Prices

May 31, 2016

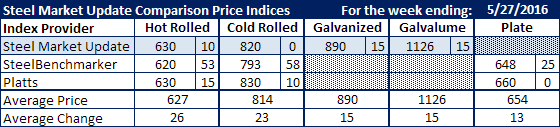

Comparison Price Indices: $200 Spread Between HRC & CRC/Coated

Written by John Packard

Flat rolled steel prices continued their long march higher with all three indexes reporting benchmark hot rolled at, or exceeding, $620 per ton (SMU & Platts at $630 per ton). The spread between hot rolled and cold rolled and coated base prices continues to expand with CR at $190-$200 per ton and galvanized at $200 per ton, instead of the more normal $100-$120 per ton spread seen prior to this current run in pricing.

SteelBenchmarker reported prices this past week and even with their impressive gains in hot rolled (up $53 to $620 per ton) and cold rolled (up $58 to $793 per ton) they lagged both SMU and Platts. Hot rolled was $10 and cold rolled by $27 and $37 (SMU and Platts respectively).

Coated steels were up by $15 per ton last week while plate prices remained the same on Platts ($660) and SteelBenchmarker was up $25 per ton to $648 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.