Market Data

May 31, 2016

Consumer Confidence in May 2016

Written by Peter Wright

Sources for the following article are the Conference Board and SMU analysis. Please see the end of this piece for an explanation of the indicator.

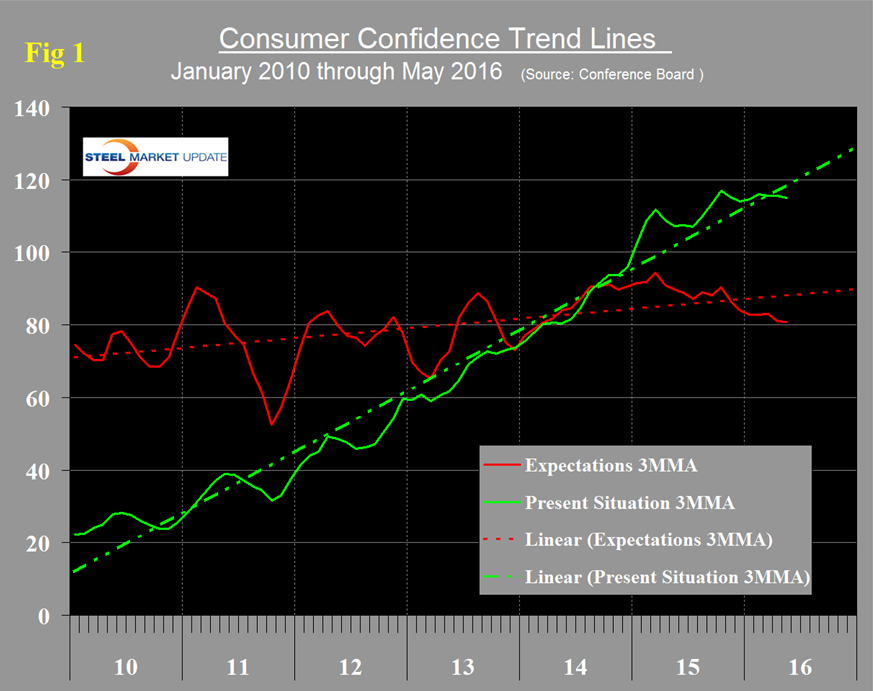

Consumer Confidence declined from 96.1 in March to 94.7 in April and to 92.6 in May. Included below is the official news release from the Conference Board. The three month moving average (3MMA) declined from 96.0 in March to 94.90 in April and to 94.5 in May. We prefer to smooth the data in this way because of monthly volatility which, in the case of Consumer Confidence, has been quite extreme since the beginning of last year. The 3MMA of the present situation is now slightly below its six year trend and the 3MMA for expectations has been below its six year trend for the last eight months (Figure 1).

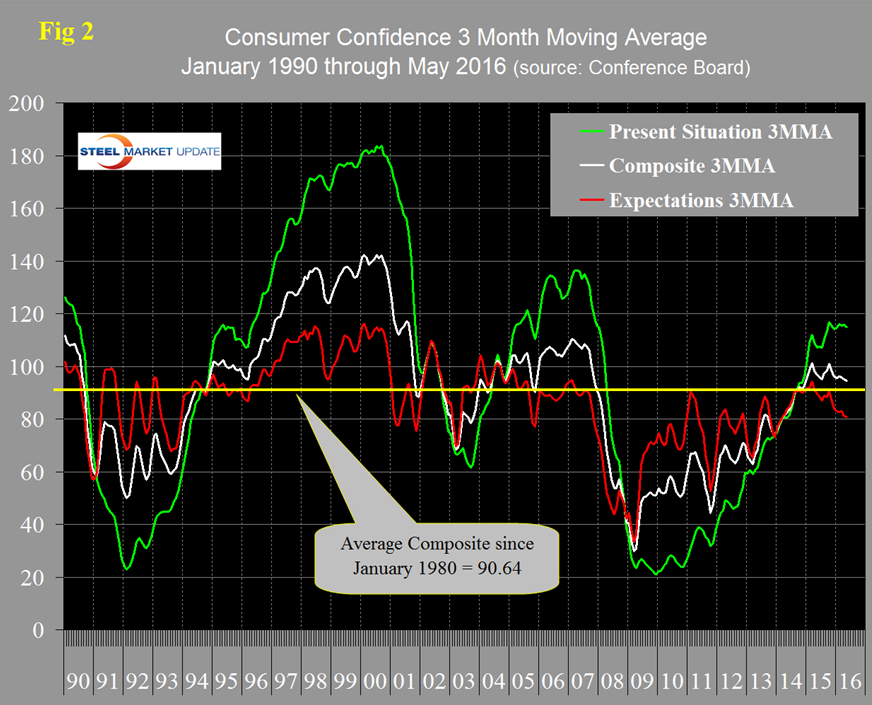

The historical pattern of the 3MMA of the composite, the view of the present situation and expectations are shown in Figure 2.

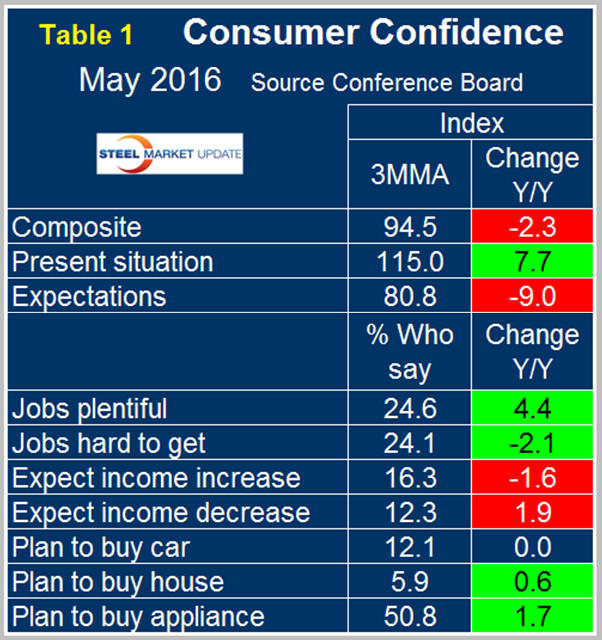

The progression of the 3MMA of the composite was positive throughout 2014 but has been trending down since October last year. Since January last year, the improvement in the present situation has been countered by the deterioration in consumer expectations. Comparing May 2016 with May 2015 (y/y) the composite was down by 2.3, the present situation was up by 7.7 and expectations were down by 9.0 (Table 1).

Comparing Table 1 with the version that we published in the last two months, the employment situation was unchanged. In all three months the perception of job availability was improving but expectations for wage improvement were deteriorating. Plans to buy homes and appliances have been improving for each of the last four months. Plans to buy a car were unchanged in May.

SMU Comment: Consumer Confidence is positively correlated with personal consumption which accounts for about 2/3 of GDP. Ultimately the growth of GDP positively drives steel consumption therefore this report is disappointing. Having said that, the sky is not falling because other indicators that we track are generally trending positive as we will show in our key market indicators report later this week. In addition the University of Michigan consumer report for May was much more positive in both expectations and the view of the present situation.

The official news release from the Conference Board reads as follows and is entirely based on monthly changes. This is a highly regarded indicator which we believe needs to be examined in a longer time context to get the real picture which is why we only consider three month moving averages and focus our comments on year over year results.

The Conference Board Consumer Confidence Index Declined Again in May

The Conference Board Consumer Confidence Index, which had decreased in April, declined further in May. The Index now stands at 92.6 (1985=100), down from 94.7 in April. The Present Situation Index decreased from 117.1 to 112.9, while the Expectations Index declined from 79.7 to 79.0 in May. The cutoff date for the preliminary results was May 19.

“Consumer confidence declined slightly in May, primarily due to consumers rating current conditions less favorably than in April,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Expectations declined further, as consumers remain cautious about the outlook for business and labor market conditions. Thus, they continue to expect little change in economic activity in the months ahead.”

Consumers’ assessment of current conditions weakened in May. The percentage stating business conditions are “good” improved from 24.2 percent to 25.9 percent. However, those saying business conditions are “bad” also increased, from 18.2 percent to 21.6 percent. Consumers’ appraisal of the labor market was less favorable. The proportion claiming jobs are “plentiful” was virtually unchanged at 24.3 percent, however those claiming jobs are “hard to get” increased from 22.8 percent to 24.4 percent.

Consumers were less optimistic about the short-term outlook than last month. Those expecting business conditions to improve over the next six months increased from 13.8 percent to 15.1 percent, but those expecting business conditions to worsen also rose, from 10.8 percent to 11.6 percent.

Consumers’ outlook for the labor market was less favorable. Those anticipating more jobs in the months ahead was virtually unchanged at 12.8 percent, but those anticipating fewer jobs increased from 16.7 percent to 18.1 percent. The proportion of consumers expecting their incomes to increase improved from 15.8 percent to 16.2 percent, while the proportion expecting a reduction in income remained steady at 12.4 percent.

About The Conference Board

The Conference Board is a global, independent business membership and research association working in the public interest. Our mission is unique: To provide the world’s leading organizations with the practical knowledge they need to improve their performance and better serve society. The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months. The Conference Board is a non-advocacy, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.