Market Data

June 2, 2016

SMU Steel Buyers Sentiment Index Sets Record High

Written by John Packard

Buyers and sellers of flat rolled steel continue to be optimistic regarding their company’s ability to be successful in both the current market environment as well as looking out three to six months into the future.

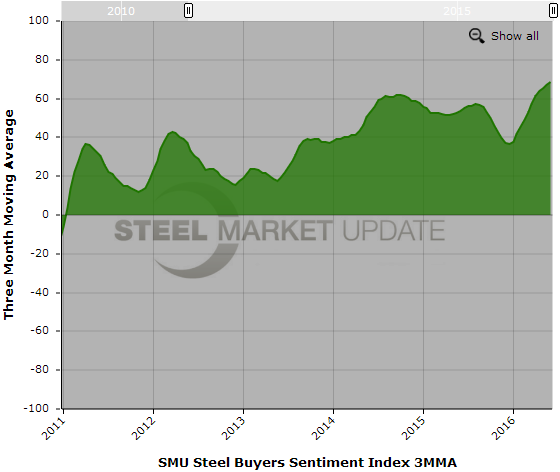

The SMU Steel Buyers Sentiment Index for Current Sentiment rose +2 points from mid-May at +69. One year ago our Current Sentiment Index was reported at +57.

Our preference is to look past the single data point and to analyze the trend using a three month moving average (3MMA). This helps smooth out any one time bumps that we might get during the collection process. Our Current Sentiment 3MMA is +68.67 breaking the record high set during the middle of May 2016. One year ago our 3MMA was reported as being +53.83.

Future Sentiment Index

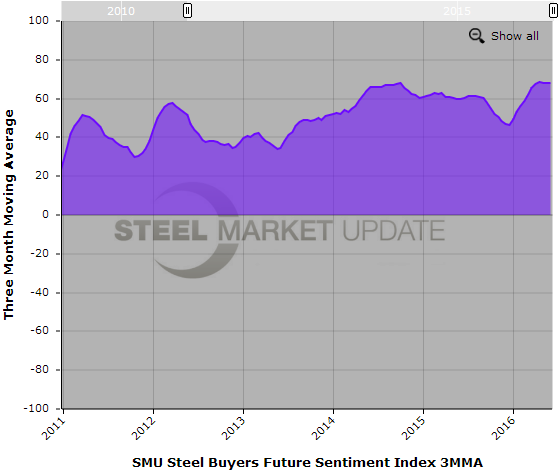

Future Sentiment, which measures how buyers and sellers of flat rolled steel feel about their company’s ability to be successful three to six months into the future, is +7 points higher than our mid-May analysis and is being reported today at +69. One year ago Future Sentiment was reported as being +58.

Looking at Future Sentiment based on a three month moving average the Index is now +68.17 the second most optimistic number reported in the history of our Index. The previous high was set during mid-April at +68.67. One year ago the 3MMA for the Index was +59.67.

Steel Market Update believes Current Sentiment remains very optimistic due to business conditions being perceived as “decent” although not robust. Steel prices have continued to rise increasing the value of inventories on the floors of the service centers. Future Sentiment is holding at very high (optimistic levels) but there seem to be a number of questions arising regarding a summer slowdown or a slowing of the economy in general later this year. This is something we will need to watch carefully in the coming weeks and months.

We have a full explanation about our Index at the end of this article.

What Our Respondents Are Saying

“I can’t say excellent due to the tightness of the market. It’s very hard to quote new business and even to cover your existing business out of the domestic mills. But ultimately, the higher prices help.” Service center

“Pricing and lead times are still undisciplined. Very frustrating.” Service center

“Summer slowdown coming?” Service center

“For the second consecutive month we exceeded forecast.” Service center

“Steel plate consumption needs to increase across the board. With higher Oil prices this should help.” Service center

“I am concerned about steel prices declining since it is difficult to hedge the risk currently given the steep backwardation of the futures market.” Service center

“Customers have bought forward. What & when do they buy next.” Service center

“Early signs are in place indicating a leveling off. However, if the ITC ruling supports Commerce it could give price increases more support and more distance.” Steel mill

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 100-170 companies. Of those responding to this week’s survey, 43 percent were manufacturing and 42 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.