times extended, foreign supply disrupted due to the ongoing dumping suits, supply constrained with a few blast furnaces being down and inventories tightening at the service center level, it is a perfect storm for the steel mills.

The question now being asked is how much is too much to ask of the mill customers?

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.