Prices

May 15, 2016

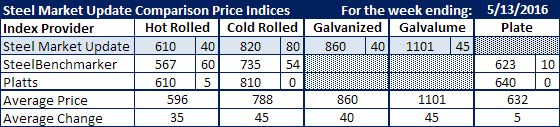

Comparison Price Indices: Are We Ready for a Breather?

Written by John Packard

Flat rolled prices have been very dynamic over the past few weeks with double digit price changes and, at times, more than one price change during the course of one week. This has kept the steel price indexes busy and has shown the strength and weaknesses of the collection techniques used by each index.

Flat rolled prices continued to move higher this past week according to the various steel indexes followed by Steel Market Update. Benchmark hot rolled prices have a $610 per ton level ($30.50/cwt) at our own index as well as Platts. SteelBenchmarker produced prices last week as well and trails the other two indexes, even after increasing their HRC number by $60 per ton. SteelBenchmarker reported HRC prices as being $567 per ton.

Cold rolled also moved higher on all but Platts. As with hot rolled, Platts and SMU were close together with SMU reporting $820 per ton ($41.00/cwt) and Platts $810 per ton ($40.50/cwt). SteelBenchmarker reported CRC at $735 per ton, $85 per ton lower than SMU and $75 per ton lower than Platts.

Both galvanized .060” G90 and Galvalume .0142” AZ50, Grade 80 pricing increased by double digits. SMU had GI up $40 from the prior week and Galvalume up $45 compared to the previous week.

Plate prices remained stuck at $640 per ton according to Platts. While SteelBenchmarker was up $10 to $623 per ton.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.