Prices

May 24, 2016

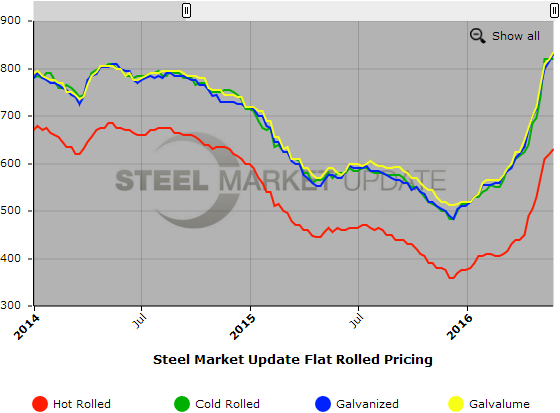

SMU Price Ranges & Indices: Still Moving Higher

Written by John Packard

The domestic steel mills continue to walk prices higher with all flat rolled products except cold rolled moving up by double digits this week. We understand that at least one mill and perhaps more are trying to collect $880 per ton ($44.00/cwt) on cold rolled and coated products. But, we did not hear from any buyers that they were actually paying those kind of numbers.

As an aside, the tone of the market seems to be less hectic than what we were hearing from buyers over the past few weeks. Adjustments appear to have been made to accommodate the longer lead times. We are not seeing any evidence of panic buying at this time. This is not to say there aren’t companies out there looking to fill holes.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $610-$650 per ton ($30.50/cwt- $32.50/cwt) with an average of $630 per ton ($31.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: All mills on controlled order entry or allocation

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt- $42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: All mills on controlled order entry or allocation

Galvanized Coil: SMU Base Price Range is $40.50/cwt-$42.50/cwt ($810-$850 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $15 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $870-$910 per net ton with an average of $890 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: All mills on controlled order entry or allocation

Galvalume Coil: SMU Base Price Range is $41.00/cwt-$42.50/cwt ($820-$850 per ton) with an average base of $41.75/cwt ($835 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to last week while the upper end increased $10 per ton. Our overall average increased $15 per ton over one week ago. Our price momentum for Galvalume steel is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1111-$1141 per net ton with an average of $1126 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: All mills on controlled order entry or allocation

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.