Analysis

May 8, 2016

Economists Weigh In on Construction Sector: Slow Growth, No Recession

Written by Sandy Williams

Economists participating last week in the CMD Webinar: Is Construction Gaining or Waning were generally optimistic about the economy and forecast for construction growth. Although some sectors of construction peaked last year, growth is continuing in almost all areas, although at a slower pace. During the webinar, chief economists Ken Simonson, Associated General Contractors of America; Alex Carrick, CMD; and Kermit Baker, American Institute of Architects, gave their insights on the U.S. construction sector.

In general, the economy is humming along quite well at present, said Kermit Baker. The U.S. economy had 2.5 percent growth last year and, despite a weak first quarter, should be in the 2 percent range for this year and 2017. Jobs have increased 2.6 million per year in the past two years bring the U.S. back to prerecession levels.

Low energy prices, said Baker, are hurting industries that have their economic base in the energy production area but are also encouraging consumer spending. Consumers are comfortable with the economy. The construction sector is back in growth mode and one of the healthiest sectors in the economy overall, said Baker.

Of concern is the manufacturing sector which has been slow since the middle of 2015 and experiencing lower pricing for most basic commodity markets. Manufacturing has been negatively impacted by weak international economies coupled with a strong dollar that is dampening U.S. export growth, said Carrick.

Nonresidential

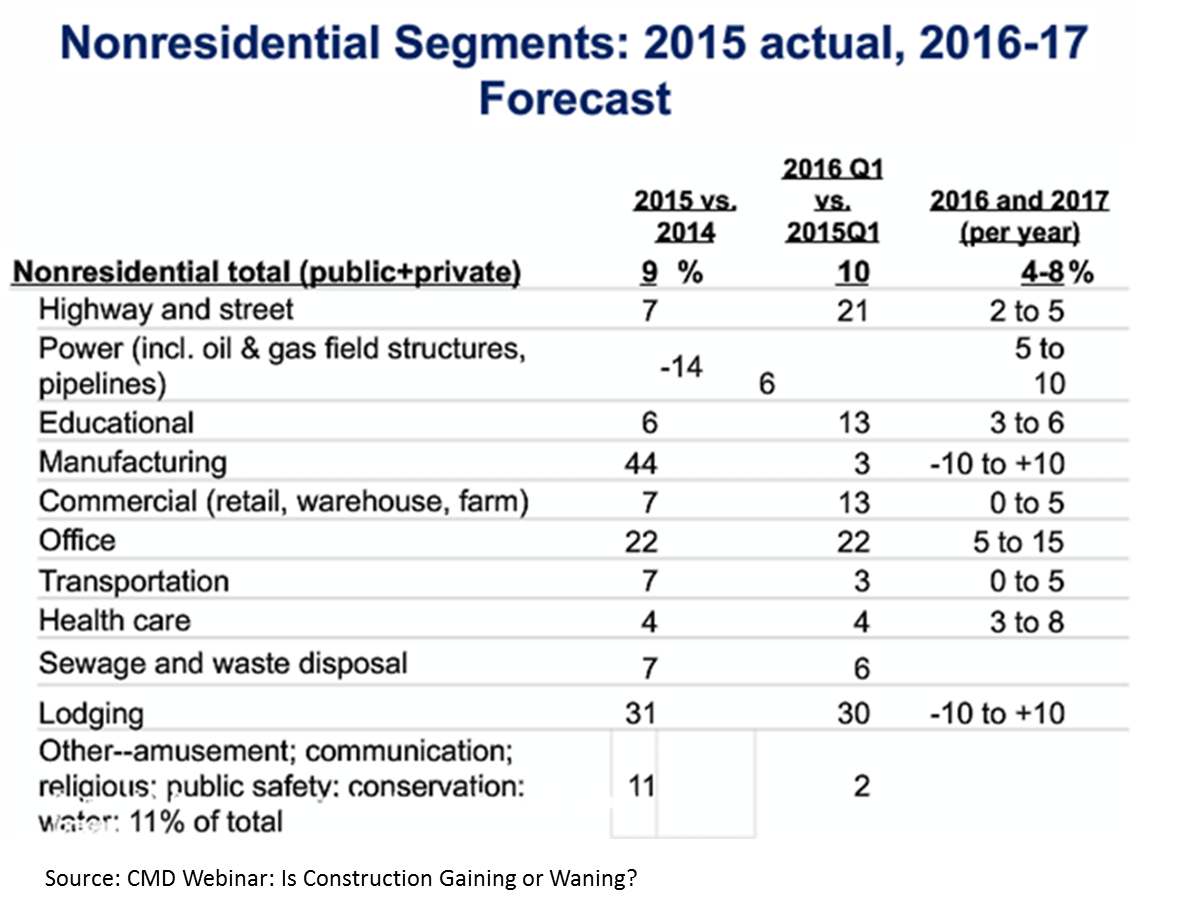

In the nonresidential sector, construction for manufacturing, transportation and healthcare were among the lowest forecasts for 2016. Manufacturing construction was up a remarkable 44 percent in 2015 but AGC is forecasting 3 percent growth for 2016 with the sector moving into contraction for 2017. Last year’s surge was due in large part to sales growth in the automotive industry resulting in factory and dealership expansion. Heavy equipment sales and company profits have dropped in 2016 due to the strong US dollar and lower demand for equipment abroad.

Transportation projects such as new railroads are slowing. There are still some airport expansions in planning or underway at O’Hare and at Louis Armstrong airport in New Orleans. Alex Carrick, at CMD, said the air sector is expecting an influx of tourism over the next few decades from an emerging foreign middle class.

Last year’s passage of highway and transportation bills should support additional construction this year into next. Roadwork planning was hampered by a series of short term extensions, said Carrick. Infrastructure should be equated with productivity, he said. Infrastructure investment is necessary to compete with countries around the world: moving goods to market, workers to jobs, sewer and water delivery systems that keep workers healthy and, thus, more productive. Bridge starts were up 18 percent in first quarter compared to Q1 2015.

Healthcare construction growth was up 4 percent in 2015 and is expected to be unchanged for 2016. Healthcare construction has had a bit of rebound but is nowhere near the dramatic increases seen before the recession said Ken Simonson. Carrick added that uncertainty about how healthcare payments will be affected by Patient Protection and the Affordable Care Act has delayed further healthcare expansion until after the elections.

The retail construction forecast is grim for 2016 and beyond. Recent closures were seen at Aeropostle, Sports Authority, Walmart, Sears, K-Mart and Macy’s. Carrick noted that retail construction is being affected in unforeseen ways, such as Amazon home delivery of groceries.

Warehouse construction is still strong but moving toward smaller local centers. Several large distribution centers began construction last year with most now completed.

Low vacancy rates for office space continue to fuel growth in office construction but most of the growth is in high rise office towers in metro areas. Office vacancy rates are at a national average of 13.5 percent but have strong regional trends. Office space is scare in San Francisco and Manhattan with vacancy rates of 5.7 percent and 6.3 percent, respectively. No need to build in Dayton, Ohio where the vacancy rate is 25.6 percent.

Another indicator of slowing in the constructor industry is the AIA Architecture Billings Index, which reflects a lead time of 9-12 months for construction starts. The trend line in recent months, although still volatile, indicates a slowing in architectural planning.

AGC’s breakdown of the nonresidential segment forecast is seen below.

AGC notes construction positions continue to be difficult to fill with skilled workers. As a result the two biggest concerns for contractors are labor availability and employments costs. Contractors are coping by raising base pay, improving benefit plans, using subcontractors and using building solution modeling.

AGC asked member whether they expect dollar volume of projects in various sectors in 2016 to increase, decrease or stay the same. All sectors except for federal construction came in positive, with a net 34 percent expecting total dollar volume to increase.

Total construction spending is expected to decrease from 11 percent in 2015 to 9 percent in 2016 with further decreases expected in 2017. The AGC construction spending forecast follows:

Residential Construction

Multifamily construction is at its highest rate since 2010, increasing almost 30 percent per year. The rentership rate (the inverse of the homeownership rate) is nearing a 50 year high. There has been an unprecedented growth in the number of rental households that has been attributed to millennials and retirees who are showing a preference for urban living. Carrick noted that, although the media has focused on the younger category, renters have increased in all age demographics.

Single family construction growth has lagged behind multi-family but was affected more by the recession. The forecast for multi-family construction growth is expected to be at low single digit growth this year, 3.6 percent in 2016, 6.6 percent in 2017 and decreasing to 2.8 percent in 2018.

Another factor affecting residential construction and, in turn, nonresidential construction, is a slowdown in population growth in the U.S. Between July 2014 and July 2015 growth was at just 0.79 percent, below the annual average of 1 percent seen in the last decade. Along with a drop in the birthrate, there is less state-to-state or even county-to-county movement to boost housing construction growth. Immigration has dropped off sharply as well.

Is a recession coming in the near term?

The economists agreed that a recession is not likely to hit the U.S. in the near future. Simonson said 35 business economists were surveyed at a recent conference he was attending and the median consensus was that a recession may occur in 2019.

Baker said recessions are caused by a lot of factors and a pretty significant imbalance in the economy which we are not currently seeing. Three signs of a recession (which are not currently occurring) are:

1) inversion in yield terms–long term rates go below short term rates

2) significant decline in equity values

3) decline in payroll and employment

Carrick said he is an optimist and thinks people should be, although he did point out several areas where there may be problems for the economy. Global occurrences, for example, such as mounting debt in China could spread through the Chinese banking center. In the U.S, the financial difficulties in the energy sector could spill over into the U.S. banking center, although Carrick does not believe it would be enough to tip the country into a recession. “You cannot easily rule out the possibility [of a recession],” said Carrick. Politics are another issue, he said. “Politics and the economy are totally tied together,” said Carrick. Election season with its negative talk on the economy, and actions taken after the vote, such as trade deals and other actions, can be problematic. “History has shown us these things are out there and can come back and bite you,” he said.

What would the construction sector look like under a Trump presidency?

Carrick: “How can you possibly know? First of all you don’t know if he will actually do what he says he will do.” The fault line, said Carrick, is in terms of trade deals. For example the only way you could build a wall and get Mexico to pay for it would be through trade sanctions. “If you start doing that you get yourself involved in trade wars, and when you have a trade war all kinds of bad things start to happen.” The uncertainty factor makes it difficult to answer the question, said Carrick. “Mr. Trump is the deal maker; maybe if he is elected…when he gets the power, if he got the power, would he change? Becoming president changes people; you are not the person you were when you entered the campaign and you’re not the person you were when you enter the oval office because there is a whole new set of responsibilities.”

Simonson says he expects continued gridlock or at least a lot of difficulty passing legislation next year no matter who is president. Uncertainty about how the elections will turn out is keeping companies from making investment until after the outcome. It is hard to tell where legislation will move, he said.

Baker said it is “difficult, if not impossible, to talk about polices that are not firmly articulated yet.” There are two different versions of where the country should be headed, he said. During election years, the economy usually does better in the first half than the second half due to uncertainty. After the election that uncertainty diminishes significantly, said Baker, and businesses move forward with plans.