Prices

May 3, 2016

SMU Price Ranges & Indices: Still Moving

Written by John Packard

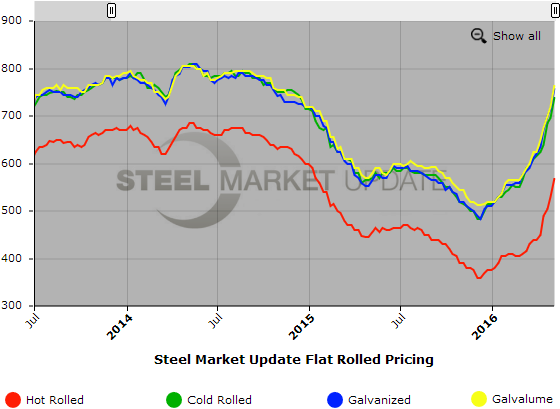

In case there is some confusion, flat rolled steel prices are moving higher and, with today’s announcement by ArcelorMittal it is only a matter of time before benchmark hot rolled breaches $600 per ton and cold rolled and coated breach $800 per ton (base plus extras). It has been a very difficult market to gauge as we have a wide range of prices provided to us on a weekly basis. Normally, that is not an issue because price changes tend to be minor from week to week. However, now is not a normal time and you can have a $37.00/cwt base price for coated on Thursday and by Tuesday the mill is closed and not offering anything. So, what is the true price on Tuesday – $37.00/cwt or something else?

When we have times like this, when market prices can actually change on a daily basis as one mill opens their order book and another closes theirs, this is the time when our publisher (John Packard) relies on the personal relationship developed over many years of actually buying and selling steel. These one on one contacts afford us the opportunity to discuss not only where offers are from each mill but where transactions are being made.

so, this week based on many conversations coupled with our survey respondents here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $540-$600 per ton ($27.00/cwt- $30.00/cwt) with an average of $570 per ton ($28.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end increased $60 per ton. Our overall average is up $40 per ton over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: All mills on controlled order entry or allocation

Cold Rolled Coil: SMU Range is $700-$780 per ton ($35.00/cwt- $39.00/cwt) with an average of $740 per ton ($37.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end increased $70 per ton. Our overall average increased $45 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: All mills on controlled order entry or allocation

Galvanized Coil: SMU Base Price Range is $36.50/cwt-$39.50/cwt ($730-$790 per ton) with an average of $38.00/cwt ($760 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end increased $70 per ton. Our overall average is up $45 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $790-$850 per net ton with an average of $820 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: All mills on controlled order entry or allocation

Galvalume Coil: SMU Base Price Range is $37.00/cwt-$39.50/cwt ($740-$790 per ton) with an average base of $38.25/cwt ($765 per ton) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to last week while the upper end increased $60 per ton. Our overall average increased $45 per ton over one week ago. Our price momentum for Galvalume steel is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1031-$1081 per net ton with an average of $1056 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: All mills on controlled order entry or allocation

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.