Analysis

May 7, 2016

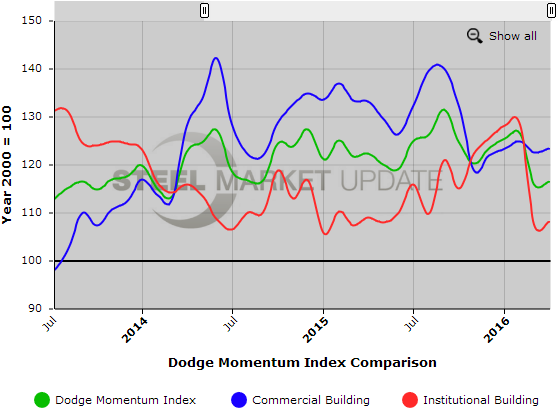

Dodge Momentum Index Up 0.6% in April

Written by Sandy Williams

The Dodge Momentum Index rose 0.6 percent in April to 116.5 from a revised March reading of 115.8. Planning for commercial construction increased 0.8 percent and institutional planning rose 0.4 percent.

Institutional planning, although volatile on a month-to-month basis, continues to recover and is now seven percent above year ago levels. The pace for commercial construction planning has been subdued and as a result the overall index is essentially unchanged from April 2015.

Six projects, valued at more than $100 million, entered the planning stage in April.

The Dodge Momentum Index, published by Dodge Analytics, is a measure of the initial report for nonresidential building projects and has been show to lead construction spending for nonresidential buildings by a full year. The index is created by summing the dollar value of Dodge’s first-reported nonresidential building projects in planning during a given month. The data is seasonally adjusted and a three-month moving average is applied to reduce the volatility and random variation in the monthly data. The resulting smoothed data provides a better fit between the index and construction spending statistics.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.