Market Data

May 3, 2016

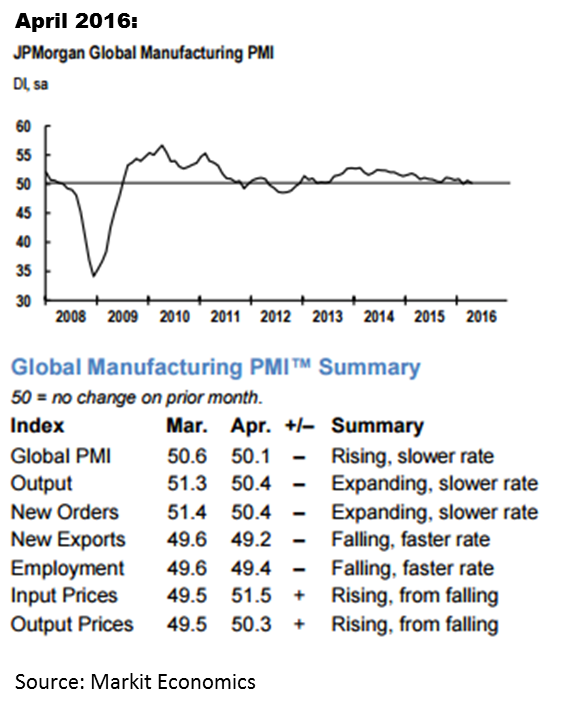

Global Manufacturing Slows in April

Written by Sandy Williams

Global manufacturing growth ground to a near-standstill in April, according to the JP Morgan Global Manufacturing PMI.

The composite index was at 50.1 for April and was the second weakest reading in 40 months. A reading of 50 signals no change.

Production output and new orders were muted in most markets and international trade volumes continued to deteriorate. Export business dropped for the third month in a row and at the fastest rate since September 2015.

Production output and new orders were muted in most markets and international trade volumes continued to deteriorate. Export business dropped for the third month in a row and at the fastest rate since September 2015.

Both developed and emerging markets showed weakness said JP Morgan and Markit Economics. Developed nations on a combined basis saw output growth slow to a three-year low. EU production dropped to a 16 month low and manufacturing in the U.S. was essentially flat.

Emerging nations fell back into contraction, decreasing for the tenth time in 12 months. Manufacturing in China was stagnant and slowed in India and Indonesia. Brazil, Russia and Malaysia recorded significant downturns in production said JP Morgan.

Prices for inputs and outputs rose in April ending a series of declines. JP Morgan noted a marked disparity between the trends seen (on average) in developed and emerging nations. “While prices tended to fall in the developed world, emerging markets generally registered solid rates of inflation.”

“The latest PMI data indicate global manufacturing output is growing at an anemic pace, similar to the past year,” said David Hensley, Director of Global Economic Coordination at JP Morgan. “What is notable is the sharp drop in the PMI finished goods inventory index. Once manufacturers have aligned inventories with sales, faster production gains should ensue.”

In the UK, where the steel industry is undergoing a domestic crisis, manufacturing fell to a critical low with the PMI at 49.2. The last time the PMI was at that level was February 2013. Softer domestic and foreign demand was attributed to the deteriorating conditions.

Manufacturing conditions in China changed marginally, falling 0.3 points to 49.4 on the Caixin China General Manufacturing PMI. Dr. He Fan, Chief Economist at Caixin Insight Group commented, “The fluctuations [in the index] indicate the economy lacks a solid foundation for recovery and is still in the process of bottoming out. The government needs to keep a close watch on the risk of a further economic downturn.”

About the Survey:

The Global Report on Manufacturing is compiled by Markit based on the results of surveys covering over 10,000 purchasing executives in over 30 countries. Together these countries account for an estimated 89% of global manufacturing output. Questions are asked about real events and are not opinion based. Data are presented in the form of diffusion indices, where an index reading above 50.0 indicates an increase in the variable since the previous month and below 50.0 a decrease.