Market Data

May 26, 2016

Increase in Durable Goods Orders But Core Goods Below Forecast

Written by Sandy Williams

New orders for durable goods in April increased 3.4 percent to $235.9 billion from March’s upwardly revised figure of 1.9 percent, according to the advance report from the Department of Commerce. Durable goods are manufactured products that are expected to last at least three years.

Transportation orders led the increase with a jump of 8.9 percent. Civilian aircraft orders surged 64.9 percent in April.

The Commerce Department reported core durable goods (non-defense capital goods orders excluding aircraft) fell 0.8 percent, below economist forecasts of a 0.3 to 0.5 percent gain. It was the third consecutive month of decline and for the first four months of 2016 is 4.1 percent below the same period in 2015. The core durable goods are considered a key proxy for business investment and the decrease signals continued weakness in manufacturing.

A struggling oil sector, along with a strong dollar and depressed import levels has hurt domestic manufacturing although glimmers of improvement were seen in ISM’s March and April manufacturing index.

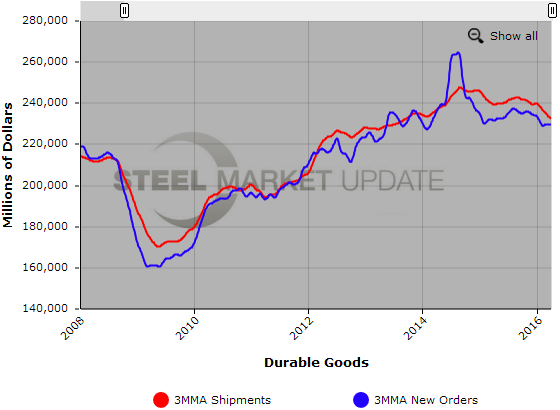

The Steel Market Update three month moving average (see graph below) shows orders and shipments have been weak since an uptick in August/September 2015.

The text from the Advance Report on Durable Goods follows:

New Orders. New orders for manufactured durable goods in April increased $7.7 billion or 3.4 percent to $235.9 billion, the U.S. Census Bureau announced today. This increase, up three of the last four months, followed a 1.9 percent March increase. Excluding transportation, new orders increased 0.4 percent. Excluding defense, new orders increased 3.7 percent. Transportation equipment, also up three of the last four months, led the increase, $7.1 billion or 8.9 percent to $87.1 billion. Shipments. Shipments of manufactured durable goods in April, up following two consecutive monthly decreases, increased $1.5 billion or 0.6 percent to $232.5 billion. This followed a 0.8 percent March decrease. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $1.0 billion or 1.3 percent to $80.9 billion.

Unfilled Orders. Unfilled orders for manufactured durable goods in April, up three of the last four months, increased $6.3 billion or 0.6 percent to $1,137.0 billion. This followed a virtually unchanged March increase. Transportation equipment, up two consecutive months, led the increase, $6.1 billion or 0.8 percent to $783.1 billion.

Inventories. Inventories of manufactured durable goods in April, down nine of the last ten months, decreased $0.7 billion or 0.2 percent to $384.4 billion. This followed a 0.2 percent March decrease. Machinery, down eight of the last nine months, led the decrease, $0.5 billion or 0.7 percent to $66.1 billion.

Capital Goods. Nondefense new orders for capital goods in April increased $5.4 billion or 7.8 percent to $73.6 billion. Shipments increased $0.4 billion or 0.6 percent to $71.4 billion. Unfilled orders increased $2.2 billion or 0.3 percent to $707.2 billion. Inventories decreased $0.2 billion or 0.1 percent to $172.4 billion. Defense new orders for capital goods in April increased $0.5 billion or 3.7 percent to $13.2 billion. Shipments decreased $0.4 billion or 4.1 percent to $9.6 billion. Unfilled orders increased $3.6 billion or 2.6 percent to $140.7 billion. Inventories increased $0.2 billion or 1.2 percent to $20.8 billion.

Revised and Recently Benchmarked March Data. Revised seasonally adjusted March figures for all manufacturing industries were: new orders, $451.4 billion (revised from $451.1 billion); shipments, $454.1 billion (revised from $455.3 billion); unfilled orders, $1,130.7 billion (revised from $1,129.5 billion); and total inventories, $621.1 billion (revised from $622.4 billion).

Below is a graph showing the history of the three month moving average for Durable Goods New Orders and Shipments. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.